A Plan to Make Medicaid Fair, Focused, and Accountable

Medicaid is structured so that the federal government pays states according to how much they spend on medical services for eligible beneficiaries. This has skewed the program’s spending toward the wealthiest states that are most able to put up their own funds. These states have expanded benefits to individuals— many of whom were already covered by private insurance—while encouraging the proliferation of accounting tricks to inflate the program’s costs to the federal government. This arrangement has ensured that the program’s funds are poorly targeted to fill unmet needs. As a result, despite $600 billion being spent on Medicaid in 2018, 28 million Americans still lack basic health-insurance coverage.

Over recent decades, Medicaid’s funding structure has led states to overextend program commitments in economic upturns, leading to enormous federal bailouts in each of the recent recessions. As Covid-19 causes state revenues to plummet and Medicaid enrollment to increase, the program’s financing arrangements appear set to collapse altogether.

Congress should take this opportunity to restructure Medicaid on a sounder foundation. This paper recommends, first, that the federal government take full financial and administrative responsibility for providing acute care to individuals that states are currently required to cover. Second, the federal government should provide a capped allotment to assist each state with the provision of long-term-care services to enrollees. Third, states should be free to provide additional health-care benefits (not required by federal law) to residents but pay for them entirely out of their own resources.

These reforms would ensure that Medicaid becomes a program focused on providing health-care benefits to Americans who most need assistance, rather than an open-ended opportunity for wealthy states to shift costs to federal taxpayers.

The Medicaid Benefit

Congress established Medicare as a federal entitlement in 1965, replacing the Kerr-Mills system of grants to states, which had supported the provision of a range of health-care benefits to the low-income elderly. That same year, Medicaid was also established to allow states to provide health-care benefits to low-income Americans under age 65.[1] States were not required to participate, and Medicaid was not expected to become a major entitlement. But it grew rapidly: since 1982, every state has operated its own Medicaid program.[2] Since the program’s inception, eligibility for Medicaid benefits has been incrementally expanded.

In 2018, Medicaid paid for health-care services for 76 million people, at a total cost of $616 billion.[3] The program is jointly funded by state and federal governments, and it is administered by states under broad federal rules. For every dollar that states spend, they may claim “matching funds” from the federal treasury. In 2017, 63% of the program’s cost was borne by the federal government.[4]

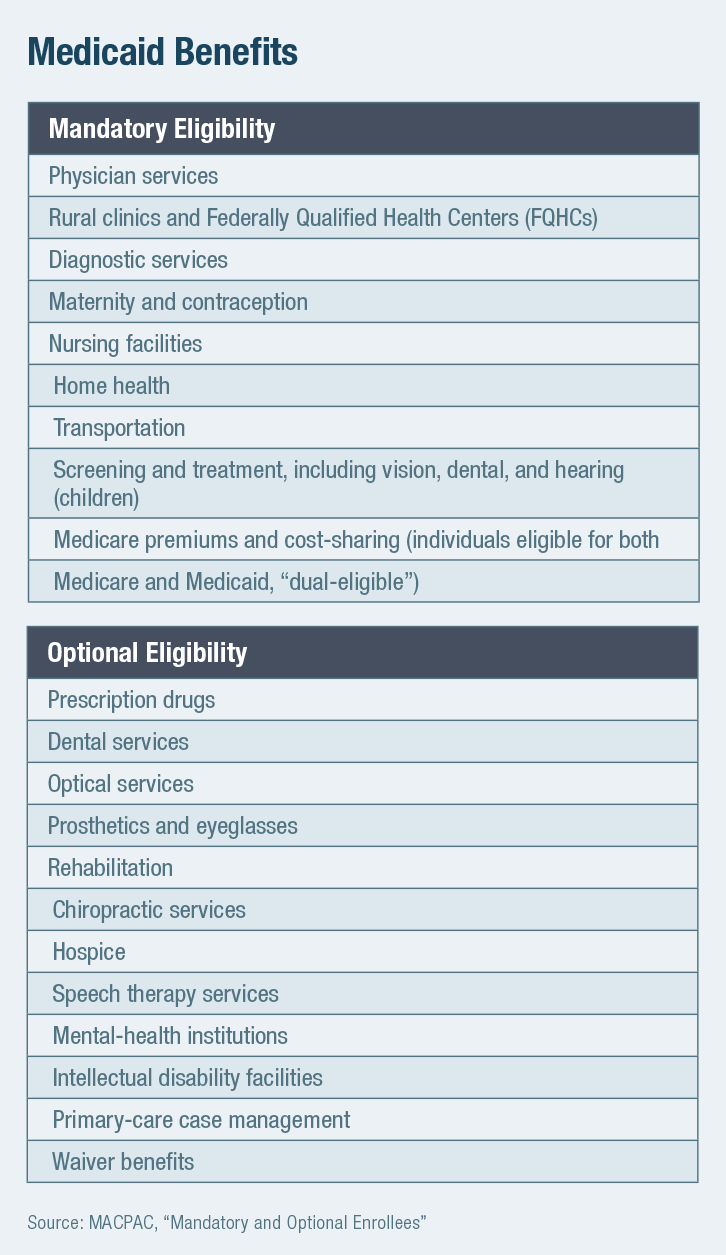

States must cover a core set of mandatory eligible beneficiaries in return for accepting any federal Medicaid matching funds. They may also include in their program a broader set of optionally eligible individuals (Figure 1). There are currently 67 different “pathways” by which states may make individuals eligible for Medicaid, and for which they must set specific incomeor asset-based limits on eligibility.[5]

States may expand income-eligibility limits so long as they do not make higher-income individuals eligible before lower-income individuals in each pathway.[6] States may also make individuals (typically in nursing homes) with high medical expenses eligible for Medicaid if their income is below the eligibility thresholds after those expenses are deducted, so long as they do not possess assets above the eligibility threshold. Most recent immigrants are excluded from Medicaid eligibility until they have been permanent residents for at least five years, though states are permitted to provide medical coverage to recent immigrants with state-only funds.[7]

Medicaid programs must cover a defined set of mandatory benefits for all who are (mandatorily and optionally) eligible for the program, but states may also claim federal matching funds to help pay for an expanded set of optional benefits (Figure 2). States may restrict such optional benefits in terms of necessity, scope, amount, and duration, though they must generally be made equally available to all enrollees in the state regardless of their eligibility pathway, place of residence, or medical history.

Exceptions to these rules allow federal Medicaid funds for states to provide targeted services for breast cancer, cervical cancer, tuberculosis, and contraception to individuals with higher income limits.[8] Some services, such as prescription drug coverage, are officially optional but included in the standard Medicaid benefit package in all states.[9] The Early and Periodic Screening, Diagnostic, and Treatment (EPSDT) benefit implicitly requires that officially “optional” treatment benefits (such as dental care) be provided to those under age 21 if the need for them is identified in screening.

States may seek waivers to expand benefits and eligibility criteria on a budget-neutral basis—allowing innovation by effectively delivering federal matching funds as a block grant. To help manage costs, enrollment caps and waiting lists can be used to limit access to additional benefits offered under waivers, but these may not deprive individuals of mandatory benefits to which they are entitled by federal law, nor may waivers (in theory) be used to claim additional federal spending.[10]

Individuals eligible for Medicaid under state law are entitled to all “medically necessary” care, though this is not defined in federal regulations, and state definitions vary.[11] As a result, while the program’s payment rates for medical providers are required to be sufficient to secure access to the same extent that services are available to the general population, this is not judicially enforceable.[12]

In practice, Medicaid payment rates for hospitals are similar, on average, to those that prevail in the Medicare program.[13] By contrast, Medicaid’s payment rates for physician services are often much lower than Medicare’s.[14] Medical providers are prohibited from charging Medicaid patients additional amounts outof-pocket beyond official rates if they accept payment from the program.[15] While Medicaid beneficiaries receive primary care at similar rates to the privately insured, access to specialists can be poor.[16]

Medicaid serves as a secondary payer when beneficiaries are eligible for other coverage, such as employer-sponsored insurance or Medicare. This means that Medicaid pays Medicare premiums and cost-sharing for low-income elderly and disabled beneficiaries who are eligible for both programs, i.e., “dual-eligible.”[17] Also, states are not allowed to charge premiums to Medicaid beneficiaries with incomes below 150% of the Federal Poverty Level (FPL), and cost-sharing is also restricted for lower-income cohorts.[18] However, states must attempt to recover Medicaid long-term-care costs from the estates of beneficiaries over the age of 55 after they and dependents have died.[19]

The Matching Fund Mess

Medicaid is defined by its funding structure. State Medicaid programs vary in almost every conceivable detail, but every dollar that they spend is shaped by a desire to qualify for federal matching funds.

The standard federal matching rate—the Federal Medical Assistance Percentage, or FMAP—varies from state to state, with the federal government covering a share of costs above a floor of 50%, according to the formula.[20]

The poorest states are supposed to receive $3 from the federal government for every $1 that they spend on Medicaid benefits for most eligible beneficiaries, and the wealthiest states are to receive $1 for every $1 that they spend on the program.[21] Under the Affordable Care Act (ACA), all states, regardless of income levels, are supposed to receive $9 for every $1 that they spend on beneficiaries that the law made newly eligible. In practice, as a result of accounting tricks (details below), these ratios are often artificially inflated beyond this in favor of states, in proportions that may be known only to themselves.

Skewed to wealthy states

Even the de jure variation in FMAP between states is slight, relative to differences in their fiscal capacity.[22] The federal match for Medicaid spending is a very good deal for all states, and each seeks to profit from it as much as it can. The distribution of federal Medicaid assistance is therefore skewed toward wealthier states that are most able to put up funds of their own.

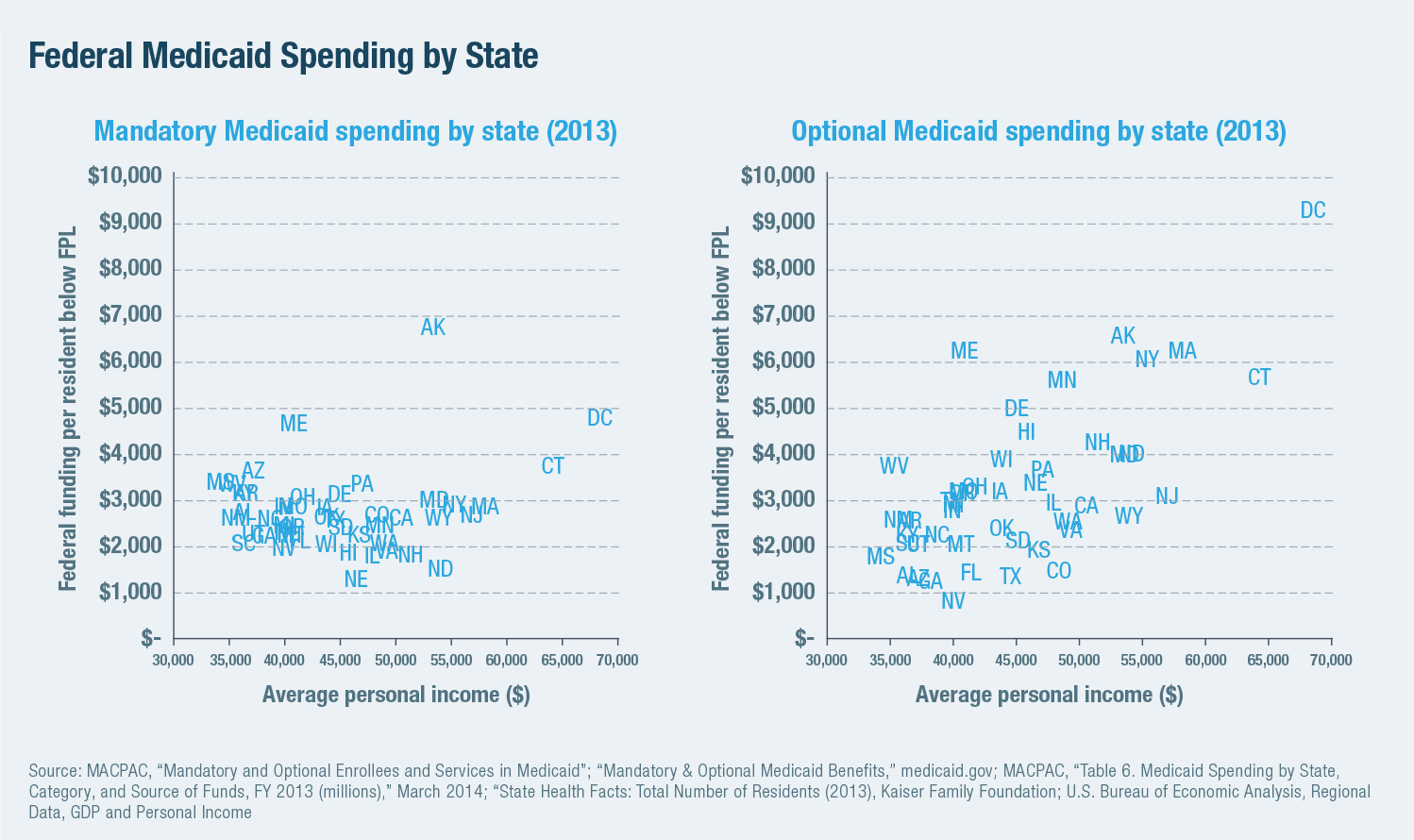

The mandatory benefit and eligibility requirements imply a floor on Medicaid spending in each state. But there is no cap on benefits that can be provided, no limit on federal matching funds, and little disincentive to increase program costs.[23] The disparity between states is therefore relatively small for spending on mandatory benefits for mandatory enrollees but increases with income for Medicaid spending that is optional in terms of enrollees or services. This was already the case (Figure 3) before the 2014 implementation of ACA’s Medicaid expansion. In 2013, for example, optional beneficiaries accounted for 4% of residents on Medicaid in Nevada, but they made up 65% of those enrolled in Vermont.[24]

Inflating costs

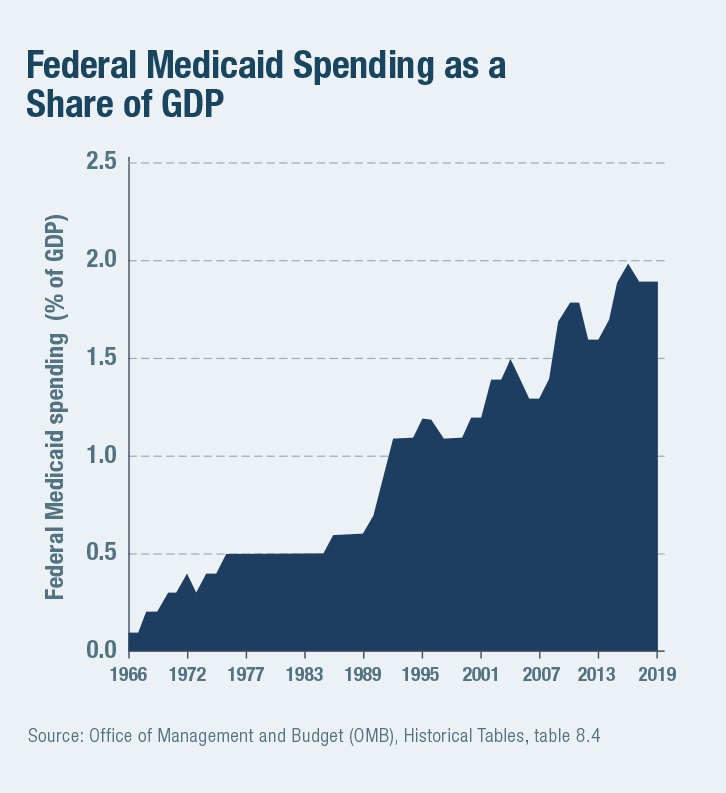

The opportunity to gain more than a dollar in federal funds for every dollar that states spend has skewed states’ cost-benefit calculations in favor of ever-expanded Medicaid spending. Even before ACA provided extra funding to help states expand eligibility to able-bodied adults with incomes up to 133% of FPL, 53% of Medicaid spending was on eligibility categories and benefits that are optional for states to provide.[25] From 1978 to 2018, federal Medicaid spending rose from 0.5% to 1.9% of GDP (Figure 4). The Congressional Budget Office estimates that the program’s cost will increase by an additional 78% over the coming decade, even without any further expansion of benefits or eligibility.[26]

The opportunity to gain more than a dollar in federal funds for every dollar that states spend has skewed states’ cost-benefit calculations in favor of ever-expanded Medicaid spending. Even before ACA provided extra funding to help states expand eligibility to able-bodied adults with incomes up to 133% of FPL, 53% of Medicaid spending was on eligibility categories and benefits that are optional for states to provide.[25] From 1978 to 2018, federal Medicaid spending rose from 0.5% to 1.9% of GDP (Figure 4). The Congressional Budget Office estimates that the program’s cost will increase by an additional 78% over the coming decade, even without any further expansion of benefits or eligibility.[26]

Crowding out private coverage

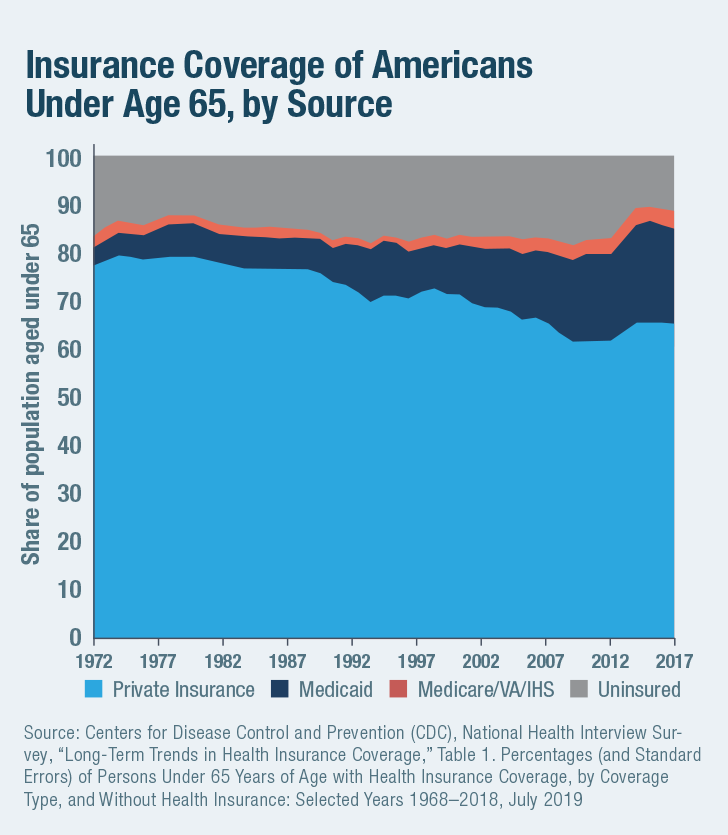

Rather than being well targeted to fill gaps in health-insurance coverage, Medicaid spending growth has increasingly served to displace private insurance. As the share of the population under age 65 enrolled in Medicaid increased from 6.7% in 1978 to 20.2% in 2018, the proportion of uninsured fell only from 12.0% to 11.0% (Figure 5). Part of this increase has served to fill in gaps that have arisen from the rising cost of private insurance, but much of it is crowd-out. As Congress expanded the program in the late 1990s, economists Jonathan Gruber and Kosali Simon estimated that 60% of those newly covered previously had private insurance. This crowd-out rate increases the higher up the income distribution that eligibility for Medicaid is expanded.[27]

Rather than being well targeted to fill gaps in health-insurance coverage, Medicaid spending growth has increasingly served to displace private insurance. As the share of the population under age 65 enrolled in Medicaid increased from 6.7% in 1978 to 20.2% in 2018, the proportion of uninsured fell only from 12.0% to 11.0% (Figure 5). Part of this increase has served to fill in gaps that have arisen from the rising cost of private insurance, but much of it is crowd-out. As Congress expanded the program in the late 1990s, economists Jonathan Gruber and Kosali Simon estimated that 60% of those newly covered previously had private insurance. This crowd-out rate increases the higher up the income distribution that eligibility for Medicaid is expanded.[27]

While the need for medical services is fairly standardized, the definition of long-term-care (LTC) benefits is often more elastic. Whereas only cancer patients will need chemotherapy and are unlikely to demand more than the recommended dose because reimbursement is higher, the demand of the frail elderly for help with household activities such as cleaning or meal preparation is likely to expand as the generosity of reimbursement for it increases—crowding out alternative sources of informal and self-financed assistance.[28]

In the wealthiest states, Medicaid’s LTC benefit has expanded from a safety net of nursing-home coverage for the poor to a broad entitlement for the middle class (Figure 6). While states are required by federal law to recover costs associated with LTC from the estates of individuals who have used the program’s nursing-home services, the structure of matching funds offers them little incentive to collect payments, and only 0.4% of LTC costs are recovered.[29]

Accounting tricks

Medicaid, which accounted for 29% of overall state spending in 2019, allows states a uniquely lucrative opportunity to draw funds from the federal government.[30] Since the early 1980s, states have therefore routinely imposed taxes on hospitals and other medical providers to drive up Medicaid expenses for which they may claim inflated federal reimbursement.[31] In 2016, all 50 states imposed such provider taxes.[32] Although Congress moved to limit such manipulation, the restrictions that it enacted are loose—allowing provider taxes so long as they are broad-based and apply uniformly on classes of providers, and so long as any direct quid pro quo does not exceed 6% of revenues for services provided to patients.[33]

States have also sought to shift the burden of paying for their minority share of Medicaid expenses to local governments, and federal law allows states to raise up to 60% of their contribution in this way.[34] This enables states to circumvent direct restrictions on provider taxes, by inflating Medicaid payments to hospitals or other facilities owned by local governments.[35] New York, for instance, was able to generate a $15 billion windfall from the federal government over 20 years by getting its Medicaid program to pay $5,000 per day for individuals with developmental disabilities at state institutions.[36] The provision of medical care to schoolchildren has similarly been used to shift school administrative expenses to the Medicaid program.[37]

Congress sought to limit the ability of states to draw down federal funds by imposing an Upper Payment Limit (UPL) cap on supplemental payments that they can claim on behalf of providers, equivalent to what Medicare would pay for such services. But UPL applies only to categories of providers as an aggregate, so individual hospitals are not subject to caps—allowing states to still steer overpayments to favored facilities.[38] A 2015 GAO report found that 44% of UPL payments went to publicly owned providers, even though these account for only 19% of hospitals.[39] One proposed UPL scheme planned to pay publicly owned nursing homes 12 times the standard reimbursement amount.[40] UPL overpayments effectively allowed states to claim federal funds regardless of how many services are provided, and states have grown to treat them as lump sums to which they are entitled—often using them for purposes outside of health care. Even after limits on UPL payments were imposed, state claims for UPL payments have well exceeded permitted limits, which are poorly enforced by the federal government.[41]

States can also harvest federal supplemental payments by overpaying facilities serving mostly low-income patients known as Disproportionate Share Hospitals (DSH), which are exempt from UPLs.[42] Medicaid DSH spending soared from $0.5 billion in 1990 to $19 billion in 1992 as this trick caught on among states.[43] New Hampshire used revenue from DSH payments to fund its judicial system, highway program, and other general expenditures, as the state overpaid for care in return for “donations” to the state budget.[44] DSH payments were also eventually restricted by Congress, though with existing overpayments grandfathered— entrenching a windfall for states that had most abused the system.

A study by Teresa Coughlin, Stephen Zuckerman, and Joshua McFeeters of the Urban Institute estimated that if intergovernmental transfers, certified public expenditures, state transfers, and provider taxes were excluded from state Medicaid contributions, the states’ share of Medicaid supplemental payments for 2005 declined from 43% to 13%. In other words, states received an average of $7.35 from the federal government for every $1 they raised from general taxation, rather than the $2.31 for every $1 that appears on the books.[45] Over the subsequent decade, the official state share of overall Medicare expenditures has since fallen significantly further.[46]

Fraud and abuse

The federal government can, in theory, withhold matching funds from states that claim payments to which they are not entitled, but it lacks the manpower to scrutinize the millions of claims and can only exercise loose oversight. States, however, stand to lose (on average) several dollars in federal revenue for every dollar that they spend reducing waste, fraud, and abuse—so they have little incentive to do so. Medicaid fraud is perceived as a misdemeanor and often goes unpunished.[47] Overall, it has been estimated that as much as 25% of Medicaid spending may consist of improper payments.[48]

States have been particularly lax in enforcing eligibility criteria associated with the ACA expansion, as they could claim over $9 from the federal government for every $1 that they spent on enrollees whom they classified as such. A federal audit found that more than half of expansion enrollees sampled in California were potentially improperly enrolled.[49]

Unaccountability

The enormous complexity of the Medicaid program— which involves many thousands of providers across 50 states receiving reimbursement through complex payment schemes under a vast array of different eligibility rules—makes abuse very difficult to identify and the overall efficiency of the program nearly impossible to assess.[50]

The Centers for Medicare & Medicaid Services (CMS) lacks access to the timely, accurate, and complete data needed for oversight, or the political autonomy to sanction states that fail to provide the information when required by federal law to do so.[51] A CMS official once testified: “Some fund transfers and financing mechanisms are designed solely to maximize Federal reimbursements to States and serve to obfuscate the source and final use of both Federal and State funds.”[52] If a state seeks to inflate its federal matching revenues by developing an elaborate scheme to hide kickbacks for hospitals through a web of formal reimbursement, indirect payments, tax preferences, managed-care rules, and favorable regulatory provisions, it is nearly impossible for the federal government to stop the abuse.

Cyclical bailouts

Over recent decades, Medicaid spending has grown faster than any other major state budget item and faster than the fully federal Medicare program. Michael Greve has noted that this is partly because the program experiences a ratchet effect associated with the business cycle: during economic expansions, states use rising tax revenues and falling caseloads to expand eligibility, for which they successfully demand extra federal funds in recessions.[53]

During the 1990s, as the economy grew and the poverty rate fell, Medicaid spending increased faster than either GDP or state revenues. In that economic expansion from 1994 to 2000, of the 38 states that saw decreases in their poverty rates, 36 increased their Medicaid spending. While poverty fell faster in Minnesota than New Hampshire, Medicaid spending fell by 25% in New Hampshire but increased by 24% in Minnesota.[54]

Covid-era collapse

The Families First Coronavirus Response Act, enacted in March 2020, increased federal Medicaid matching rates by 6.2 percentage points—the same amount as in the 2009 American Recovery and Reinvestment Act. (Congress had previously provided similar, though smaller, payment bumps in 2001 and 2003.)[55] Yet states argue that such assistance is still inadequate in the current crisis.[56] Given the collapse of state revenues and the prospect of soaring Medicaid enrollment, House Democrats have argued that even 100% federal funding of Medicaid would be inadequate and have called for a retrospective increase in FMAP for previously incurred Medicaid spending.[57]

Such an arrangement would exacerbate the moral hazard inherent in the split of Medicaid responsibilities between state and federal governments, prop up the most overextended state programs, and fail to target assistance at individuals in greatest need. But this latest demand for a bailout starkly reveals that Medicaid’s structure is unsustainable in recessions, when it is needed most, and that matching finance has reached the end of the road as an intellectually justifiable basis for allocating $600 billion in annual spending. Reform is necessary to give the federal government some ability to control the expansions in Medicaid costs that it inevitably becomes liable for in economic downturns.

Previous Attempts at Reform

The problems with financing Medicaid through open-ended matching funds have been known for many years. During the past four decades, Republican policymakers have sought repeatedly to address them by converting the program to a system of block grants or capped allotments. The Reagan administration first proposed block grants in 1981 but was unable to get it through Congress. In 1995, a proposal to turn Medicaid into a system of block grants passed the newly elected Republican Congress but was vetoed by President Clinton.[58]

In their ideal form, block grants would give Medicaid funds to states as a lump sum. The hope is that this would eliminate the incentive for states to inflate costs at the expense of the federal government while increasing the scope for innovation by states. Movement in this direction often receives the support of state governors, who like the prospect of getting federal funds with fewer strings attached or the requirement to contribute funds of their own. But opponents fear that block grants would lead to the erosion of individual entitlements to care as medical costs increase over time.[59] Opponents also contend that block grants would shift risks to states and leave them potentially more exposed in recessions.[60]

In any event, block grants would still likely come with strings to stop states from simply reallocating funds out of health care for other purposes. For that reason, the 1997 Children’s Health Insurance Program (CHIP), which sought to address Republican concerns with Medicaid’s structure to gain their support for the new entitlement, limits the purposes on which funds may be spent. CHIP also requires states to put up their own matching funds to claim federal assistance but caps the amount that each can claim.[61] The cap allows more federal funding (93% of program costs in 2017) to be provided without inflating moral hazard, and Congress has repeatedly increased the total amount provided when the program has been reauthorized.[62]

The GOP proposed caps on federal matching funds as part of its 2017 push to replace the ACA.[63] But as Republican governors prodded their friends in Congress to avoid significant cuts, the caps proposed were set at levels so loose that they would have had done little to constrain spending while still affording much scope for states to manipulate them. Indeed, the proposed cap on increases in matching funds claimed per enrollee would have done little to check rising program costs, which are largely being driven by increased enrollment of relatively young and healthy enrollees.[64]

After four decades of trying, attempts to reform Medicaid matching funds into a system of capped allotments for states have proved politically unworkable. The political opposition arising from concerns that individuals may lose entitlements to coverage is compounded by opposition from governors seeking to avoid shortfalls in funds needed to deliver benefits that their states are required to deliver. Nor would granting funds to states eliminate the ratchet effect of expanding programs during economic upturns leading to bailouts in subsequent recessions. There is little sign that such a reform is getting closer to succeeding politically—in fact, the opposite seems more likely to be true.

A Better Way

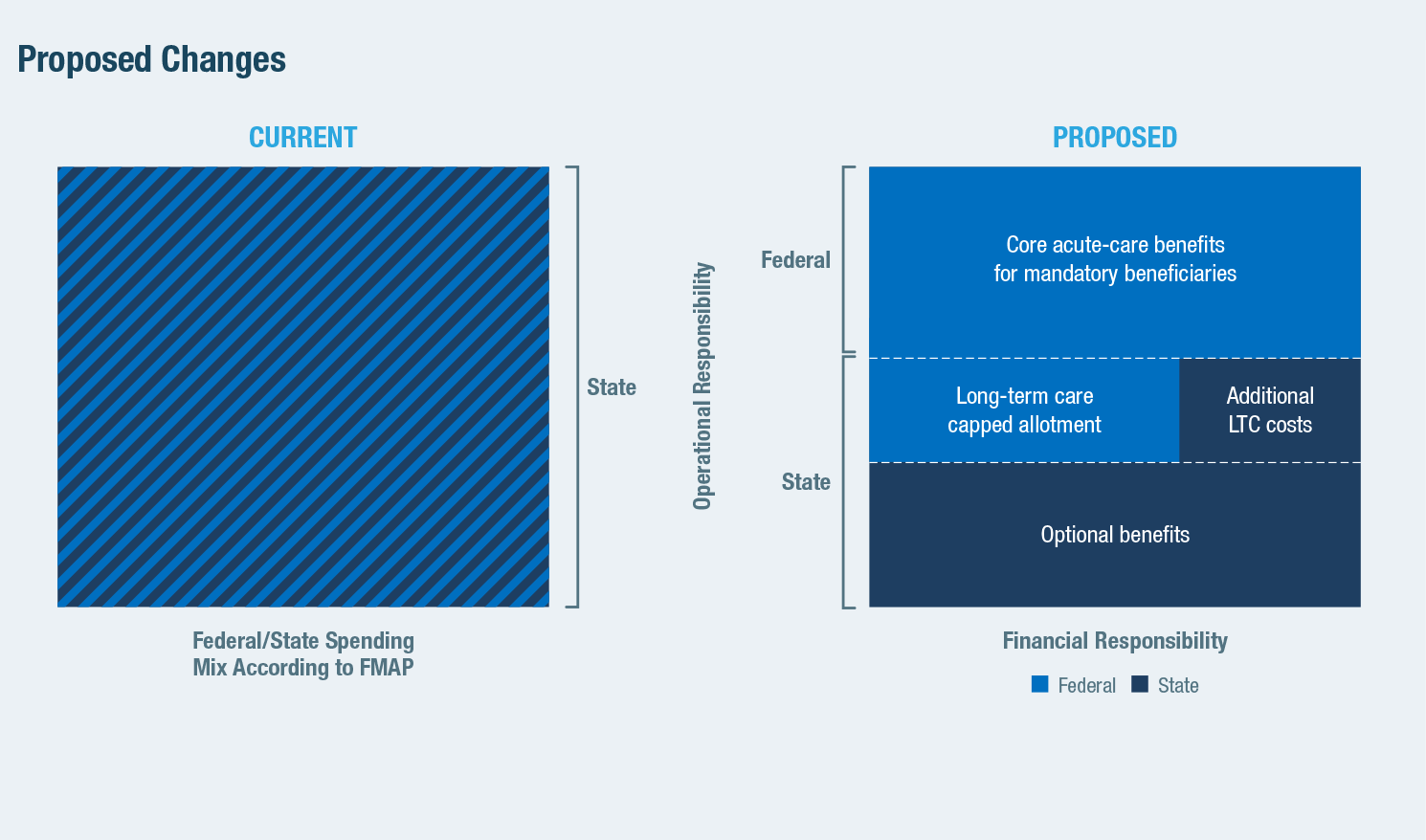

Medicaid’s open-ended matching fund structure has invited states to inflate program expenditures without attention to what offers the most value for money for federal taxpayers. To make Medicaid fair, focused, and accountable, it is necessary to align financial responsibility with operational responsibility throughout the program.

Congress enacted Medicaid’s mandatory benefit and eligibility categories with the intent of establishing a federally guaranteed safety-net entitlement to health care for individuals. Requiring states to operate and raise funds for a benefit that is defined at the federal level adds little value while imposing unnecessary fiscal instability and inviting cost-shifting mischief.

Instead, this paper proposes these structural reforms (Figures 7 and 8):

1) The provision of mandatory benefits for mandatory eligibility categories should be fully funded and directly administered by the federal government, as with Medicare. This arrangement should extend to prescription drug coverage for mandatory beneficiaries, which is nominally optional but already exists in all states. The federal government should also assume full responsibility for funding Medicare premiums and reductions in cost-sharing for those also eligible for Medicaid—costs over which states have no control. It should also assume the responsibility of determining which individuals meet these eligibility criteria.

2) Medicaid’s LTC benefits should be administered by states with the support of federally financed capped allotments, as per the current structure of CHIP. States are already required to provide many nursing-home and home health benefits to Medicare beneficiaries, but there is enormous variation in how these benefits are defined from state to state. LTC needs are less clinically objective and standardized than medical-care services, and the definitions of eligibility and benefits are both more elastic. Furthermore, the nature of LTC services delivered varies greatly among states, most of which operate home and community-based services waivers intended to encourage a shift of funding from nursing homes to support people to remain in their own homes.

Providing a capped allotment of funds to states for them to operate LTC would accommodate this diversity and sustain such innovations in care delivery while eliminating the incentive for wealthier states to maximize revenue from the federal government by inflating benefits and eligibility at the expense of federal taxpayers. As LTC enrollment and utilization vary little with the business cycle, distributing federal Medicaid funds for this care as a capped allotment would reduce the need for states to come up with matching funds in a downturn without exposing them to rising program expenses.

3) The expansion of Medicaid beyond mandatorily eligible groups should be fully financed by states, as should be the expansion of benefits beyond the basic mandatory package. This would ensure that further coverage expansions are deliberately and equitably distributed across the country, rather than opportunistically produced according to differences in the fiscal capacity of states and their creativity in devising schemes to draw down federal matching funds.

Conclusion

Medicaid is the foundation of America’s health-care safety net, but its resources are allocated without any deliberate overall planning, prioritization, or accountability. Instead, the allocation is the result of the ability of states to incur expenses that qualify for matching funds. The rapid increase in the program’s cost over recent decades has not been accompanied by a proportionate decline in unmet medical needs across the country. Most of the spending associated with some of the program’s expansions has served simply to crowd out private insurance coverage.

Ideally, responsibilities should be aligned: the federal government should take responsibility for funding and administering health-care services that it deems mandatory, with states being responsible for funding and administering health-care services that they choose to undertake by themselves. In practice, political constraints mean that policymakers will likely be able to move only part of the way in this direction. Nevertheless, if the overall goal is kept in mind as various incremental patches to Medicaid are made under the pressure of short-term circumstances and opportunities, the program’s structure can gradually be made sounder and more effective over time.

Endnotes

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).