Taking the Strain Off Medicaid’s Long-Term Care Program

As Americans live longer into old age and disability with fewer close relatives, the need for formal (paid) long-term care to assist with basic activities of daily living (such as bathing, cooking, and personal mobility) is expected to significantly increase. Medicaid currently covers nursing-home and home-based care for all Americans who need an institutional level of care, so long as they hold fewer assets than the program’s eligibility criteria. The “Medicare for All” bill, a measure backed by many Democratic members of Congress, includes provisions to loosen or eliminate Medicaid’s long-term care means tests.

The overall level of long-term care in the U.S. is similar to that in other developed countries, and the distribution of unmet needs has little to do with eligibility for Medicaid benefits. The main problem is the poor quality of nursing-home services—to which Covid-19 has drawn painful attention. Even in the absence of the pandemic, nursing-home residents in the U.S. frequently suffer abuse, neglect, and mistreatment. Malnutrition, bed sores, and overmedication are widespread in these facilities, while infections cause about 380,000 deaths every year.

These problems are the result of the overdependence on publicly financed care through Medicaid, whose resources are overstretched. Facilities are underpaid and lack incentives to compete for new residents by improving quality. Since private long-term care insurance pays for services that Medicaid would cover, few Americans purchase it—even though the median nursing-home entrant has more than $100,000 in household wealth and could benefit from the better-quality care that insurance might enable.

To improve the quality of long-term care, this paper recommends that policymakers tighten the asset tests that Medicaid requires to establish eligibility. Doing so would encourage more middle-class Americans to purchase long-term care insurance, directly rewarding nursing homes for improvements in quality. Reducing the number of middle-class enrollees in Medicaid would also ensure that the program’s funds can purchase better-quality care for the elderly who are poor.

Long-Term Care: An Overview

Long-term care (LTC) refers to nonmedical assistance that individuals with disabling medical conditions need.[1] These needs are generally classified as “Activities of Daily Living” (ADLs), such as bathing, dressing, eating, walking, and getting out of bed, or “Instrumental Activities of Daily Living” (IADLs), such as meal preparation, money management, house cleaning, medication management, and transportation.[2] In practice, the need for help exists on a spectrum from occasional low-intensity, informal assistance from neighbors to 24/7 care in a nursing home.

LTC needs increase with age (Figure 1).[3] Of those reaching age 65, 70% will develop severe long-term care needs at some point in their lives, and 48% will employ paid care. As Americans age, these disabilities become more severe, and they are less likely to have relatives able to fully assist them. A recent report noted that while 8% of retirees aged 65–74 had severe LTC needs, 40% of those over 85 did.[4] Indeed, 22% of Americans over 85 live in a nursing home.[5]

The number of Americans needing formal, i.e., paid, LTC is projected to rise from 12 million in 2010 to 27 million in 2050.[6] This is partly due to rising life expectancy; Americans over 85 are expected to increase from 2% of the population to 4%, the result of improved medical care.[7] Alzheimer’s disease afflicts 2% of Americans aged 65–74, 19% of those 75–84, and 43% over 85. This necessarily creates a need for LTC as its severity increases.[8] Americans who grew up in the postwar era also have higher rates of obesity and disability than previous generations.[9]

Family members are the primary source of LTC. In 2011, 15 million family and unpaid caregivers assisted 8 million older Americans who needed help with daily living—with those sharing a residence being more likely to provide it and to provide assistance of greater intensity.[10] While 6% of those aged 16–64 provided informal care, 15% of those aged 65–79 did so—for an average of 17 hours per week.[11] In 2011, MetLife estimated that leaving the workforce to care for an aging parent cost women, on average, $324,044 in lifetime wages and benefits.[12] The Congressional Budget Office (CBO) estimated the value of informal LTC ($234 billion) provided to be greater than what was then spent on formal care ($192 billion).[13]

A 2016 study by the U.S. Department of Health & Human Services estimated that Americans would spend, on average, $138,000 on LTC from age 65 to death, with 48% having no LTC expenses and 15% incurring costs in excess of $250,000.[14] CBO expects formal LTC spending to increase from 1.9% of GDP in 2011 to 3.3% in 2050.[15]

Some suggest that we may see an increasing shortage of unpaid caregivers. Baby boomers are projected to enter retirement with lower marriage rates, fewer children, fewer siblings, fewer close friends, and fewer community ties than previous generations.[16] Children are living farther away from their parents than before, and more women are working full-time than in previous generations— leaving them less able to care for elderly relatives.[17] Yet improvements in medical science mean that their spouses are more likely to survive into later years, when LTC needs are greatest.[18] Although the number of informal caregivers has declined over recent years, the amount of time devoted to such care remained stable from 1989 to 2012.[19]

Formal LTC employs large numbers of personal-care aides or nursing assistants doing unglamorous and often thankless work for strangers, around the clock. That makes the provision of care very expensive, with costs increasing in line with the intensity of care needed. In 2019, costs averaged $19,500 annually for adult day care, $48,612 for accommodation in an assisted- living facility, $52,624 for a home health aide, and $102,000 for a private room in a nursing home.[20]

Unlike medical expenses, which are associated with episodes of hospitalization, LTC services tend to fluctuate little after they begin. Only one in five of those admitted to nursing homes will ever return to live in the community.[21] This care usually accounts for a small period at the end of life: 24% of seniors receive paid LTC for more than two years, 15% spend more than two years in a nursing home, and only 2% receive paid LTC for more than 10 years.[22]

Formal Long-Term Care Funding Sources

Medicare’s post–acute care benefits (provided in a skilled nursing facility immediately following a hospitalization) relate narrowly to the delivery of medical services and are generally not considered to be LTC, which comprises broader assistance with basic personal activities and household chores.[23] As a consequence, Medicaid dominates formal LTC funding. In 2018, LTC spending was $379 billion, of which Medicaid accounted for 52%, out-of-pocket spending 16%, private insurance 11%, and other payers 20%.[24]

Medicaid

Medicaid’s LTC benefit is administered by states, which may claim $1–$3 in federal matching funds for every $1 they spend on covered services for eligible beneficiaries.[25] Within the federal rules governing benefits, eligibility, and payments to providers, states have broad flexibility in shaping their Medicaid programs.[26]

State Medicaid programs must cover low-income aged, blind, or disabled permanent residents who are unable to engage in “substantial gainful activity” because of physical or mental impairment.[27] Medicaid also must cover nursing-home care for individuals needing an “institutional level of care,” which is usually defined by states in terms of medical diagnoses or capacity to perform ADLs unassisted.[28] Since a 1999 Supreme Court ruling, states have been required to provide the option of care outside a nursing home to those eligible.[29] In 2016, 57% of Medicaid’s $167 billion LTC spending was on home-based services—up from 17% in 1996.[30] Medicaid LTC spending on those with developmental disabilities is now mostly home-based, but spending on the elderly and physically disabled remains concentrated on nursing facilities.[31]

Although states must provide the basic benefits that Medicaid mandates for eligible residents in nursing homes, they may seek waivers from the federal government to impose conditions on funds used to expand eligibility and covered services beyond this mandatory coverage floor. These waivers have most commonly been employed to provide broad coverage of Home and Community-Based Services (HCBS), which allows Medicaid beneficiaries to receive assistance with daily living needs without admission to costly nursing homes. These expanded services include case management, respite care, personal care, and residential care.[32] States are allowed to cap enrollment, prioritize categories of beneficiaries, and impose waiting lists on access to homebased services for those whose eligibility is not mandated, in order to keep costs from increasing above levels that would have been spent in the absence of waivers.[33]

Medicaid’s LTC coverage varies from state to state, according to a complex variety of eligibility pathways.[34] Under the broadest pathway, states must limit eligibility to individuals whose income is less than 300% of Supplemental Security Income levels ($28,188 for an individual, with spousal income being exempt) but may allow medical costs to be deducted from income in eligibility calculations.[35] Such individuals may be charged for Medicaid LTC services but are allowed to keep a small amount for personal needs. States typically limit eligibility to those with less than $2,000 in personal financial assets and $600,000 in home equity, though no limits exist for the value of household goods, a car, the value of life-insurance policies, or business assets—and asset restrictions can often be circumvented by estate planning.[36]

From 1998 to 2008, almost 10% of adults over 50 who had been non-Medicaid-eligible spent down their assets sufficiently to qualify for the program.[37] There is a penalty period of ineligibility for individuals who have transferred nonexempt assets within the previous five years to qualify for Medicaid LTC coverage.[38] Following the death of beneficiaries over 55 (and the death of any surviving dependents), states may recover Medicaid’s LTC costs from decedents’ estates (including their home and other exempt assets).[39]

Personal Income and Savings

In 2018, the median household income for Americans 65 and older was $44,992—likely an underestimate, as income from defined-benefit pensions and retirement accounts tends to be underreported in surveys.[40] Administrative data find median household income to be 30% higher.[41] In 2013, 59% of households aged 55–64 had retirement savings, 48% aged 65–74 did, but only 29% of those 75 and older did. Among households 55 and older in 2013, 29% had neither a defined-benefit pension nor retirement savings. But 59% of that group did own their home.[42]

Home Equity

Home equity is the dominant asset held by the elderly. Overall, 79% of Americans over 65 in 2019 owned their home.[43] Thirty-nine percent had more than $100,000 in home equity.[44] In 2016, homeowners over 65 had median assets of $377,900, a median net worth of $319,250, and median home equity of $143,500.[45] As a result, most seniors above the income and asset eligibility cutoffs for Medicaid have substantial home equity that could be used to pay for LTC.

Reverse mortgages allow seniors to use the equity in their houses to pay for LTC directly or to purchase LTC insurance while they remain in their homes.[46] The federal government has sought to support this approach with Home Equity Conversion Mortgages (HECM). These make available loans that need not be repaid until the last surviving borrower dies or moves out of the house, so long as homeowners are creditworthy and able to cover property taxes and home insurance.[47] Most reverse mortgages are employed to take out a specified line of credit, though it is possible for borrowers to take fixed monthly payments during a specified term or the remainder of lifetimes.[48]

Since it was established in 1988, the HECM program has insured 1 million loans, with an average maximum claim amount of $275,000 in 2015.[49] However, only 2% of retirees currently have reverse mortgages, because they are not necessary for home equity to be used as a cushion against emergency expenses, are not the only method of borrowing available to seniors, and incur substantial transaction costs.[50] Elderly homeowners tend to be reluctant to tap home equity for routine consumption and tend to do so mostly when a spouse dies or when they enter a nursing home.[51]

Insurance

The median household wealth of those admitted to nursing homes averages $108,300 but declines to $5,518 after 180 nights of residence.[52] Among the seniors admitted to nursing homes in 2010, 14% had LTC insurance. It was most often purchased to protect their assets from depletion.[53]

In 2015, the average annual premium for an LTC insurance policy was $2,727; it paid $161 per day for nursing- home care and $155 per day for home care for up to four years.[54] Such reimbursement rates are in line with home health costs but still leave significant nursing- home costs to be borne out-of-pocket by enrollees.[55]

The number of individuals with LTC insurance increased steadily from 1.2 million in 1992 to 7.1 million in 2008 but has been flat since then, as the cost of these policies increased.[56] This is largely because potentially high-cost enrollees have proved more likely to purchase insurance than those with substantial savings or access to unpaid care from family members.[57]

Reform Proposals

During the 2020 presidential primaries, Democratic Party candidates Elizabeth Warren and Bernie Sanders proposed to abolish Medicaid’s LTC benefit and replace it with coverage as part of a “Medicare for All” program.[58] Their proposed entitlement would have eliminated income or asset tests associated with eligibility for public assistance—but it would cover only long-term-care services deemed “medically necessary and appropriate” by the Secretary of Health & Human Services—with eligibility and provider payment rates also left entirely to executive discretion.[59] Spending at each nursing home would have been capped by law, and private payment for equivalent services by LTC insurance, life insurance, or personal funds would have been prohibited.[60]

More modestly, Pete Buttigieg proposed to raise Medicaid asset- and income-eligibility limits and prevent Medicaid programs from recouping LTC costs from home equity after death.[61] Joe Biden has proposed a $5,000 nonrefundable tax credit for family caregivers, with the intent of encouraging people to look after relatives rather than leaving them to Medicaid or other formal LTC.[62] The campaign has not yet made clear how eligibility for such a tax credit would be determined in terms of the level of care or the degree of impairment needed to qualify for it.[63]

Assessing Long-Term Care in the United States

International Perspectives

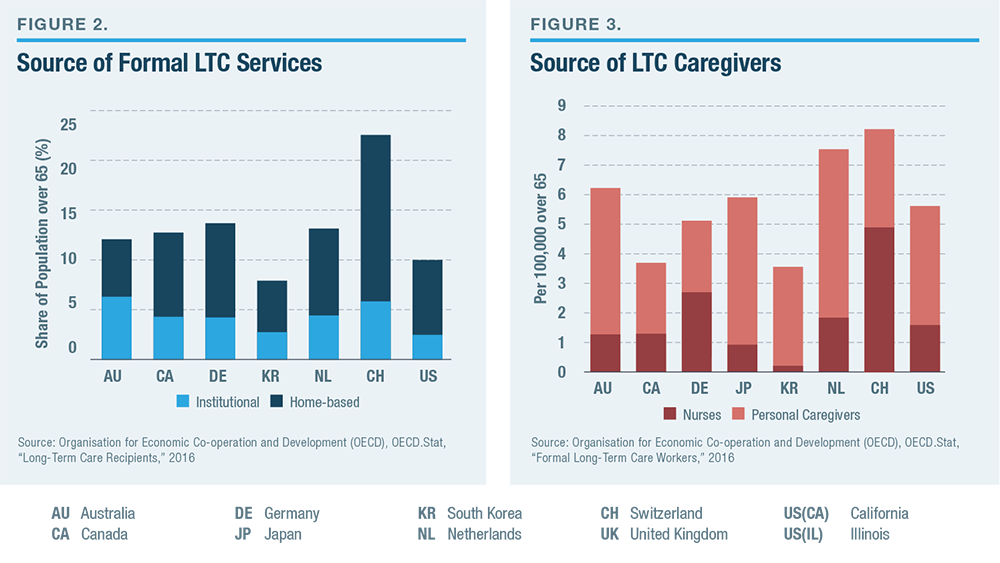

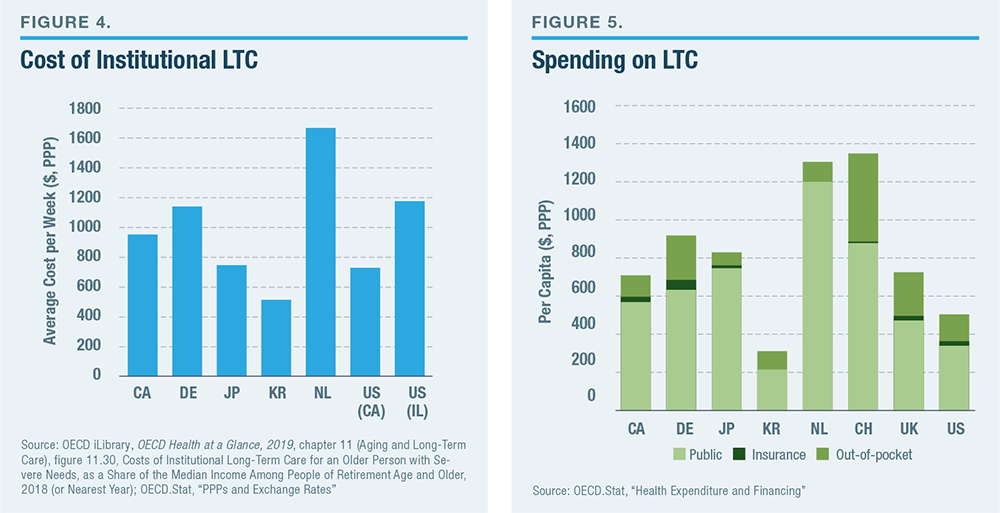

The U.S. has a slightly smaller share of its elderly population receiving LTC services in nursing homes than other developed countries but a similar level of homebased services (Figure 2). The overall number of LTC nurses and personal workers per senior citizen is also in line within the range that is typical among developed countries (Figure 3). The cost of institutional LTC in the U.S. is similar to that in other developed countries (Figure 4). By contrast with medical care, where spending in the U.S. is much higher than in other developed countries, Americans spend significantly less on LTC (Figure 5). The high level of U.S. spending on medical services is distinguished by the fact that half of it is privately financed; private funds support less than a third of America’s LTC.[64]

Unmet Needs

The share of adults living in the community (i.e., not in a nursing home) who lacked assistance with eating, cooking, bathing, dressing, shopping, and doing laundry by themselves was much lower than those expressing difficulty with those tasks (Figure 6). The share of those expressing difficulty using the toilet by themselves who lacked help to do so was relatively high, though it still amounted to only 1.6% of seniors living in the community. The proportion (4.8%) who were unable to go out because of lack of assistance was slightly higher than the proportion (4.4%) who said that they had some difficulty in doing so. The proportion who admitted some or a lot of difficulty managing medication (1.8%) was substantially lower than the proportion who recalled making a mistake taking medication (3.3%).

The proportion of seniors with unmet needs for assistance increases relatively little with age, until the mid-eighties, at which point it more than doubles across types of ADL (Figure 7). This reflects not only increased frailty; it also reflects the increased likelihood that individuals over 85 will no longer have a living spouse. Seniors who own a home are significantly less likely to have unmet LTC needs, though this reflects unmeasured correlates of affluence and well-being, rather than solely the extent to which a house provides resources that an individual can draw upon to meet LTC needs.

Seniors enrolled in Medicaid are more likely to have unmet needs than those who are not. This should not be interpreted as suggesting that Medicaid makes those enrolled worse off, as it registers correlates of poverty and the fact that LTC needs also cause many to spend their resources down to become eligible for the program. But it does suggest that Medicaid falls short of meeting the needs of its enrollees.

Relative magnitudes are instructive. Of those who had unmet needs for assistance using the toilet, 35% were Medicaid beneficiaries, 49% owned their homes, 41% lived with a spouse, while only 10% had none of those potential resources. This would suggest that the problem of unmet needs relates more to the shortcomings of existing forms of coverage and assistance than excessively narrow eligibility for them. While 3.1% of seniors needed assistance using the toilet, only 0.2% of seniors had unmet needs for this assistance and none of the potential resources.[65]

Quality of Care

Covid-19 has led to tens of thousands of deaths in U.S. nursing homes; it has also revealed serious shortcomings in these facilities.[66] Yet this problem is not new. Every year in LTC facilities, 1 million–3 million serious infections occur, with infections causing the deaths of as many as 380,000 residents.[67] Nursing homes often fall short on basic care, while residents suffer high rates of depression and a low quality of life.[68]

Nursing homes can be austere institutions, resembling hospitals more than homes, and elderly Americans often fear the prospect that they will be required to move to a nursing home as their health deteriorates.[69] Residents are vulnerable to neglect and poor conditions due to cognitive impairment, behavioral abnormalities, and physical limitations. Malnutrition, dehydration, bedsores, and falls are common—as is mistreatment and abuse by staff.[70] Tube feedings and urethral catheterization present challenges, as does overmedication: 63% of residents were given psychoactive medications in 2016.[71] In 2016, 45% of U.S. nursing homes were found deficient in infection control, 42% had deficiencies in accident prevention, 40% were deficient in food sanitation, 25% administered drugs unnecessarily, and 21% failed to meet standards in maintaining the personal dignity of residents.[72]

Nursing facilities are often responsible for housing individuals whom no one else wants to take care of, and overworked staff face the task of dealing with residents who are regularly difficult and occasionally violent.[73] Good-quality care is labor-intensive, and the attempt to work around staff shortages by making greater use of urethral catheters, feeding tubes, and medication to help manage patients with dementia creates a risk of adverse effects.[74]

Discussion

The problem with long-term care in the U.S. does not appear to be the breadth of eligibility for public assistance. Individuals can draw upon family assistance, personal financial resources, and home equity to pay for LTC services, and they can receive comprehensive services through Medicaid when those are no longer enough. A recent study estimated that 81% of the nation’s households met or surpassed wealth targets for retirement, associated with spreading funds over the life cycle and likely expenditure needs.[75] Above Medicaid’s income and asset limits, most individuals have sufficient home equity to cover likely LTC costs.[76] Meanwhile, American public policy already redistributes substantially from the young to the old—a group that is wealthier than all other age groups.[77]

The bigger problem is that the quality of formal LTC is generally unsatisfactory and falls well short of what many Americans would be willing to pay for. This has been a problem for many decades and is getting worse as individuals live longer into illness and frailty.[78]

The poor quality of nursing-home care owes much to the dependence of the industry on Medicaid revenues, whose provider payment rates are set at low levels by states. According to the nursing-home industry, Medicaid revenues per resident are 11% lower than average costs, and these facilities only break even because of higher reimbursement rates for post–acute care Medicare patients.[79] The share of nursing-home revenue from private payers fell from 49% in 1970 to 27% in 2017.[80] Low reimbursement rates are correlated with reduced staffing levels and strongly related to the incidence of pressure ulcers (bedsores) in highly Medicaid- dependent nursing homes.[81] These facilities have fewer nurses, lower quality of care, lower occupancy rates, and are more likely to close.[82]

Thirty-five states have sought to protect such facilities from closure while controlling overall Medicaid longterm care spending with Certificate of Need (CON) laws that limit the expansion of nursing-home capacity without regulatory approval.[83] CON laws are generally supported by the nursing-home industry, as limiting the expansion of capacity increases occupancy rates and helps them defray overhead costs.[84] But these laws have a downside: they stop better nursing homes from expanding at the expense of poorly managed ones. Guaranteeing demand for each nursing home eliminates the incentive to improve care arrangements while encouraging them to reduce costs by cutting back on quality.[85]

Inhibiting competition from new entrants (or more capable nursing homes) also allows existing facilities to increase the prices they charge to patients paying outof- pocket. One study of the New York market found nursing homes charging private payers markups of 25%–40% relative to cost.[86] Given the current structure of the federal entitlement, this increases the speed with which individuals spend down their assets to qualify for Medicaid eligibility.[87] As a result, though CON laws were established to constrain Medicaid LTC spending, they no longer seem to do so.[88]

The absence of a market incentive to improve quality, created by the combination of low Medicaid reimbursement and CON laws, increases policymakers’ reliance on flawed bureaucratic methods of upholding quality.[89] Harvard Medical School’s David Grabowski has suggested that the nursing-home regulatory system “has a ‘check-box’ feel in that the surveyor is simply going through a predetermined list which often feels disconnected from what residents and their advocates want from nursing homes.”[90] In 2012, nursing homes were subject to 175 federal quality standards, but enforcement was left to states.[91] The combination of budget constraints and provider shortages makes it hard for states to severely penalize facilities that violate existing regulations, and nursing homes are rarely excluded from Medicare or Medicaid.[92]

The breadth of Medicaid’s LTC eligibility rules has done much to crowd out private insurance coverage. Jeffrey Brown and Amy Finkelstein have estimated that 60%–75% of the benefits paid by private LTC policies are redundant for individuals of median income levels, as they pay for benefits that Medicaid would otherwise have paid.[93]

The 2006 Deficit Reduction Act sought to boost the incentive to purchase LTC insurance by establishing Long-Term Care Partnership plans, which broaden Medicaid LTC eligibility by forgiving the recovery of Medicaid costs from estates to the extent that the insurance bears costs that otherwise would have been borne by Medicaid.[94] This makes it easier for seniors to purchase LTC insurance that acts as a complement to Medicaid benefits, formalizing Medicaid’s role as a secondary form of catastrophic insurance beyond the limits of private coverage. But the appeal of these plans has been stymied by the fact that most retirees are already easily eligible for Medicaid at little cost, even if they have substantial assets.[95]

Increasing the recovery of assets from estates after a Medicaid patient dies is unlikely to be a good solution, as the rules can easily be circumvented by deeding property to a trust—thus protecting family inheritances at the expense of the public. In practice, asset recovery tends to hit only the estates of those who are unable to afford estate planning or die suddenly by surprise.[96] As it may threaten the homes of grieving non-spousal family members after losing relatives, asset recovery is highly unpopular.[97] It tends to be loosely enforced by states, which are reluctant to upset voters and incur substantial enforcement costs for the sake of collecting Medicaid funds that will mostly be returned to the federal government. Overall, only 0.4% of Medicaid LTC costs are recouped ex-post.[98] Nor does the vague and distant prospect of Medicaid’s asset recovery provide salient up-front incentives for buying LTC insurance.

Tightening Medicaid eligibility for LTC is likely to prove more effective at reducing the crowd-out of LTC insurance—or at least more effective in encouraging appropriate spend-down by those with substantial assets who have failed to purchase such insurance. The largest existing loophole associated with Medicaid’s asset tests is the home equity exemption for those who fail to purchase insurance through a Long-Term Care Partnership plan. The maximum exemption is now $858,000.[99] The exemption should be reduced significantly.

Mark Warshawsky of the Mercatus Center has suggested that $100,000 might be a more appropriate figure, and such a provision may be politically feasible. In principle, however, there is little reason to exempt an elderly individual’s home equity from Medicaid’s asset rules at all, given that individuals may relinquish their equity without ceasing to live in their homes.[100] The nonprofit Long-Term Care Financing Collaborative group has also suggested that Medicaid could emulate Britain and New Zealand by requiring potential beneficiaries of the program’s LTC to sign an explicit lien against home equity before being eligible for assistance.[101] This would strengthen expectations about responsibility for LTC costs and facilitate the recovery of expenses.

Conclusion

Policymakers should seek to improve the quality of long-term care by repealing CON restrictions on nursing- home competition and increasing Medicaid reimbursement rates for care provided to beneficiaries. These reforms would prod nursing facilities to upgrade the quality of their services and, by raising these facilities’ revenue per patient, increase their financial capacity to do so.

To offset the additional reimbursement costs, policymakers should tighten the program’s eligibility criteria and shrink the program’s enrollment levels. This would, in turn, strengthen the incentive for individuals who have the means to purchase LTC insurance—increasing the revenue to nursing homes from private payers.

Medicaid, in short, should be more focused on the task of providing good-quality LTC to the subset of the elderly who truly can’t afford it, rather than providing mediocre or poor-quality care to all. Eligibility for Medicaid’s LTC benefit should be defined so that it serves as a safety net of last resort for those who genuinely lack the ability to pay, rather than an inheritance-protecting entitlement.

Endnotes

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).