The Declining Case for Municipal Recycling

Garbage pickup is one of the core responsibilities and functions of many local governments. That service has been augmented, over the past four decades, by the collection of recyclables—typically paper, glass, metals, and plastic. Every major American city provides this service. Recycling has long been considered environmentally and financially beneficial. The materials would be reprocessed and used as newsprint, bottles, or cans, while the markets for such materials would make it possible to cover the costs of collection and reprocessing, or even to realize income. Even in periods of slack demand, the cost to dispose of recyclables was lower than that of mixed garbage—allowing cities to reap an economic benefit by paying less to get rid of some of their trash.

This apparent win-win situation has changed dramatically. China, which was importing several billion dollars’ worth of U.S. recyclables in 2017, announced a new policy, Operation National Sword, under which it would no longer permit the import of what it called “foreign trash.” The government stopped taking in other nations’ garbage partly because much of the material was not recyclable, and this was partly because of contamination. Pizza-box cardboard, for instance, is frequently contaminated by food residue, and plastic by dirty labels. As a result, much of the garbage that China imported was not recycled and ended up in landfills or incinerated. When Operation National Sword took effect in 2018, China insisted that it would accept only the noncontaminated recyclables that its manufacturers could use. As a result, the market for recyclables collapsed, and imports from the U.S. and elsewhere plunged.

Since then, newspapers and other materials that municipal sanitation departments (or private firms) had picked up from city residents, who had dutifully sorted the materials and placed them in blue boxes, have increasingly piled up in warehouses or have been sent to landfills. Yet, despite their reputation, landfills—once infamous for leaking into groundwater—have become federally regulated and are far more environmentally safe. It remains true that recyclable materials may be reused—but there is no assurance that this will happen, especially for plastics.

Meanwhile, the economics of municipal recycling has been turned upside down. Those city departments responsible for trash pickup now incur significant costs, over and above what they would have to pay in the absence of recycling. These costs include the personnel and equipment for separate additional refuse collection (or payment to a contractor to provide the service), as well as the cost of paying firms to accept recyclables, now that they no longer can be profitably resold.

Some recyclables—notably, aluminum cans—continue to have a relatively high market value. But they are mixed with other materials that have little value and therefore require expensive sorting.

This paper examines the financial impact of separately collecting waste materials for recycling in five jurisdictions: New York City; Boston, Massachusetts; suburban Westchester County, New York; San Jose, California; and Dallas, Texas. It finds that the cost-benefit trade-off is unfavorable and that suspending or adjusting recycling services could lead to significant budget savings. These savings are particularly relevant in the wake of the Covid-19 pandemic, which is expected to reduce tax revenues and lead to pressure to reduce public services. Determining what is an essential public service in this context is crucial, and the costs of collecting and sorting recyclable materials—some materials may not even be recycled—risk crowding out appropriations for public safety, public health, parks, and schools.[1] This paper asks if the collection of recyclables should continue to be considered a core municipal service—or how it might be adjusted to be both environmentally beneficial and not an economic drain.

Recycling History

The idea of recycling municipal garbage grew in popularity over the last quarter of the 20th century. Over time, the methods of collection became more refined. Municipalities arranged to collect paper, metals, glass, and plastic in separate “streams,” or, increasingly, to collect recyclables in a “single stream” as a way to encourage residents to participate. The paper, glass, metals, and plastic would then be separated by municipal employees or a private contractor or facility.

Complementary goals were to be achieved by increasing the amount of waste diverted to recycling markets. One goal was the supposed environmental benefits of keeping nonbiodegradable materials out of landfills. Since recycled materials would generate revenue for the city, recycling could lead to avoided costs, such as the traditional “tipping” fees that municipalities paid to landfills to dump their garbage.

This line of reasoning is well represented by a 2019 guide for municipalities published by the U.S. Environmental Protection Agency (EPA). In “Managing and Transforming Waste Streams: A Tool for Communities,” EPA advises that “waste is a valuable resource. Communities can recover the lost value of material discards by setting up systems for reuse, recycling, and and composting.” The goal, the guide continues, is “charting a path toward zero waste”[2]—in other words, burying no trash in landfills.

During the past 40 years, however, the environmental and economic benefits of municipal recycling have become less clear-cut. Writing in the Journal of Environmental Economics and Management, U.S. economist Thomas Kinnaman, in collaboration with Japanese economists Takayoshi Shinkuma and Masashi Yamamoto, examined recycling in Japan, where rates of collection are similar to those of the U.S. and other developed nations. They found that Japan was collecting far more nominally recyclable materials than its markets could profitably absorb. As the authors put it in 2014, “Japan and perhaps other developed countries may be setting inefficiently high recycling goals.”[3] The authors estimated that the optimal recycling rate, as judged by environmental and economic criteria, may be only 10%, far below the 35% of municipal solid waste that the EPA estimated was collected for recycling in 2017.[4]

The inefficiency that the authors found in Japan applies in the same way for American municipalities: more money is being invested in collection than can be realized in revenue or reduced disposal costs. The advent of “single-stream” recycling—in which households merge paper, plastic, glass, and metal—has attracted particular concern, in light of limited markets for recycled plastic and because of transport costs (and thus carbon emissions and greenhouse gases) associated with getting it to countries with the capacity to reprocess it. In a 2015 essay for the New York Times, the newspaper’s longtime science writer John Tierney quoted the chief executive officer of Waste Management, the largest recycler of household trash in the U.S., saying, "Trying to turn garbage into gold costs a lot more than expected. We need to ask ourselves: ‘What is the goal here?’"[5]

The China Syndrome

The guiding assumptions behind the movement toward municipal recycling were upset in July 2017. That’s when China announced Operation National Sword, under which it would severely limit imports of “foreign trash.”[6] Beijing did this partly because much of the imported material was not recyclable, partly because of contamination. Pizza-box cardboard, for example, frequently includes food residue; and plastic often comes with dirty labels. As a result, much of the trash that China imported simply went into landfills or was incinerated.

When Operation National Sword took effect in 2018, China insisted that it would accept only the noncontaminated recyclables that its manufacturers could use. As a result, the market for recyclables collapsed. Global exports of recyclable plastic to China, for example, dropped by 99% in 2018.[7]

Since the early 1990s, China had grown to become the leading destination for U.S. recyclables—as its growing economy had an appetite for reusable materials for its manufacturing sector. In 2017, the year Operation National Sword was announced, China imported $5.6 billion in U.S. recyclables.[8] The collapse of the Chinese import market led to a collapse in prices for recyclables. Bloomberg estimated that the average price of corrugated cardboard fell 85% from 2017 to 2019. Virgin plastic turned out to be less expensive than the recycled version.[9]

From a sheer economic perspective, a strong argument could be made that, after China cut off the pipeline, U.S. municipalities had good reason to get out of the recycling business. And that has occurred in some small, cash-strapped jurisdictions. The Atlantic reported that the small town of Franklin, New Hampshire (population 7,800), halted the collection of recyclables after the market change. Franklin used to sell the contents of the ubiquitous blue bins for $6 per ton. After the market collapsed, it had to pay $125 per ton simply to dispose of recyclables, significantly more than the $68 per ton that it would cost to incinerate the materials. In this tiny community, 20% of the residents have incomes below the poverty line.[10]

Franklin’s decision is not a one-off. The national website Waste Dive, which has tracked the impact of the change in China’s policy in all 50 states, estimates that “approximately 60 curbside programs have been canceled, with even more drop-off site closures and material limitations.”[11]

Nevertheless, the dramatic change in the economics of recycling has not led to a change in practice in big cities with larger budgets—although it has led to a significant change in their costs. What follows is an analysis of the financial implications of ongoing recycling in five large and distinct jurisdictions. They include municipalities that use public employees and others that contract private firms to do so.

New York City[12]

The Department of Sanitation of the nation’s largest city (population 8.4 million) picks up recyclables from residential properties weekly. The department estimates the cost of collection for FY 2019 at $686 per ton. Collection includes paper, cardboard, metals, glass, plastics, and cartons. Based on preexisting contracts, the city continues to receive revenue from paper recycling, but at a declining rate: $12 per ton for 2019, compared with $14 per ton in FY 2017.

The situation is less positive for other recyclables. As the department puts it: “Under current market conditions, we do not receive revenue-sharing on these materials.” In fact, the city must pay $79.88 per ton of non-paper recyclables as a “tipping” fee to dispose of them in any way possible (in a landfill or to a recycling processing plant).

The economics are stark. Overall, the city collected 680,000 tons of recyclables in FY 2019—and for that portion of the recyclables comprising everything but paper, it must pay over and above its $686-per-ton cost of collection to dispose of the materials. Yet it could dispose of both recyclables and general refuse in landfills at $126.03 per ton—and avoid the separate, astronomical cost of collecting recyclables. Using recycling quantities from a 2017 “waste characterization study” (Figure 1),[13] the total potential savings exceed $340 million.

By comparison, the entire budget of the New York City Parks Department, which provides immediate environmental benefits to residents, is $540 million.[14]

It’s important to note that the above budget savings are based on the assumption that the current volume of recyclables can be accommodated by collection trucks picking up general refuse while not adding to present fixed costs. This is a reasonably safe assumption, however, as only 18% of New York City household refuse is diverted for recycling.[15]

Boston[17]

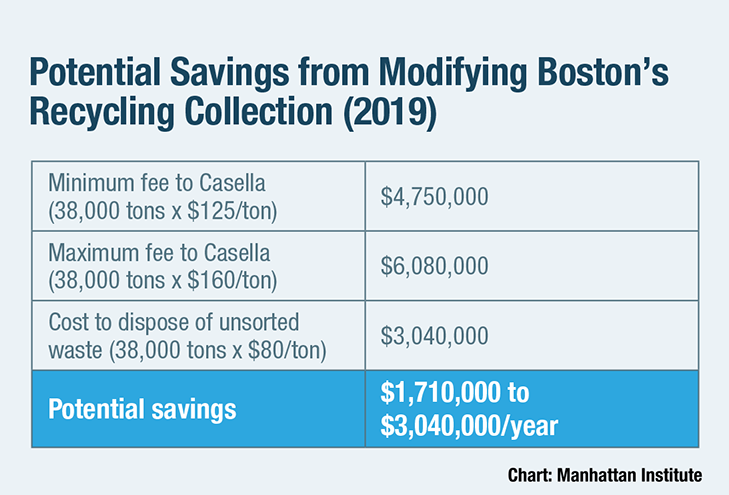

Municipal contractors in Boston, Massachusetts (population 694,000) annually collect 38,000 tons of recyclables—about 21% of the estimated total waste that city households discard. Boston then pays a private firm, Casella Waste Systems, to sort and sell the materials when there is a buyer, or otherwise dispose of them.

The price that the city must pay Casella to accept these recyclables has been rising, partly because some 25% of the materials are contaminated. A five-year “residential recycling processing contract” that expired in 2019 called on the city to pay $70 per ton for that service;[18] a new contract signed in 2019 increased that fee to a minimum of $125 per ton and a maximum of $160 per ton—depending on market conditions.[19] In other words, Boston had to ensure that Casella would not lose money if it were unable to find buyers for the materials at a price in line with its costs. That possibility is real: from 2017 to 2018, Casella’s revenue from recyclables fell from $62.31 million to $42.19 million[20]—including a $23.5 million decrease attributable to “unfavorable commodity pricing in the marketplace.”[21]

Notably, Boston pays a significantly lower tipping fee to dump the unsorted general refuse that it collects: $80 per ton.[22] Thus, Boston, like New York, could realize significant budget savings (albeit a much lower dollar figure, given the differences in population and municipal garbage collection practices) by ending or altering its collection of recyclables (Figure 2).

Notably, Boston pays a significantly lower tipping fee to dump the unsorted general refuse that it collects: $80 per ton.[22] Thus, Boston, like New York, could realize significant budget savings (albeit a much lower dollar figure, given the differences in population and municipal garbage collection practices) by ending or altering its collection of recyclables (Figure 2).

Westchester County, New York[23]

Westchester County (population 967,000) is a suburban area north of New York City. It consists of 43 separate municipalities, including those with city forms of government, such as White Plains, New Rochelle, and Mount Vernon, and smaller towns and villages, including Scarsdale, one of the wealthiest communities in the United States. All the municipalities also support and receive certain services from the county, a distinct unit of government that is overseen by an elected chief executive and legislature.

Those services include the handling of recyclables. Westchester pays a private contractor (City Carting) some $2 million annually to sort and sell the collected materials. At first glance, the county appears to have a financially beneficial arrangement; it pays City Carting a flat collection fee and receives 80% of the revenue that the contractor earns from the sale of recyclables. To date, based on figures from the county’s Department of Environmental Facilities, the revenue realized through the sale of some 130,000 tons of recyclables has been declining but is nevertheless adequate to cover the county’s costs (Figure 3).

Those services include the handling of recyclables. Westchester pays a private contractor (City Carting) some $2 million annually to sort and sell the collected materials. At first glance, the county appears to have a financially beneficial arrangement; it pays City Carting a flat collection fee and receives 80% of the revenue that the contractor earns from the sale of recyclables. To date, based on figures from the county’s Department of Environmental Facilities, the revenue realized through the sale of some 130,000 tons of recyclables has been declining but is nevertheless adequate to cover the county’s costs (Figure 3).

These figures are deceptive because, unlike New York City or Boston, Westchester County does not collect recyclable materials at the household level. Instead, each of the 36 municipalities in Westchester’s Refuse District is responsible for the pickup of all residential garbage, whether recyclable or not. Thus, the full cost of recycling is not reflected in the county’s $2 million contract. And the costs of collection at the local level are substantial. Rye, the county’s smallest city (population 15,000), estimates its cost for collecting recyclables (which requires special-purpose trucks and crews) to be $530,000 annually. Sanitation department costs are among the largest budget items for most of these local governments. New Rochelle (population 79,000) does not distinguish between the cost of picking up residential waste and recyclables, but its total annual cost is $5.9 million.[24]

Local municipalities are forgiven a tipping fee by the county—ordinarily $29 per ton of nonrecyclable refuse (itself well below the county’s full cost of $90 per ton to City Carting to sort and sell recyclables). However, this arrangement does not make up for the municipalities’ cost of picking up recyclables. Rye, for instance, paid $530,000 to collect 2,283 tons of recyclables (1,470 tons of paper, 732 tons of glass and plastic, and 81 tons of metal). Paying the county to dispose of that, at the $29-per-ton rate, would cost Rye just $66,207 and require no recycling trucks and special crews. Even if Rye paid the county’s full $90-per-ton cost of disposal for recyclables, it would incur a cost of $205,470—far less than what it pays to pick up residential recyclables.

The county’s larger cities, including Yonkers (population 200,000), White Plains (population 58,000), and New Rochelle are also calling on their taxpayers to provide what amounts to a free collection service to deliver recyclables to the county government, which itself barely breaks even on their processing. These jurisdictions do not specify, in their published budgets, the specific collection cost for recyclables. But based on the Rye example—that city devotes 25% of its refuse collection to recycling—the potential savings for other Westchester cities are likely significant.

San Jose, California[25]

The nation’s 10th largest city has long been considered a leader in recycling. With a population (1.03 million) similar to that of Westchester County, it diverts far more residential refuse from the general refuse stream, thanks to the high recycling rate of its 320,000 households. (The overall San Jose diversion rate, according to a case study published by EPA, is 74%, including compost and yard waste. By comparison, Westchester estimates that just 52% of the paper, glass, metal, and plastic is placed in recycling bins. For Boston, that figure is 21%.) EPA lauds San Jose as “a nationally recognized leader in waste management and boasts one of the highest diversion rates in the country.”[26]

EPA notes that the city provides financial incentives for two contractors to divert as much household waste as possible from the general refuse stream: “San Jose pioneered the use of contractual rates, fees, taxes, and contractor compensation to provide incentives for generators, waste haulers, recyclers, composters, and even landfill operators to focus first on reducing and reusing materials, then recycling, digesting and composting the rest.” For example, the recycling contractor receives approximately $5.40 per household for diversion of 40%–42%, $6.50 per household for diversion of 42%–44%, $8.30 per household for diversion of 44%–46%, and $9.20 per household for diversion of at least 46%.[27]

The arrangement worked to the benefit of the city and its contractors—until it didn’t. For even as EPA praised San Jose’s recycling policy, local reporting highlighted the fact that “waste piles up in San Jose as China limits recycling imports” and noted that the market price for mixed paper had fallen from $160 to $3 per ton.[28] The situation has become similarly dire for plastics recycling in California, as the state’s largest operator of plastic bottle redemption centers outside grocery stores closed all its 284 sites[29] in August 2019 because of falling prices for plastic and even aluminum, which had historically enjoyed a relatively strong market.[30]

San Jose, however, like most other municipalities, has remained committed to its “zero waste” goal, although this goal appears to be impractical. Indeed, the city’s “diversion rate,” praised by EPA, was, in all probability, illusory. Reprocessors in China were rejecting much of the materials they received, instead simply dumping it in settings far less sanitary and environmentally safe than contemporary U.S. landfills.[31]

Dallas[32]

The Big D has what appears to be the financially best recycling arrangement in the United States. The city’s recyclables are sent to a privately owned and managed recycling processing center, a state-of-theart facility that opened in 2017. That facility operates under a contract that gives Dallas an unlimited right to send recyclables to it without charge—and revenue earned by the contractor (the Madrid-based FCC Environmental Services) is to be shared with the city. The city pays only to collect recyclables, a cost that it covers by a monthly $28.54 general refuse collection fee charged to 240,000 households—some 185,000 to 190,000 of which participate (at no additional charge) in the recycling program.

The City of Dallas Department of Sanitation Services is responsible for the collection of both general refuse and recyclables from the city’s residential households. It also runs the city-owned McCommas Bluff Landfill. This landfill has operating costs but also generates revenue through tipping fees charged to commercial operators and other municipalities.

The total cost of Dallas sanitation services ($113 million in FY 2019) is covered, by statute, by revenues realized or charged by the department. The service is run as an “enterprise fund” and must balance its budget through a combination of income or fees. Because private firms or other municipalities pay Dallas to dump their refuse at McCommas Bluff, the city realizes some $30 million annually, more than covering the landfill’s $26 million operating costs. That sum dwarfs the $882,606 that Dallas received from its share of the sale of recyclables by FCC in 2019.[33]

The combination of refuse collection fees charged to households and the tipping fees from the landfill covers the city’s costs of collecting all refuse (recyclables and general waste). However, the city realizes virtually no recyclable sales revenue to help reduce the cost to residential households, as first envisioned when recycling began to be widely adopted.

Dallas officials believe that they were fortunate to have entered into the “design-build-operate” contract with FCC before the collapse in the recycling market. In doing so, Dallas transferred market risk to a private firm and insulated itself from the market problems that developed. This is not an option that other cities could likely pursue successfully today. The Dallas deal allows the city to fulfill the contract simply through the collection of recyclables; cities such as New York today must pay reprocessors to accept the materials at all.

In 2015, when Dallas issued its RFP for a recycling process center, a good case could be made for the investment. Revenue could plausibly lead to recycling paying for itself, or coming close to doing so, if the city were to realize significant revenues. As matters stand in 2020, that is not close to being the case.

If all recyclables were merged with general refuse collection, the city would save some $14 million annually in operating costs.[34] In effect, 240,000 Dallas households are subsidizing FCC’s operations through a $58.33-per-year cost that is included in the refuse fee that each household pays ($14 million divided by 240,000 households). These fee-payers are covering the cost of collecting and delivering 55,000 tons of recyclables annually to a private company—supporting its fundamental need for raw materials. Dallas also subsidized FCC by providing the land on which the company built its reprocessing plant.

There is some evidence that FCC is under financial pressure. In 2019, the company asked the Dallas City Council to lessen the $15-per-ton host fee that it pays when it processes recyclables from sources outside the city.[35] FCC has the right to opt out of its arrangement with Dallas after 15 years, at which point the city could find itself forced to operate the reprocessing facility itself, likely a loss. One city official said, “Based on the current economics of it, absolutely, it would make more sense to landfill. I think that’s the case across the country—or the world, for that matter—in most cases.”

Dallas, thanks to an unusual combination of factors, has buffered itself somewhat from the current recycling market by transferring risk to a private entity. But in the long term, that risk remains.

The Recycling Path Forward

As a practical matter, none of the municipal case studies that this paper examined makes a strong case to continue the collection of recyclables as it has historically been conducted. Jurisdictions face a series of unappetizing choices: paying more to recycle less, or paying less but still seeing recycling goals not attained. The financial case for recycling that seemed strong not long ago has evaporated.

In effect, municipalities are operating what might be called “field of dreams” systems. Rather than the “build it and they will come” story line of the film about a baseball stadium built in a cornfield, what might be called “collect it and they will come” assumes that, at some point, the recycling market will rebound; thus, it makes sense for the collection system to remain in place.

This is a defensible policy only for municipalities in a financial position to effectively lose money in the service of a long-term environmental goal, even if the goal may never be attainable. Even so, it ignores the question of which other city services—schools, police, or parks and recreation—might receive less funding as a result.

Municipalities do, however, have other choices.

First, they could simply cease separate pickups for recycling—and resume them if and when market conditions change. This would allow cities to pay lower fees to send refuse to landfills—which, notwithstanding a bad environmental reputation based on practices that predate federal regulation, are now considered a safe and sanitary substitute. As EPA puts it: “Modern landfills are well-engineered facilities... [that] must be designed to protect the environments from contaminants, which may be present in the solid waste disposed in the unit.”[36]

Alternatively, recycling pickups could be confined to those materials that command the highest prices, although even aluminum—long considered the most valuable recyclable—has dropped sharply in value. At least one city, Minneapolis (population 425,000), has already excluded some types of plastic (black plastic and styrene) from materials that residents can place in recycling bins for collection.[37] Broadly, adapting and adjusting recycling pickups to focus on those materials with ongoing value is an option worth examining.

In this context, it’s important to acknowledge the environmental limits of recycling. “To reduce carbon emissions,” as Tierney has written, “you’ll accomplish a lot more by sorting paper and aluminum cans than by worrying about yogurt containers.” (Tierney estimates that to offset the greenhouse impact of one passenger’s round-trip flight between New York and London would require the recycling of roughly 40,000 plastic bottles.)[38]

Under current conditions, in short, it is difficult to make a financial and environmental case for municipalities to continue the universal, single-stream recycling of plastic, glass, metal, and paper.

Acknowledgment

The author is grateful for the assistance of Noah Muscente, a project manager at the Manhattan Institute.

Endnotes

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).