The Real Fuel of the Future: Natural Gas

The U.S. is now the world’s fastest-growing producer of natural gas, and it is on track to becoming the dominant world exporter. Meanwhile, the number of nations importing liquefied natural gas (LNG) has jumped from a dozen to more than 40 in the past two decades. In the next two decades, the international LNG trade is expected to become a $200 billion annual business and an increasingly critical fuel for growing economies.

Natural gas, unlike alternative energy sources such as wind and solar, does not depend on massive public subsidies or mandates. But it does require capital-intensive physical infrastructures—pipes, ports, and, especially, LNG terminals. Encouraging investments in these facilities in this country will, first of all, require streamlining the environmental review that is necessary to acquire building permits and instilling confidence among investors that the government will not revoke them once they are granted. Second, LNG producers currently require federal permission to export natural gas. This requirement—created a half-century ago, when many believed that America was in imminent danger of running out of energy—is an anachronism and needs to be abolished.

Accelerating America’s LNG exports would greatly expand the domestic economic benefits from shale gas. America’s natural gas industry already employs 3 million Americans and adds more than $350 billion to the economy. Expanding exports would continue price pressure on world gas markets, to the benefit of citizens everywhere. Finally, if the U.S. becomes the world’s dominant LNG exporter, such geopolitical “soft power” would counterbalance the influence of Russia and the Middle East on the world stage.

Executive Summary

The U.S. is now the world’s fastest-growing producer of natural gas, and it is on track to becoming the dominant world exporter. Meanwhile, the number of nations importing liquefied natural gas (LNG) has jumped from a dozen to more than 40 in the past two decades. In the next two decades, the international LNG trade is expected to become a $200 billion annual business and an increasingly critical fuel for growing economies.[1]

Natural gas, unlike alternative energy sources such as wind and solar, does not depend on massive public subsidies or mandates. But it does require capital-intensive physical infrastructures—pipes, ports, and, especially, LNG terminals. Encouraging investments in these facilities in this country will, first of all, require streamlining the environmental review that is necessary to acquire building permits and instilling confidence among investors that the government will not revoke them once they are granted. Second, LNG producers currently require federal permission to export natural gas. This requirement—created a half-century ago, when many believed that America was in imminent danger of running out of energy—is an anachronism and needs to be abolished.

Accelerating America’s LNG exports would greatly expand the domestic economic benefits from shale gas. America’s natural gas industry already employs some 3 million Americans and adds more than $350 billion to the economy.[2] Expanding exports would continue price pressure on world gas markets, to the benefit of citizens everywhere. Finally, if the U.S. becomes the world’s dominant LNG exporter, such geopolitical “soft power” would counterbalance the influence of Russia and the Middle East on the world stage.

Introduction

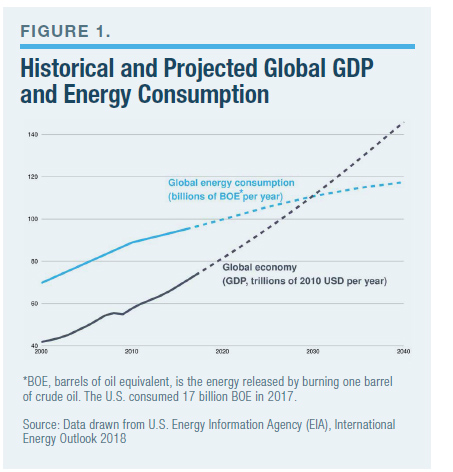

The world will consume far more energy over the next two decades (Figure 1). That reality is locked in by two immutable facts: rising population and wealth will lead to greater consumption of goods and services; and energy is required to fabricate and operate everything, whether cars and computers or aircraft and air conditioners. Even as efficiency inexorably improves, global growth will increase energy demand by an amount equal to the entire consumption of the U.S.

Many policymakers and “new energy economy” enthusiasts believe that the future is now centered on a hoped-for revolution in supply coming from wind and solar technologies.[3] The real revolution—not based on hope—centers on natural gas. Wind and solar power combined provide less than 2% of world energy; natural gas supplies 23% and is on track to displace oil as the number-one global energy form.[4]

The dramatic impact of the shale revolution in restructuring world oil supply has been widely reported and analyzed. Until recently, far less attention has been afforded the implications of the contemporaneous—and, in some ways, more remarkable—rise of U.S. natural gas.

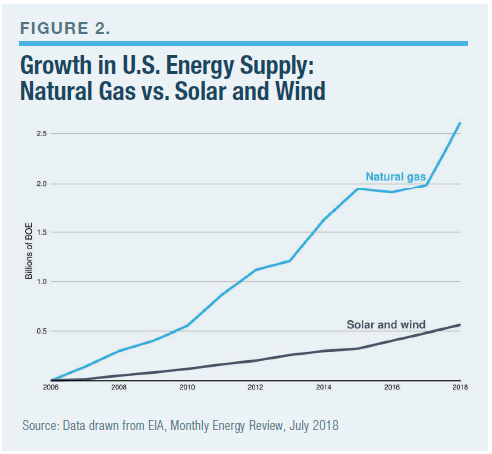

U.S. shale technology was responsible for nearly one-third of the world’s increased production of natural gas over the past decade: the Middle East was slightly ahead, accounting for 40% of the new supply.[5] And, over that period, American growth in shale gas production added 400% more to U.S. energy supply than did the combined growth of wind and solar, even though the latter had the advantage of policy preferences as well as at least $150 billion in subsidies over that period (Figure 2).[6]

In light of physics (discussed below), it is far more likely that wind and solar power will fail to meet forecast expectations than to exceed them. Any shortfall means more demand for natural gas. Fortunately, the U.S. is now the fastest-growing producer and exporter of natural gas. The biggest energy wild card on the nearterm horizon is in how much and how quickly U.S. export capability might yet grow.

In light of physics (discussed below), it is far more likely that wind and solar power will fail to meet forecast expectations than to exceed them. Any shortfall means more demand for natural gas. Fortunately, the U.S. is now the fastest-growing producer and exporter of natural gas. The biggest energy wild card on the nearterm horizon is in how much and how quickly U.S. export capability might yet grow.

The U.S. position in world energy markets today is similar to its position circa 1918. At that time, the world demand for oil, thanks to automobiles and airplanes, began a steep ascent. The U.S. became the single largest source of new petroleum and then, for a half-century, the dominant supplier of crude oil to the world.

The central energy story today is the fast-growing electrification of the world’s economies, thanks in large measure to the digitalization of everything. With abundant low-cost natural gas becoming the single largest source of new fuel to power grids, the U.S. has the opportunity to once again become a dominant supplier of fuel for global growth.

This paper summarizes the remarkable increase in natural gas production and exports that has already occurred, along with the prospects for even greater expansion. It explores the domestic economic and geopolitical implications of the U.S. becoming the dominant supplier to world gas markets. Finally, it identifies the government actions needed to ensure that America captures all the benefits from the natural gas revolution.

Natural Gas vs. Wind and Solar: State of Play

The same class of shale technology—hydraulic fracturing, or fracking—that has revolutionized U.S. oil production has also revolutionized natural gas production. Natural gas output is at this country’s highest level in history, and it is rising rapidly. Remarkably, total U.S. natural gas production is 150% greater than crude oil in energy-equivalent terms.[7] As a result—and unlike the case with petroleum—the U.S. has already become a net exporter of natural gas.

All this has occurred for an energy source that was once considered so limited and precious that, in 1978, Congress enacted and President Carter signed into law the Power Plant and Industrial Fuel Use Act in order to limit and even prohibit such uses for natural gas. Congress had similarly (in 1977) passed legislation to establish the Department of Energy (DOE), giving that agency the authority to permit or deny U.S. producers the right to sell natural gas to any foreign entity. The 1978 Fuel Use Act was repealed in 1988, during the Reagan administration. But DOE’s export control is still on the books.

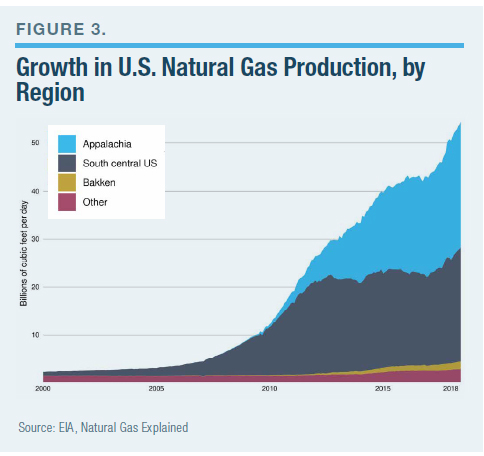

Today, more than a dozen states are significant producers of natural gas, but Pennsylvania, Ohio, and West Virginia now account for 40% of U.S. gas production and supplied 60% of the increased supply in the past decade.[8] Fracking has vaulted America’s Appalachian region to become one of the world’s biggest producers of natural gas (Figure 3).

Will the Gas Bounty Continue?

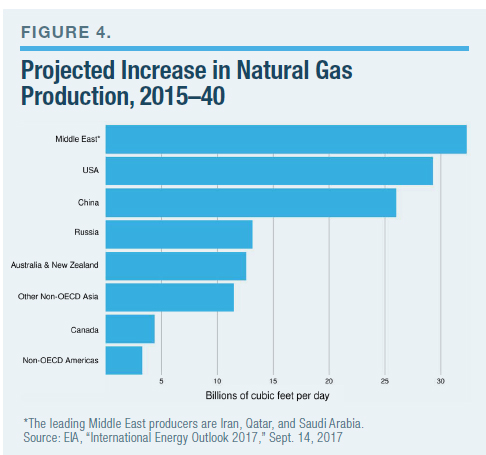

Depending on assumptions, the U.S. Energy Information Agency (EIA) and other organizations forecast U.S. shale production to increase 25% to 100% over the next two decades.[9] Even in the case of the lower growth, America would become the world’s second-largest source of new natural gas, only slightly behind all Middle East producers combined (Figure 4). While most analysts expect that China will occupy the number-three position in terms of net new growth in natural gas production, it will still need to import to meet internal demand (as we will discuss shortly).[10]

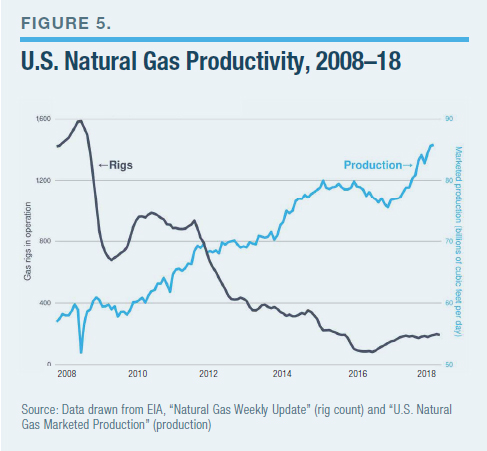

America’s remarkable transformation in natural gas production did not arise from the discovery of new resources, nor was it the result of high prices making it more profitable to drill for expensive reserves. The price of natural gas has remained consistently low over the past decade, at about one-fifth the cost of oil (in energy-equivalent terms). The number of gas-drilling rigs in operation has collapsed to almost one-tenth the peak (Figure 5). This juxtaposition of low costs and less hardware leading to rising output came about through revolutionary technology progress.

The expectations for future natural gas production are typically based on gauging the pace of improvement in existing techniques and tools. This forecasting task has become easier, given the sheer quantity of data and experience now available from the shale industry. Thus, the conventional wisdom now is that incremental gains in shale technology will lead to continued production expansion, even if today’s historically low prices continue unabated.[11]

But forecasts of U.S. natural gas production do not take into account technological surprises. That’s why nearly every forecaster missed the shale revolution in the first place.

The shale gas (and oil) industry is entering a new era of productivity, driven by machine learning, artificial intelligence, robotics, and sensors linked by low-cost networks to algorithms in the Cloud.[12] These techniques and tools, more common in other industrial sectors, are now penetrating the oil and gas industry, enabling lower costs, faster and more efficient production, and often radically improving productivity.[13] The complexity and variety of data, as well as the nature of hardware, make shale businesses, as noted by the International Energy Agency (IEA),[14] ideal targets for digitalization.

One indicator of the coming digital transformation: recent alliances between oil-service giants Schlumberger, Halliburton, and Weatherford with Microsoft and Intel, as well as a new business unit within Google Cloud, all targeting gas and oil.[15] There is also a new ecosystem of Silicon Valley–like startups developing software and digital tools for the gas and oil industries.

With digital gas and oil technologies still in the early days, we can expect to see the rapid progress of drilling productivity (energy output per rig) continue. Output per rig (wherein rig costs having remained relatively constant) is doubling every three years. Last year, rig productivity jumped from 30% to 40% across the various shale plays. No other energy source is experiencing technological progress on this scale.[16]

Digital technologies are squeezing more money from rocks. While shale tech, like all technologies, will reach physics limits, the data make it clear that those limits are still a long way off. The underlying geophysics points to a roughly 500% gap between what today’s shale tech can extract and what nature ultimately permits.[17] EIA’s “high tech” forecast envisions natural gas production increasing more than four times as much in the coming two decades than it did over the past two.[18]

How much natural gas is ultimately available? The U.S. Geological Survey (USGS) identifies 100 years of U.S. natural gas resources, but its estimate radically understates the actual resource. As the USGS itself specifically notes, that estimate is based on “current technology” and includes only “some of the shale basins.”[19]

The speed with which more natural gas production can come online will not depend so much on price as on the velocity of technology progress and the willingness of governments to permit, if not facilitate, the construction of the necessary infrastructures. EIA’s base-case forecast— which is inherently technologically conservative—sees incremental shale gas production rising in the coming two decades by an amount 200% greater than the energy added by the combined growth of wind and solar.[20]

New Physics for Wind and Solar?

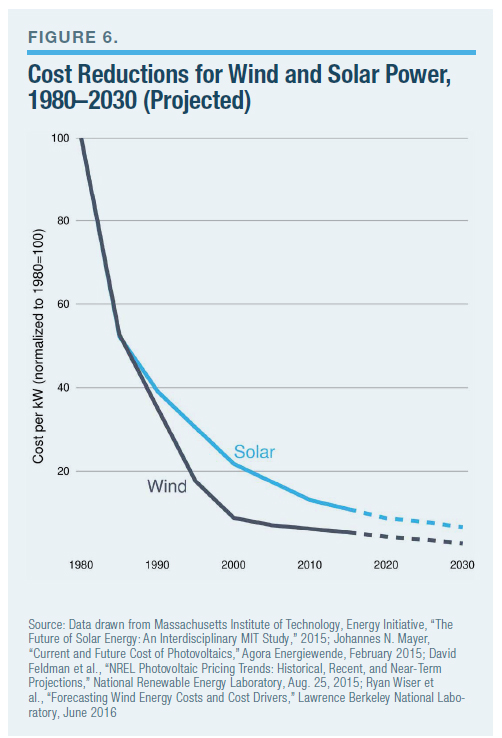

As for renewable energy? Over the past two decades, there has been a greater than 10-fold reduction in the costs of wind and solar power (Figure 6). Today, there is a general sense—in some cases, a specific claim[21]—that these two energy sources have the potential to improve at the speed of information technologies. But every expert forecast today, including those from IEA and the National Renewable Energy Laboratory (NREL), sees a future with only a slow rate of improvement in underlying wind and solar technologies. The reason? The technologies are approaching the limits of physics.

Solar arrays and wind turbines are so efficient now that they are approaching the point where there is no more energy in the wind or arriving from the sun to be converted into electricity. Thus, one sees underlying progress in improving efficiencies now measured in single-digit percentages.[22]

There is nothing unusual in this slowdown. Throughout history, engineers have achieved big gains in the early years of a technology’s development, whether wind turbines and PV cells, aircraft engines, steamships, or computer processors. With time, engineers start to approach the limits of physics. Bragging rights for gains in efficiency or speed, or any other equivalent metric, shrink from double-digit percentages to fractional changes. These days, aircraft turbine manufacturers eagerly tout single-digit percentage gains in fuel efficiency because those machines are now near the thermodynamic limits of how much heat can be converted to thrust. Wind and solar have entered that domain of limits.

The physics limit for a wind turbine, called the Betz Limit, permits capturing about 60% of the kinetic energy in moving air.[23] (Physics dictates that one can never capture 100% of any potential energy.) Modern turbines already exceed 40% capture. That leaves gains to be made, but nothing revolutionary. In addition, there are no game-changing economies of scale left for the underlying components to make wind farms—concrete, steel, fiberglass—which are already in mass production.

Similarly, photovoltaic cells are now approaching nature’s limits. The physics of using silicon to convert photons into electrons ends at about a 33% conversion (called the Shockley-Queisser Limit.)[24] The most recent announcements of high-efficiency silicon cells with 26% efficiency are approaching the limit. Again, more efficiency is possible, but there are no 10-fold gains left. Similarly, there are no opportunities for big cost reductions in the associated materials to make solar farms (silicon, steel, copper wires, glass), since they, too, are already being mass-produced.

Researchers will doubtless continue to find new non-silicon photovoltaic options that will offer both incremental efficiency gains and cost reductions.[25] But even the most exotic and expensive laboratory cells cannot beat a roughly 50% limit.

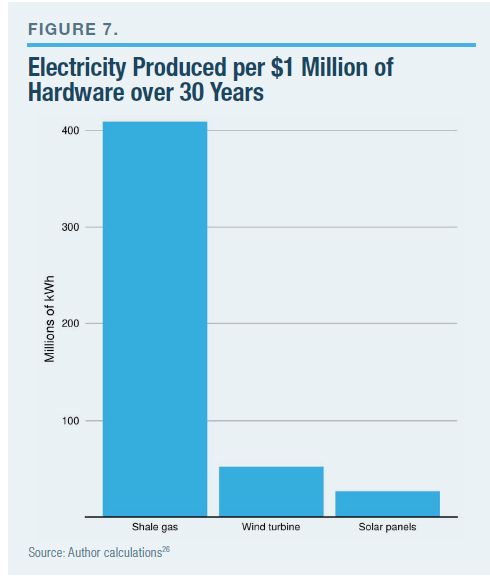

After stripping out hyperbole and subsidies, one can usefully compare the underlying engineering costs for producing electricity—the only market for wind/ solar and the biggest market for natural gas. At today’s costs, $1 million invested in a modern wind turbine will produce, over 30 years of operation, about 50 million kWh. And $1 million spent on utility-grade solar panels will produce about 25 million kWh over 30 years. Meanwhile, $1 million spent on a shale rig will produce enough natural gas to generate 400 million kWh over the same 30 years (Figure 7).

Subsidies and preferences can disguise or partly fill such huge cost disparities in the underlying economics between natural gas and wind/solar for electricity generation. But the proposition that further subsidies will lead to dramatic efficiency gains or cost reductions has no basis in physics. To obtain more wind and solar power, policymakers will necessarily need to pay more subsidies.[26]

As it stands, wind/solar projects in America receive 45%–140% of the installed capital costs in the form of state rebates, utility programs, federal incentives, and tax credits. (Similar subsidies exist in much of Europe.) If subsidies continue, and wind/solar increases from today’s 5% share of U.S. energy supply to, say, the oft-cited “green” goal of 50%, the overall economic burden from subsidies will necessarily rise dramatically.

The wild card for the future of wind/solar, in short, is not technology but public tolerance for subsidies. In California, “green” subsidies have led to overall electricity rates that are double the national average and likely to rise. Meanwhile, Germany, where aggressively subsidized wind/solar on a national scale has led to a 300% increase in national average electricity rates, is showing signs of an end to the tolerance for subsidies.[27]

New Demands for Natural Gas

There are three primary uses for natural gas: to generate electricity (the biggest market); in industry (half as a chemical feedstock and half for process heat); and to heat residential and commercial buildings. Thus far, over the past decade, 80% of the increased supply of U.S. natural gas has been used to produce electricity in the U.S. and for exports in roughly equal proportions, even though the latter began just two years ago.[28]

EIA forecasts that over the coming two decades, 90% of the additional supply of America’s electricity will come from wind/solar and natural gas in almost equal shares. The extent to which even more natural gas is needed for domestic electricity generation will be determined significantly by policies relating to preserving and extending old coal and nuclear plants, as well as the public appetite to preserve and expand wind/solar subsidies. But in nearly any scenario, domestic electricity demands are unlikely to consume even 20% of the expected increase in domestic gas production.

The biggest new demand for domestic U.S. natural gas is abroad. Within two decades, the world demand for electricity will increase by an amount equal to adding an entire U.S. grid. More than 80% of the demand will come from emerging economies, none of which have sufficient domestic resources to meet their needs. Meanwhile, Europe will also increase gas imports to power its domestic grids, because natural gas production from the North Sea fields is rapidly declining and expected to drop by about 50% over the coming decade.[29]

As with U.S. domestic forecasts, global projections for new electricity supplies are also heavily weighted by the expectation that wind/solar will capture nearly half the net new supply of kilowatt-hours, requiring a 300%– 500% increase in wind/solar generation in the next two decades.[30] These optimistic forecasts are predicated on continuing technological improvements and global government incentives.

Meanwhile, the second-biggest driver in increased demand for domestic natural gas has been in chemical manufacturing. Natural gas is a feedstock used to fabricate chemicals such as plastics, fertilizers, pharmaceuticals, biochemical products, polymers, solvents, and various additives. The rising and long-term availability of low-cost natural gas has thus caused this sector of U.S. manufacturing to boom.

Since 2010, businesses (domestic and foreign) have poured more than $180 million into 260 new U.S. chemical manufacturing projects. All are expected to come online by 2020, to generate more than 400,000 jobs, and to consume more gas.[31] Overall, these planned chemical projects exceed all the existing similar projects in the Middle East.[32]

While over half of the shale-inspired manufacturing activity is along the Gulf Coast, the shale gas revolution is also converting Pennsylvania, Ohio, and the Northeast into a second U.S. “chemicals hub.”[33] No other U.S. manufacturing sector is on track for such rapid expansion. The chemical industry already accounts for about 15% of all U.S. exports, but this sector of the industry is growing at a rate that would, if it continues, lead to a doubling of output in the next decade. Yet even this torrid growth will not absorb more than 20% of the expected rise in domestic gas production.

As for transportation, it accounts for only 2% of global natural gas consumption, and much of that is to power pipeline compressors to transport natural gas itself. As for cars, compared with using batteries, compressed natural gas (CNG) or LNG comes far closer to matching gasoline in terms of vehicle range and fueling convenience. There are currently sevenfold more CNG than battery-powered cars on the world’s roads, but only 0.1% of those are in America.[34] Even a (sensible) 10-fold increase in natural gas use in U.S. vehicles would have a de minimus impact on the surplus of gas production to come.

Finally, there is the emerging demand for extremely reliable electricity. Demand for reliability is growing faster than the overall demand for the underlying commodity kilowatt-hours. Critical sectors of the economy—including anything related to computing and the Internet— cannot tolerate grid outages.[35]

More reliable grids are costly to build, and it doesn’t make economic sense to construct a super-reliable overall grid when, say, only 10% of loads require it. So far, solutions are centering on on-site backup generation, usually based on high-maintenance oil-fired engines. Commercially viable on-site fuel cells offer a new option, since they have nearly no moving parts and the fuel comes from the natural gas pipeline network; the latter has a 10- to 100-fold greater reliability than the grid’s wires.[36]

Until recently, fuel-cell “engines” were themselves too expensive, as was the cost of natural gas. The latest lower-cost commercial fuel cells combined with cheap gas unlock a new market. But if fuel cells powered half of all critical loads (assuming, say, 20% of the grid were deemed critical), that would absorb less than 5% of America’s natural gas abundance.[37]

The bottom line is that in any scenario, the U.S. economy cannot absorb half of the expected increase of 40–60 billion cubic feet per day (40–60 bcf/day is the energy equivalent of 7–10 million barrels of oil per day) in U.S. natural gas production over the coming two decades. But there is more than ample demand coming from global markets.[38] The LNG export business requires specialized, capital-intensive facilities that chill natural gas down to –260oF, at which point it becomes a liquid and is reduced 600-fold by volume.

The LNG can then be carried in specialized tankers designed to keep the liquid cold. The all-in cost of liquefaction is about $7/BOE (a cost obviously not associated with crude oil). Shipping in specialized tankers costs about $8/BOE (compared with approximately $1 for crude). But the low cost of natural gas production (less than $15 per barrel of oil equivalent) enables LNG to reach world markets for a final cost of about $35/BOE, depending on the distance traveled.[39]

The New Energy Market

For decades, petroleum has dominated energy policymaking and geopolitics. The 1973 Arab oil embargo shocked the world, especially the United States. By that year, U.S. oil imports had increased eightfold over the preceding two decades. And at that time, transportation was America’s biggest overall energy-consuming sector; the second-largest, electricity, accounted for 10% less of overall U.S. energy use.

These dynamics have all reversed. U.S. oil imports are trending down and have dropped by 25% in the past decade. Today, the electric sector uses 50% more energy than transportation.[40] And demand for electricity is growing faster than demand for transportation fuels. This same electrification transformation is happening globally.

Rising demand for electricity over the coming two decades will account for 70% of all the net increase in global energy supply.[41] A billion people in the world still lack any access to electricity.[42] And electricity is the primary or sole power for nearly every feature of a modern economy, from buildings and data centers to hospitals and factories.

In the energy economy of the 21st century, the new disruptive market dynamic is the increase in demand for natural gas and the emergence of America as the single most important supplier. Global natural gas consumption is nearly 200% greater today than it was in 1990, and is forecast to double again within the coming two decades.[43]

In every future scenario, roughly 80% of the world’s new energy supplies will come from the combination of natural gas and alternative energy, the latter mainly as wind and solar.[44] Thus, as with U.S. domestic forecasts, the key variable influencing future gas demand is whether wind and solar actually reach the current aggressive forecasts.

In any case, natural gas overall is on track over the coming two decades to become the largest single source of world energy supply, overtaking the position that oil has occupied since 1960. Behind this trend, consider several recent occurrences, all related to the U.S. shale gas boom, that epitomize the radical change in global energy markets now under way.

A Spot Market for Natural Gas Exports

America’s second operational LNG terminal—at Cove Point, near Lusby, Maryland—sent its first shipment offshore in March 2018. While that ship was under way, it was diverted from its Asian destination and made landfall in the United Kingdom, to provide fuel to deal with a cold spell. That was the first time ever that an LNG ship’s cargo was sold to a higher bidder and changed destinations mid-route.

LNG shipments, unlike oil, have long been based on firm, long-term, point-to-point supplier-seller agreements, with prices linked to global petroleum prices. Until now, there has never been a commodity-like market for global LNG trade. Until recently, LNG was linked to oil markets; they are now de-linked.

In 2008, the average LNG contract term was 18 years and for large volumes; the average has dropped to five years, and there is a rapidly growing spot market.[45] The evolution of LNG exports from a slow-moving, nation-state-dominated market to a more freewheeling, commodity-like, and episodically oversupplied business brings into play all the features of trade that have benefited world consumers with regard to other critical commodities.

The Panama Canal

On one single day this year, April 17, three LNG tankers sailed through the recently expanded Panama Canal.[46] Those ships carried natural gas from America’s shale fields to energy-hungry Asian markets. Without the canal’s recently completed $5 billion expansion, such ships would have been forced to make a far longer and more expensive voyage. And without the boom in America’s shale gas, there would not be the supply to make such transits.

The natural gas in those three LNG ships alone could produce 20 times more electricity than all U.S. wind turbines produce daily.[47] Since the first-ever LNG export left the Sabine Pass terminal in February 2016, more than 300 LNG shipments have left U.S. ports— the equivalent of more than five years’ worth of total U.S. wind energy production.[48]

“Negative Prices”

Largely unnoticed outside expert circles, shale gas wells are unlike conventional wells that typically produce either oil or natural gas. In many shale fields, the wells produce both oil and natural gas simultaneously.[49]

Coproduction in shale fields is so large that many producers have to pay to have the gas taken away. Natural gas typically sells on the wholesale market for about $2.50 per thousand cubic feet; but in parts of the Permian Shale Basin (located largely in Texas), its value can be negative $2–$3 per thousand cubic feet.[50] The challenge for American natural gas producers is finding markets for a product where supply is growing far faster than domestic demand.

Micro-Grids

The U.S. natural gas glut has led to another emerging shift in market dynamics: replacing oil with micro-LNG exports to power so-called micro-grids. In January, a micro-LNG receiving facility came online in Nassau, Bahamas;[51] and America’s first micro-LNG export terminal is expected to come online later this year on Elba Island, Georgia. This terminal’s export capacity is only about one-tenth the standard size, but it is still capable of shipping the energy equivalent of 12 million barrels of oil annually.

Instead of massive, special-purpose tankers, micro-LNG terminals use conventional cargo ships carrying small tanks configured around standardized containers. Micro-LNG terminals cannot capture their bigger cousins’ economies of scale. Nevertheless, the combination of low-cost gas and the latest-generation micro-LNG hardware means that these micro-terminals can deliver natural gas for the equivalent of $45–$50 per barrel of oil.[52] Diesel fuel, by contrast, costs over $150 per barrel in the Caribbean and Central American markets.[53]

Today, diesel-fueled, engine-based generators are commonly used for electric micro-grids. Now, more than a dozen companies have announced plans to build U.S. micro-LNG shipping terminals focused initially on regional markets, including the Caribbean.[54]

A New Export Dynamic

The world LNG trade grew by a record 10% in 2017 alone, outpacing the growth of gas exported by pipelines. Some 80% of that new LNG supply came from Australia and the U.S. in roughly equally shares.[55] Last year was also the first time LNG was shipped from the Arctic, specifically from Russia’s newly commissioned Yamal LNG facility. Yamal made news in January of this year, when a cargo was rerouted to Boston to help alleviate a gas shortage created by a late-winter cold snap (a shortage that would have been supplied by American gas if New York State had not opposed a planned pipeline).[56]

While Asian nations account for the largest share of rising LNG demand, Europe’s need for imports will increase faster than India’s and rival the growth expected for all of Southeast Asia. China is expected to obtain roughly equal growth in imports from LNG and pipelines—the latter, notably, from Russia.[57]

If the U.S. were to meet half the new demand for which global export capacity has yet to be built or planned (~30 bcf per day more global LNG demand is forecast for 2040 than existing capacity and plans), that would result in a nearly 10-fold increase over current American LNG exports. Increasing U.S. natural gas production and export capacity sufficient to meet that export demand would yield domestic economic benefits of about $200 billion a year.[58] And long before new capacity comes on line, bullish pro-export policies would permanently reshape the geopolitical landscape.

The Geopolitical Advantages

The U.S. is the world’s top producer of natural gas, with an annual output of 27 trillion cubic feet (TCF) versus 22 TCF in Russia, 23 TCF in the Middle East, and 5 TCF in China.[59] And America could yet, as noted earlier, double current production.[60]

Aside from the domestic economic benefits from an expanded shale gas industry, other implications are associated with a potential American upset of the former hegemony in global gas trade. Consider a little-noted event in 2018: the media preoccupation with Russian social-media meddling in the 2016 U.S. presidential election obscured a comparable attempt by Russia to sow discord in our domestic energy debates. In March, a report from the House Committee on Science, Space, and Technology found that more than 4,000 social-media accounts linked to Russian entities were engaged in inflaming online debates over pipelines, fossil fuels, and climate change.[61] The fake accounts, for example, advocated for “the complete abandonment of specific fuel sources, such as fossil fuels, by touting exaggerated claims about alternative energy sources,” while sometimes both promoting and mocking climate change, all intended to “generate further domestic [U.S.] controversy.”[62]

It’s not hard to discern why Russia cares about Americans’ opinions on energy issues. Almost 40% of Russia’s federal budget comes from exporting natural gas and petroleum.[63] And the speed and scale of what America might yet do with regard to exporting gas is intimately related to political attitudes and decisions in Washington, D.C., and dozens of state capitals. Even before America began exporting, the U.S. oversupply of natural gas, combined with the prospects of imminent exports, triggered a global collapse in gas prices. In order to lock in market share, Gazprom, Russia’s state-owned natural gas company, sharply reduced its European prices by nearly 30% in 2009 and another 10% in 2014.[64]

Until recently, two of the biggest suppliers of natural gas into world trade have been Russia (mainly via pipelines) and LNG from the Middle East (mainly Qatar, Iran, and Saudi Arabia). Current forecasts for 2040 see Europe increasing its dependence on Russian gas from today’s one-third to 50%.[65] And until very recently, options for China and much of Asia have been similar. But now two new suppliers have upset the old status quo. First came the completion of enormous offshore projects in Australia, adding that nation as a major player in the world LNG export game. And now comes the U.S., as potentially the biggest player in the global gas trade.

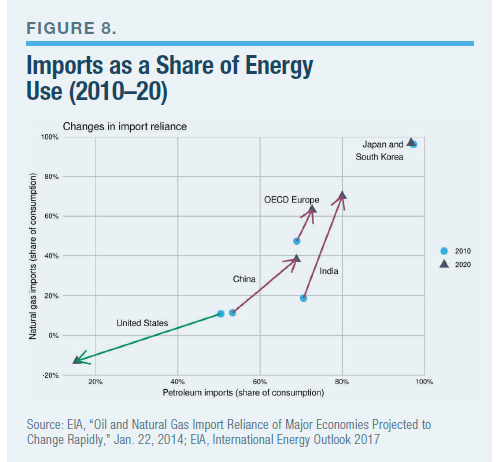

The implications of the new geopolitical era are inherent in the trajectories of national import dependencies for energy. Of the five major economic regions of the world that make up 85% of global GDP—the U.S., China, Europe, Japan, and India—every region but one is becoming rapidly more dependent on imports of both oil and natural gas. And import dependencies are rising faster for natural gas than for petroleum (Figure 8).[66]

Nowhere is the intersection of geopolitics and economics more obvious than in the Sturm und Drang following President Trump’s meeting with Jean-Claude Juncker, president of the European Commission, this summer. The two discussed Europe’s rising dependence on Russian gas and the opportunity to offset that with U.S. LNG. The discussion was motivated by Russia’s Nord Stream 2 pipeline, currently under construction, which will double Gazprom’s ability to sell gas to Europe.[67] One member of Germany’s Green Party summarized the concerns of those opposed to Nord Stream 2: “We’re concerned that this project will destabilize Ukraine, divide the European Union, and give the Russians more excuses to militarize the Baltic Sea.”[68]

One can debate the extent to which Europe is politically swayed by reliance on Russian gas, but the underlying facts are not debatable. Massive subsidies for wind and solar have not eliminated Europe’s need for more natural gas. Europe already imports half its natural gas, and that share is rising. Consequently, the EU has publicized support for new LNG terminals, and Germany is planning to build its first-ever such terminal.[69]

One can debate the extent to which Europe is politically swayed by reliance on Russian gas, but the underlying facts are not debatable. Massive subsidies for wind and solar have not eliminated Europe’s need for more natural gas. Europe already imports half its natural gas, and that share is rising. Consequently, the EU has publicized support for new LNG terminals, and Germany is planning to build its first-ever such terminal.[69]

But Europe already has 26 LNG terminals, and those terminals collectively operate at only 26% of capacity.[70] This means that Europe could easily increase its LNG imports some fourfold nearly overnight. Notably, that could bring in almost threefold more gas than the Nord Stream 2 pipeline’s capacity.[71]

Germany’s government takes the position that if “the LNG coming out of the U.S. came to Germany at competitive prices, that would be fine by us.”[72] U.S. shale gas arrives in European markets for less than half the price of five years ago, but pipelines from Russia can still deliver it about 20% cheaper.[73] But if all of Europe’s idle LNG capacity took delivery of U.S. LNG, that would result in a less than 2% increase in Europe’s total annual energy import bill.[74]

Pressing the U.S. Natural Gas Advantage

Exporting both oil and natural gas requires pipelines, ships, and ports. But shipping LNG overseas also requires capital-intensive gas liquefaction facilities. Sabine Pass, America’s first operating LNG export terminal, cost $18 billion, and its expansion (under way) will bring the total capital invested to $30 billion. That one facility will likely generate over $100 billion in export revenues over a 30-year operating life. But it took DOE five years to issue a final decision that Sabine Pass exports were in “the national interest.” America’s second LNG terminal, at Cove Point, waited four years for final permission.

There is ample evidence of significant overseas, not just U.S., appetite for investing in American LNG export infrastructure.[75] But given the magnitude of the up-front costs, reducing uncertainty is always critical for investors, domestic and foreign. Every additional layer of bureaucracy inherently creates potential for delays, including the potential for ex post facto cancellations.

Two regulatory reforms are needed to reduce such uncertainties and to level the field so that LNG export investments are at least as attractive as domestic industrial infrastructures.

First, the requirement that companies receive permission from the Department of Energy to sell natural gas to overseas buyers needs to be revoked.

Congress did finally see fit to pass legislation signed into law by President Obama in late 2015 to revoke the ban on crude oil exports that was enacted as part of the 1975 Energy Policy and Conservation Act. Nevertheless, DOE still retains the authority to determine if a producer’s interest in exporting natural gas is in the “national interest.” This constraint is unnecessary: natural gas exports are now de facto in the national interest for economic and geopolitical reasons. The president should issue an executive order declaring as much—and provide preemptive permission to any and all LNG export applicants.

To provide long-term confidence among investors and buyers, Congress should firmly and completely revoke DOE’s export authority. This outdated federal authority finds its roots in the 80-year-old 1938 Natural Gas Act that was extended specifically in the 1975 Energy Policy Act. At the same time, Congress should repurpose DOE’s “permissioning” function with a mission to facilitate exports, emulating the U.S. Department of Agriculture’s Foreign Agricultural Service, which has “a variety of services and programs that help U.S. agricultural exporters succeed in the global marketplace.”[76]

Those in Congress who recognize the gratuitous impediment of lengthy export permissions have already proposed legislation to require DOE to expeditiously review LNG applications. Unfortunately, there is no practicable way a vague, rubbery timeline requirement can be enforced by Congress or by a future president determined to ignore it. A clean, straightforward repeal is the solution.

As a related action, Congress should also direct DOE to refocus research funding in order to expand R&D in basic science areas relevant to taking advantage of the effectively unlimited supply of natural gas. Such refocus would also comport with the Office of Management and Budget’s plans to streamline and reorganize federal energy innovation.[77]

Second, the review process under the National Environmental Policy Act (NEPA) needs to be streamlined. More than 70 energy projects are currently under NEPA review, nearly one-third of which involve natural gas. All 13 of the current LNG export applications require Environmental Impact Statements, the most burdensome level of review, which can cause delays ranging from five to nine years.[78]

This market is dependent on a smoothly operating Federal Energy Regulatory Commission (FERC), the agency that leads NEPA review for LNG exports. As of this writing, FERC lacks a fifth commissioner, a position critical to its operations and ability to resolve agency disagreements. Appointing the fifth commissioner should be a priority for the administration and Senate; delay only adds another layer of uncertainty to near-term decisions needed for long-term LNG investments.

As for those harboring fears that America’s natural gas abundance might be a bubble—and thus worry that exports risk raising domestic prices[79]—the obvious solution for production is to open up offshore acreage, where geophysics promises vast resources.[80] The shale gas boom has come entirely from onshore and nonfederal lands. Today, more than 90% of America’s offshore acreage is off limits to production or even exploration to gather information.[81] The U.S. is unique among nations averse to accessing its vast offshore resources available. Offshore production is welcomed and eagerly pursued from Saudi Arabia to China, from Norway to Russia, Ireland to Guyana, India to Israel, and Brazil to Mexico.

But America, as the world’s energy colossus, remains gratuitously hobbled in both the long-term pursuit of its resources and, critically, in the near-term acceleration of massive LNG export opportunities.

Endnotes

- BP Energy Outlook 2018.

- American Petroleum Institute (API), Benefits and Opportunities of Natural Gas Use, Transportation, and Production, June 2017.

- Christopher T. M. Clack et al., “Evaluation of a Proposal for Reliable Low-Cost Grid Power with 100% Wind, Water, and Solar,” Proceedings of the National Academy of Sciences, June 27, 2017.

- U.S. Energy Information Agency (EIA), International Energy Outlook 2018.

- BP Energy Outlook 2018.

- Mark Muro et al., “Beyond Boom and Bust: Getting Clean Energy Policy Right,” Brookings Institution, April 2012; EIA, “Shale Gas Production Drives World Natural Gas Production Growth,” Aug. 15, 2016.

- U.S. Department of Energy, EIA, Today in Energy, “By Some Measures, U.S. Natural Gas Production Set a Record in 2017,” Apr. 16, 2018.

- EIA, “Natural Gas Gross Withdrawals and Production, 2018.”

- EIA, “Annual Energy Outlook 2018, with Projections to 2050,” pp. 59–76.

- EIA, “United States Remains the World’s Top Producer of Petroleum and Natural Gas Hydrocarbons,” May 21, 2018.

- Vello Kuuskraa, Advanced Resources International, “Perspectives on Domestic Natural Gas Supplies and Productive Capacity,” workshop, Growing the North American Natural Gas Production Platform, EPRINC (Energy Policy Research Foundation), Apr. 19, 2018.

- See Mark P. Mills, “Shale 2.0: Technology and the Coming Big-Data Revolution in America’s Shale Oil Fields,” Manhattan Institute, May 2015; Harsh Choudhry et al., “The Next Frontier for Digital Technologies in Oil and Gas,” McKinsey & Co., August 2016; Goldman Sachs, “The New Oil Order,” 2018; World Economic Forum, “Digitalization: A New Era for Oil and Gas,” 2017.

- Mark P. Mills, “The Future for Oil Supply and Prices After the ‘Amazon Effect’ Stimulates Shale 2.0,” Forbes, Oct. 6, 2017; Christopher M. Matthews, “Silicon Valley to Big Oil: We Can Manage Your Data Better than You,” Wall Street Journal, July 24, 2018.

- International Energy Agency (IEA), “Digitalization and Energy,” Nov. 5, 2017.

- “Schlumberger Announces New Digital Well Construction Planning Solution,” World Oil, Sept. 14, 2017; Microsoft News Center, “Microsoft and Halliburton Collaborate to Digitally Transform the Oil and Gas Industry,” Aug. 22, 2017; “Weatherford, Intel Collaborate on Digital Oilfield Technologies,” World Oil, Oct. 3, 2017.

- EIA, “Drilling Productivity Report,” July 2018.

- James L. Smith, “Estimating the Future Supply of Shale Oil: A Bakken Case Study,” MIT Center for Energy and Environmental Policy Research, Jan. 19, 2017.

- EIA, “Annual Energy Outlook 2018.”

- USGS quoted in Robert Pirog and Michael Ratner, “Natural Gas in the U.S. Economy: Opportunities for Growth,” Congressional Research Service (CRS), Nov. 6, 2012.

- EIA, “Annual Energy Outlook 2018.”

- Tony Seeba, “Clean Disruption of Energy and Transportation: How Silicon Valley Will Make Oil, Nuclear, Natural Gas, Coal, Electric Utilities and Conventional Cars Obsolete by 2030” (beta edition, 2014).

- John Boyd, “Efficiency of Silicon Solar Cells Climbs,” IEEE Spectrum, Mar. 20, 2017.

- Marisa Blackwood, “Maximum Efficiency of a Wind Turbine,” Undergraduate Journal of Mathematical Modeling: One + Two 6, no. 2 (Spring 2016).

- Alexis Vossier et al., “Approaching the Shockley-Queisser Limit: General Assessment of the Main Limiting Mechanisms in Photovoltaic Cells,” Journal of Applied Physics 117, no. 1 (Jan. 6, 2015).

- Sam Davis, “Scientists Use Silicon-Perovskite to Boost Solar-Cell Efficiency,” Power Electronics, July 12, 2018.

- Data for calculations drawn from: Kuuskraa, “Perspectives on Domestic Natural Gas Supplies and Productive Capacity”; gas turbine kWh/Btu from General Electric, “Breaking the Power Plant Efficiency Record”; EIA, “Capital Cost Estimates for Utility Scale Electricity Generating Plants,” Nov. 16, 2016; solar and wind capacity factors from EIA, Electric Power Monthly, May 2018. Calculations do not include the ~$1,000/kW capital cost of a turbine generator for natural gas or the cost of battery storage for wind/solar of~$1,500–$4,000/kW (EIA, “U.S. Battery Storage Market Trends,” May 2018), the latter as critical as the former for utility-scale grid operation.

- “Incentivizing Solar Energy: An In-Depth Analysis of U.S. Solar Incentives,” Consumer Energy Alliance, June 2018.

- Frédéric Simon, “Germany Pours Cold Water on EU’s Clean Energy Ambitions,” EURACTIV.com, June 12, 2018.

- Rusty Braziel, “U.S. Natural Gas Flows and Prices Are Now Inextricably Tied to LNG Export Markets,” RBN Energy, June 4, 2018.

- Frédéric Simon, “Europe Grapples with Dutch Gas Production ‘Collapse,’ ” EURACTIV.com, May 16, 2018.

- EIA, International Energy Outlook 2017, re 300%; BP Energy Outlook 2018, re 500%.

- American Chemistry Council (ACC), “Mid-Year 2018 Chemical Industry: Situation and Outlook.”

- “Transporting Growth: Delivering a Chemical Manufacturing Renaissance,” PwC report for the American Chemistry Council, March 2017. See also ACC, “Outlook: U.S. Chemical Industry Continues to Outpace Industrial Output; Accounts for More than One-Half of Construction Spending by Manufacturing Sector,” Dec. 8, 2016; Jack Kaskey, “U.S. Chemicals Are Rocketing Back—Manufacturers Are Making the Most of Cheap Natural Gas,” Bloomberg Business Week, Nov. 3, 2017.

- “Northeast Could Be Second US Chemicals Hub,” Petrochemical Update, June 14, 2018.

- DOE, Natural Gas Vehicles.

- Mark P. Mills, “Exposed: How America’s Electric Grids Are Becoming Greener, Smarter—and More Vulnerable,” Manhattan Institute, June 2016.

- Mark P. Mills, “The Bloom Energy IPO, Tesla and the Shale Technology Revolution,” Forbes, July 25, 2018.

- Natural gas already provides approximately 40% of U.S. electric supply; assuming that 20% of all loads are critical and U.S. natural gas production doubles implies absorbing less than 5% of production growth.

- Braziel, “U.S. Natural Gas Flows and Prices Are Now Inextricably Tied to LNG Export Markets.”

- “Liquefied Natural Gas Developments and Market Impacts,” report by staff of the Market Intelligence Branch Division of Market Oversight, U.S. Commodity Futures Trading Commission, May 2018.

- Michael Ratner and Carol Glover, “U.S. Energy: Overview and Key Statistics,” CRS, June 27, 2014.

- BP Energy Outlook 2018.

- IEA, “World Energy Outlook 2017,” Nov. 14, 2017, p. 13.

- BP Energy Outlook 2018.

- See BP Energy Outlook 2018 for examples of various estimates.

- Julie Gordon, “Next-Wave LNG Terminals Get Smaller to Offer Flexible Supply Deals,” Reuters, Feb. 5, 2018.

- Ryan Collins and Naureen S. Malik, “A First for Panama Canal: Three LNG Tankers Crossed in a Day,” World Oil, Apr. 19, 2018.

- Calculation based on 0.8 million tons LNG per Panamax ship; see LNG World News, “LNG Sakura Transits Panama Canal,” May 1, 2018.

- Business Wire, “Cheniere and GAIL Celebrate Commencement of 20-Year LNG Contract,” Mar. 5, 2018; wind data from EIA, “Monthly Energy Review.”

- Sheetal Nasta, “Record Gas Production Reins in Futures Prices,” RBN Energy, July 9, 2018.

- Bloomberg New Energy Finance, “Sustainable Energy in America,” 2018.

- “Liquefied Natural Gas (LNG) Arrives in the Bahamas: Polymers International and New Fortress Energy Sign Historic Multi-Year LNG Agreement,” Polymers International, Jan. 29, 2018.

- Yasmine Zhu, “Will a Gas Market Develop in the Caribbean?” Energy Insights, McKinsey & Co., November 2017.

- Joanna Martin Ziegenfuss, “Big Break Through for Small Scale LNG,” OilPrice.com, Sept. 13, 2016.

- “U.S. Liquefied Natural Gas (LNG) Exports: Prospects for the Caribbean,” CRS, Nov. 1, 2017.

- Carolyn Davis, “Global LNG Trade Sets Record Annual Increase on U.S., Australia Exports,” Natural Gas Intelligence, June 11, 2018.

- Charlie Passut, “Despite Sanctions, Russian LNG Cargo Arrives in New England,” Natural Gas Intelligence, Jan. 29, 2018.

- IEA World Energy Outlook 2017, “Change in Gas Imports by Selected Region and Mode in the New Policies Scenario, 2016–40,” November 2017.

- ICF International, “Calculating the Economic Benefits of U.S. LNG Exports,” Apr. 17, 2018; assumes that today’s 3.5 bcf/d goes to ~30 bcf/d. The economic value of +30 bcf/d comes from API, “Benefits and Opportunities of Natural Gas Transportation and Production.”

- BP Energy Outlook 2018.

- See EIA, “Annual Energy Outlook 2018”; “high” case, p. 67.

- See “Russian Attempts to Influence U.S. Domestic Energy Markets by Exploiting Social Media,” House Committee on Science, Space, and Technology, Majority Staff Report, Mar. 1, 2018; Miranda Green, “House Panel: Russia Aimed to Disrupt US Energy Markets Using Social Media,” The Hill, Mar. 1, 2018.

- Craig Timberg and Tony Romm, “These Provocative Images Show Russian Trolls Sought to Inflame Debate over Climate Change, Fracking and Dakota Pipeline,” Washington Post, Mar. 1, 2018.

- EIA, “Russia Exports Most of Its Crude Oil Production, Mainly to Europe,” Nov. 14, 2017.

- Jack Farchy, “Russia’s Gazprom Left Wounded by Gas Price Plunge,” Financial Times, May 22, 2016.

- BP Energy Outlook 2018.

- EIA, “Oil and Natural Gas Import Reliance of Major Economies Projected to Change Rapidly,” Jan. 22, 2014.

- Simon, “Europe Grapples with Dutch Gas Production ‘Collapse,’ ” EURACTIV.com, May 16, 2018.

- Nick Snow, “A Unified Europe Is Essential to Its Energy Security, Forum Told,” Oil & Gas Journal, May 24, 2018.

- Klaus Stratmann, “A New German Gas Terminal Could Be an Opportunity for U.S.,” Handelsblatt Global, July 23, 2018.

- International Gas Union, World LNG Report, 2018.

- Gazprom, Nord Stream 2 (1,900 bcf/yr); EURACTIV.com, “Trump Bets on New European LNG Terminals but EU Funds Meagre,” Aug. 1, 2018 (LNG terminals’ collective capacity of 7,300 bcf/yr, 75% unused ~5,500 bcf/yr).

- Stratmann, “A New German Gas Terminal.”

- Jo Harper, “Can Juncker Keep His Pledge to Buy More US Gas?” DW Akademie, July 27, 2018.

- Eurostat, “EU Imports of Energy Products—Recent Developments,” Aug. 6, 2018 (European energy imports from all sources ~$300 billion).

- See, e.g., Tim Daiss, “Trump’s Tariffs Can’t Deter Chinese LNG Investment,” Oil Price.com, Mar. 30, 2018; “Japan to Promote American LNG Exports with Eye on Trade Gap,” Nikkei Asian Review, April 23, 2018; Yuta Sugiura, “Multiple Gas Plant Construction Projects Start Up After Two-Year Slump,” Nikkei Asian Review, June 3, 2018.

- Mark Slupek, “Exports: Getting into the Game,” U.S. Department of Agriculture, Foreign Agricultural Service, June 15, 2016.

- Office of Management and Budget, “Delivering Government Solutions in the 21st Century: Reform Plan and Reorganization Recommendations,” June 2018.

- Philip Rosetti, “Energy Infrastructure Plans Should Reform Federal Approval Process,” American Action Forum, Oct. 12, 2017, has a list of the projects involving natural gas exports. See also Charles Hughes, “Streamlining Infrastructure Environmental Review,” Manhattan Institute, June 15, 2018.

- Office of Senator Markey, “New LNG Export Rule Is a Fossil Fuel Handout,” July 25, 2018.

- Bureau of Ocean Energy Management, U.S. Dept. of Interior, “2016a National Assessment of Undiscovered Oil and Gas Resources of the U.S. Outer Continental Shelf,” 2017.

- API, “Unlocking America’s Offshore Energy.”

______________________

Mark P. Mills is a senior fellow at the Manhattan Institute and a faculty fellow at Northwestern University’s McCormick School of Engineering. In 2016, he was named “Energy Writer of the Year” by the American Energy Society. Follow him on Twitter here.

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).