Industrial Policy: Old-Think in the New Cloud Era

Policymakers and pundits are increasingly claiming that this country needs an “industrial policy.” Although this is far from a new idea, topline statistics give it surface plausibility.

In 1980, the U.S. had a 30% share of global manufacturing; today, it has slipped to 16%. China’s share, less than 10% in the early years of this century, has now climbed to 28%. If America recaptured even half the lost global market share, it would constitute a massive doubling of domestic manufacturing. Meanwhile, the Covid-19 pandemic has revealed the dangerous extent to which pharmaceuticals and medical equipment and supplies—not to mention key components for everything from automobiles to air conditioners—are produced offshore.

National security is an obvious reason to consider reshoring; the overall importance of the manufacturing sector to the economy is another. Nearly half of U.S. exports, for example, are in the form of manufactured goods; that share rises to two-thirds if one includes the industrial production of all the materials associated with producing and delivering energy. Factories have traditionally provided well-paying jobs, especially for individuals without a college education, and manufacturing employment offers the biggest economic multiplier in creating collateral jobs and prosperity. Manufacturing enterprises are responsible for almost 70% of private-sector R&D spending.

There are many sensible—and some not so sensible—proposals for fostering domestic industry. But all of them have the failing that is the focus of this report: a failure by many policymakers and commentators, as well as the general public, to recognize significant developments in the manufacturing sector that are already under way.

First: for several years, there has been an ongoing fusion of services within and around manufacturing enterprises. As a result, the official data that are the foundation for commentary and public-policy proposals misconstrue economic reality: many jobs and economic activities categorized as “services” are, in fact, part of “industry.” This fusion is no small matter. Across a wide range of industries, research shows that services account for 30%–90% of the value of manufacturing output. The majority of these services are not clerical, back-office tasks; they involve every aspect of the production ecosystem. Some 40%–90% of those services are performed by outsourced—but not necessarily offshored—providers. Overall, some significant share, perhaps 20%–50%, of the economic and labor activity involved in manufacturing is now being erroneously counted under “services.”

This widespread miscategorization paints a bleaker picture of industrial affairs than is the case. It also means that policymakers run the risk of aiming incentives or penalties at the wrong targets, leading to unintended consequences.

Second: the evolving “servicification” of manufacturing is now being accelerated by the massive growth of the cloud infrastructure in concert with artificial intelligence (AI). In the first half of 2020, manufacturing increased its use of the cloud by more than 140%, even outpacing a similarly rapid expansion in education. And after years of overpromises, AI is finally yielding useful software tools that are bringing some of the most important gains in manufacturing efficiency seen in decades. However, employment in, as well as the value-added of, both the cloud infrastructure and AI is counted under “services.”

The digital servicification of manufacturing is bullish for America—and the U.S. is the dominant home, so far, to both the cloud infrastructure and AI development. Yet more attention has been afforded to the news, entertainment, and “social” features of the digital infrastructure. That is partly because the manufacturing revolution is just beginning and also because the servicification is hidden, in large measure, by government accounting that is anchored in obsolete metrics.

Those considering industrial policies need to recognize and facilitate the profound changes under way in manufacturing. Tax and regulatory policies that foster—or, at least, do not inhibit—more private investment in new technologies and companies should be front and center. But the recognition of these changes will not happen unless Congress directs the Department of Commerce to work with the private sector to find better ways to measure what’s happening in the manufacturing economy.

Introduction

These days, there appears to be one area of bipartisan agreement: America needs an industrial policy.[1] To the extent that there is any debate between Republicans and Democrats, it is mainly over how much to spend and which types of industries should be favored (or disfavored).

Preserving and enhancing the health of industry is not a new idea in this country. In his 1791 “Report on the Subject of Manufactures,” Alexander Hamilton, the nation’s first Treasury secretary, noted: “Not only the wealth; but the independence and security of a Country, appear to be materially connected with the prosperity of manufactures.”[2]

Ever since, America’s policymakers and presidents have, in various ways and at different times, flagged industry as a critical feature of the economy and the nation’s security. Manufacturing prowess anchored President Franklin D. Roosevelt’s “arsenal of democracy” speech in December 1940. In a 1961 speech before the National Association of Manufacturers, President Kennedy asserted that “if American industry cannot . . . increase this nation’s surplus of exports over imports, our international payments position and our commitments to the defense of freedom will be endangered. … Capitalism is on trial as we debate these issues.” In 2012, President Barack Obama sent a “Blueprint” to Congress to create manufacturing jobs in the United States. Aggressive reshoring of American industry was also a core theme of Donald Trump’s administration, and it is, again, a centerpiece of President Joe Biden’s 2020 promise to make manufacturing part of the “arsenal of prosperity,” the latter explicitly borrowing Roosevelt’s locution.[3]

Today, the coronavirus pandemic and its China origins have exposed the challenges with manufacturing supply chains and strategic vulnerabilities that had been largely comfortably ignored. Policymakers and citizens discovered the extent to which pharmaceuticals, medical equipment and supplies, and textiles for personal protective equipment—not to mention key components for everything from automobiles to air conditioners—are being produced offshore.

Given the pandemic’s disruption of supply chains, politicians of both parties are—de facto, if not explicitly—affirming the critical role of manufacturing. And this is all happening in the context of a long-standing drumbeat of claims about deindustrialization, the loss of factory jobs, and the rise of a service economy.

The core issue is not whether the government has a role in the nation’s industrial and economic health; the existence of taxes, tariffs, trade agreements, and environmental and other regulations guarantees that it does. Rather, the core dispute reflects, broadly speaking, a difference in political philosophy. To oversimplify, there is, on the one hand, a more free-market-centric approach that, in the face of the complexities of markets and manufacturing, is confident that the myriad of large and small firms, on average, makes better decisions about where to invest, and how much, than the government. On the other hand, there is a persuasion more sympathetic to federal experts steering specific industries and the economy toward specific outcomes.[4] The latter, by definition, seeks to identify “winners,” while the former seeks to facilitate a framework that yields winners. And with the 2020 disruptions to supply chains, national security was resurrected as a key factor in this debate.

Yet both camps are operating under a kind of old-think that has yet to catch up with and recognize that the entire manufacturing sector is at a technological inflection point. Without a clear understanding of just how different the future of manufacturing will be from the past, policymakers run the risk not only of promoting ineffective but also counterproductive actions. At a fundamental level, policymakers risk the equivalent of trying, over a century ago, to foster more waterwheels and steam-boiler manufacturing—just as electrification and mass production assembly lines arrived on the scene.

Today, we are witnessing the fusion of digital services within and around manufacturing enterprises. This evolution began gradually, several decades ago, but is now maturing and rapidly accelerating with the emergence of the cloud infrastructure, in concert with what can be characterized as the “democratization” of artificial intelligence (AI).[5] It is a kind of digital servicification of manufacturing, and it makes a mockery of the old bifurcated taxonomy of services and industries.

Unfortunately, the emerging fusion of digital services with manufacturing is obscured by legacy government accounting anchored in yesteryear’s metrics. Those metrics increasingly report, under “services,” activities and employment that are, in reality, part of manufacturing. This miscategorization not only paints a bleaker picture of industrial affairs than is actually the case. It also means that policymakers risk fashioning incentives that may lead to successes that are not properly accounted for or even noticed or, worse, that lead to outcomes that are the inverse of those intended.

Why Manufacturing Still Matters

The rumors of the demise of the U.S. manufacturing industry are greatly exaggerated. —Elon Musk, 2020[6]

Measured by stock-market value—$2 trillion—the world’s most valuable manufacturing enterprise is Apple, a quintessential “tech” company.[7] Some 80% of Apple’s sales come from hardware—though most of that hardware is produced by “contract manufacturers” and much of it offshore.[8] Many other similarly valued tech companies, with revenues that are more software-centric than Apple, are nevertheless anchored in massive physical infrastructures filled with hardware. Without that hardware, Amazon, Microsoft, Google, IBM, and Oracle, to note just the biggest examples, could not provide the software and cloud services that are “disrupting” traditional markets. Amazon operates more than 15 million square feet of buildings filled with computer hardware, from servers and routers to memory banks—an area that would cover more than 60 Manhattan city blocks under one roof.[9] It also operates more than 200 million square feet of warehouses, which are increasingly filled with robots.

The point? It is the ability to fabricate hardware, using the technologies of the materials and chemical sciences, that allows the creation of all society’s magical and mundane services, from e-commerce, video conferencing, and clean water, to pharmaceuticals, electric power, ride-sharing, and vacations. There are no services without manufactured products. And, as we will shortly illuminate, the inverse is increasingly the case: there are no manufactured products without services.

Physical stuff still matters, even in this digital age. America produces and moves over 12 trillion pounds of physical goods annually.[10] Roughly 70% of U.S. exports are in the form of something manufactured.[11] And, as is often noted, manufacturing jobs, compared with nearly all services, have a greater economic multiplier—a spillover effect in creating collateral jobs and prosperity.[12] Manufacturing enterprises are also responsible for about 68% of private-sector R&D spending.[13]

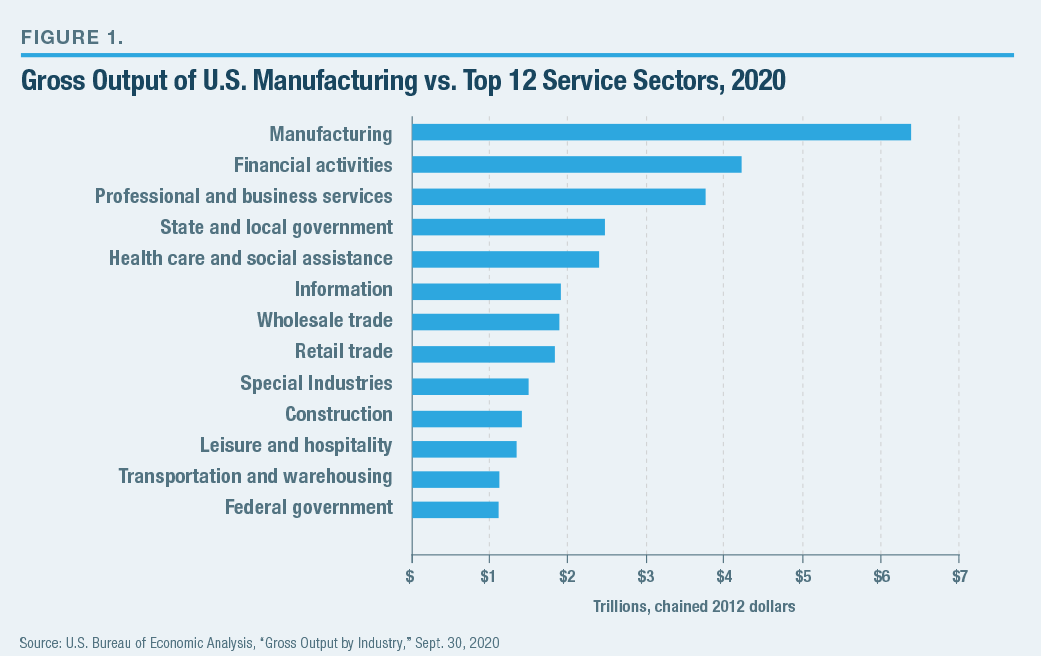

Properly viewed, manufacturing itself is the single biggest part of the U.S. economy, nearly triple the size of health-care services. This little-recognized fact is found in Bureau of Economic Analysis (BEA) data that unbundle the overbroad “services” category that includes activities as different from one other as a machine shop is different from a bakeshop (Figure 1).

Each year, the world fabricates some $2 trillion worth of information hardware from computer and memory chips to cell towers, and from smartphones to data centers.[14] That’s roughly equal to global automobile sales. Without all that digital hardware, there wouldn’t be another $4 trillion in software services that now infuse the global economy.

The dominant role of “stuff” in the world economy is not about to be dislodged anytime soon. Post-Covid, as the world economy returns to normal, the scale of unaddressed, pent-up demand for manufactured products is staggering. Consider: under 15% of the world’s citizens own a car; and only 8% of nearly 3 billion people living in the hottest parts of the world have air conditioning.[15] Forecasters expect the world to return to and surpass the 2019 manufacturing peak—$14 trillion— within a few years and keep growing from there.[16]

Still, Americans are told that, to the extent that the goal of reshoring is to reinvigorate domestic manufacturing employment, efforts will be for naught because automation and information tech will take those jobs.[17] The role of technology in replacing human labor is a subject that requires far more exploration than is feasible here. However, a few high-level realities— especially servicification—are important to recognize and are particularly relevant to understand what’s left out of overbroad claims about automation and employment. Technology-driven gains in productivity— by definition, a reduction in inputs, especially labor, per unit of output—are precisely what has led to reduced costs of goods of all kinds, the expansion of wealth, and, collaterally, more overall employment over the centuries.[18] Productivity gains that come from fewer-people-per-product-produced are often offset by far more production, leading to a net rise in employment (somewhere)—or, at least, a slower decline. Whether that employment is captured by U.S. businesses has more to do with policies than with technology.

Over the past two decades, the U.S. has indisputably lost global market share and millions of manufacturing jobs, as a result of foreign competition (often heavily subsidized), particularly from China.[19] At the same time, America’s domestic policies have been increasingly hostile to industry.[20] It was a toxic combination.

Meanwhile, census data reveal a significant shift in the structure of U.S. employment, away from production and toward services. MIT economists David Autor and Anna Salomons have done pioneering work in mapping this shift and note that the data show a kind of hollowing-out of high-paid “middle-skill” jobs (typically without a college degree), with a simultaneous shift toward more employment in low-skill (low-paid) and high-skill (high-paid) occupations. Both trends are found mainly in services.[21]

This is where we begin to see the challenge in categorizing as services a wide variety of activities that are actually part of production. All leading-edge manufacturing firms and industries know that competitive advantage is gained in the close integration of physical production with tasks that are usually labeled as services— research, development, design, operations, and supply-chain management. That reality is why it will take time to shift many manufacturing businesses back to the U.S.

The late Andy Grove, after retiring as Intel’s CEO, made a campaign of explaining that this “chain of experience” closely links the two ostensibly separate kinds of businesses; services and production.[22] Economic historian Marc Levinson has been one of a handful of analysts warning that the traditional data don’t reveal what is going on in the industrial economy. He has noted, for example, that “whether an activity is classified as manufacturing depends largely on where it is conducted” (emphasis added), not necessarily whether the work is part of manufacturing.[23]

And so if designers, researchers, maintenance staff, and truck drivers are directly employed by a domestic manufacturer, their jobs will be recorded in the government statistics as part of “production” or “manufacturing.” But if those tasks—for whatever reason—are outsourced (not necessarily offshored) to companies that provide those identical services to the same domestic manufacturer, sometimes even using the identical people and hardware, those businesses and employees will typically be recorded as part of “services.”

One clear example is a factory-less manufacturer—i.e., a manufacturer that invents and markets a product that is fabricated by a contract manufacturing service. That would be a firm such as Apple, again, or chipmakers Qualcomm or Nvidia. While many such contract manufacturers do show up on the census rolls as “industries,” the most recent data (from 2012) show that some 20,000 U.S. firms, collectively employing some 1.5 million people, are not categorized as “manufacturing” but nonetheless report providing contract manufacturing services.[24]

Categorizing production activities as services does not, by any means, explain away the precipitous decline in U.S. manufacturing jobs in the past two decades. However, it does, by definition, give the appearance of a more rapid decline and of fewer industrial jobs and more service jobs. This misunderstanding will become greater as the “servicification” of manufacturing is accelerated by the next epoch in computing and software— and may badly mislead policymakers and the public in the years to come.

The Servicification of Manufacturing

There are no such things as service industries. There are only industries whose service components are greater or less than those of other industries. Everybody is in service. —Theodore Levitt, Harvard Business Review, 1980[25]

Despite this admonition from the late economist, governments and economists have long tracked progress and framed policies by dividing the economy into the three familiar, simplistic categories: agriculture, manufacturing, and services. And for much of history, such divisions seemed usefully true because of obvious differences in what goes on in each domain. Economists like to use the example of a haircut to illustrate how different services are from manufacturing. Services, like a haircut, are typically intangible, hard to store or transport, and are often highly personal or customized. Such features make services inherently resistant to productivity gains. (Much the same is being said about health-care services today.) But the world has changed.

Software-as-a-service is easy to store, transport, and standardize. This is why such services as mailing, filing, accounting, clerical work, and advertising have been the first to be so quickly upended by information-centric technologies. It is also why that same digitalization of those kinds of business services has entered the manufacturing sector.

Consider business services, from accounting, payroll, and regulatory compliance, to operational analytics, product design, and supply-chain management. That category of the economy in 1950 accounted for only about 9% of the U.S. GDP. By 2000, business services had grown to over 20% of GDP, roughly where it remains today.[26] The role of business services accelerated from 1980 to 2000 contemporaneous with, and almost certainly because of, the advent of ever more powerful software provided by ever-cheaper computing. That should have been a signal that something new, and big, was emerging. Indeed, during the first Obama administration, a U.S. International Trade Commission analysis focused on the “increased importance” of business services, particularly in manufacturing.[27] And the Congressional Research Service has noted that purchased services (i.e., services not provided internally) now account for more than 30% of the “value-added” in U.S. manufacturing exports.[28]

A 2015 study looked at 22 hardware manufacturers in 15 countries, including North America, that made products for industries from telecom and wastewater to power generation and automobiles. The survey showed that 30%–90% of the value of output for those hardware suppliers was attributable to services.[29] Clerical back-office tasks, common to all classes of business, accounted for less than one-third of all the types of services identified; the rest included everything from the production ecosystem and security to improving customer or supplier relationships (Figure 2).

A 2015 study looked at 22 hardware manufacturers in 15 countries, including North America, that made products for industries from telecom and wastewater to power generation and automobiles. The survey showed that 30%–90% of the value of output for those hardware suppliers was attributable to services.[29] Clerical back-office tasks, common to all classes of business, accounted for less than one-third of all the types of services identified; the rest included everything from the production ecosystem and security to improving customer or supplier relationships (Figure 2).

The study found that increased service input correlated with increased manufacturing productivity. That shouldn’t be surprising, since the pursuit of productivity and profits is the primary reason firms use the services in the first place. But 40%–90% of services used by those manufacturers were supplied by outsourced providers, rather than performed in-house. Thus, all that activity (and employment) would not show up in the accounts of the manufacturing sector.

Other analyses have found similar results.[30] A 2017 OECD study revealed that purchased or outsourced services accounted for 37% of the overall value of manufacturing exports for firms in both the European Union and the United States. If services within manufacturing firms are included, the share exceeds 50%.[31] It found the same pattern across industries from chemicals and plastics, to ICT (Information and Communications Technology), electronics, and motor vehicles. “Part of what we measure as the service content of manufacturing (whether outsourced or insourced),” the study noted, “is a shift of resources to digital technologies in all stages of production.”

Thus, whether it is a person or a robot that drives the rivet or welds the parts on an assembly line, the far greater share of tasks and value-added reside both upstream and downstream from the factory floor. That entire panoply of activities is not only where we find a variety of discrete software services; increasingly, it is where software integrates everything into a kind of holistic machine, something unique in history.

To the extent that some significant share, perhaps 20%– 50%, of the economic and labor activity involved in manufacturing, has been outsourced and is now being counted under “services,” an ineluctable truth follows: economists, journalists, pundits, politicians, and citizens are significantly undercounting the actual size of industry and the industrial workforce. That undercounting may also be revealing itself as the “hollowing-out” of the middle-skill workforce in manufacturing.

Thus, economist David Autor wondered “whether a countervailing set of economic forces will soon reverse the decline of middle-skill work.”[32] We think that the answer to Autor’s question is yes. In addition to the fact that many manufacturing tasks, including middle-skill ones (such as operating and maintaining increasingly complex supply chains or production machines), have not disappeared but have simply moved, in government statistics, from “manufacturing” to “services,” there is also under way a fundamental technology transformation, one that will again restructure employment.

This transformation is fueled by the advent of commercially viable artificial intelligence (AI) and cloud-based enterprise software. It promises something as different from the software that preceded it as PCs were different from mechanical calculators and typewriters. The software pioneered in the latter decades of the 20th century—for word processing, filing, mailing, drawing, printing, and spreadsheets—shifted clerical tasks away from middle-skill employees to the desktops of professionals. Now, the arrival of AI and cloud services will do the inverse and make it possible for “middle-skill” employees to perform tasks previously found in the professional and management domains. To see the evidence for this revolution, consider first the nature of the digital infrastructure.

A New Epoch

We’ve seen two years’ worth of digital transformation in two months. —Satya Nadella, Microsoft CEO, 2020[33]

The year 2020 may go down in history as the year of the cloud. Digital traffic spiked for everything from online grocery shopping and video games to movie streaming and video conferencing.[34] Epitomizing the dawn of a new era, Exxon was removed from the Dow Jones Industrial Average on August 31 and replaced by Salesforce, a cloud-based software company providing a suite of customer relationship services for businesses.

Meanwhile, in the wake of the pandemic lockdowns, telemedicine was unleashed and software put to work alongside physicians to enhance diagnoses. The cloud also allowed researchers to rapidly create common “data lakes” of clinical information to deploy the astronomical capacities of today’s supercomputing in pursuit of therapeutics and vaccines. The cloud, a new and vital infrastructure, didn’t exist just a couple of decades ago.[35]

The cloud may seem like a cooked-up PR term, but it is a distinction with a profound difference—it is as different from the Internet as the latter was different from telephony. The cloud connects anything and everything— especially all manner of so-called smart things—but this time, back to centralized computing infrastructure and one that increasingly offers the emerging software tools based on AI. Spending on cloud services, essentially nonexistent two decades ago, is now a $250-billion- per-year global business that is growing rapidly.[36]

The physical nature of that infrastructure is remarkable. While computers in daily life have collapsed in size, those that form the cloud utility have exploded in scale. At the heart of the cloud are the so-called data centers, buildings filled with thousands of racks of computing power, communications, and storage. Data centers are effectively warehouse-scale computers, many the size of an entire shopping mall with as much as a million square feet under the roof. The annual rate of datacenter construction, measured in square feet, began to take off a decade ago, and then more than doubled in the past five years. More than 8 million square feet are now built each year in the U.S. alone.[37]

The world already has hundreds of millions of square feet of data centers (the U.S. is home to over half of it). And every 10 square feet of a data center has more computing horsepower than all the world’s computers had circa 1980.[38] Every kind of business, especially manufacturing, will see a future affected by the rise of cloud capabilities. It accelerates the servicification of everything.

Unsurprisingly, 2020 saw businesses large and small accelerate their use of cloud services.[39] This comes just two years after crossing a Rubicon wherein more data are now stored remotely, in the cloud, rather than in devices at the endpoints with consumers and businesses.[40] The manufacturing sector increased its cloud utilization by more than 140% in the first half of the year— faster than the 114% rise in cloud use by education, the sector with the second-fastest growth.[41] A new survey looking at future spending on IT and the cloud across all businesses, from retail and health care to financial services, found industrial products and transportation services reporting the highest planned increases in spending on cloud services.[42]

Artificial Intelligence (AI) as an “Amplifier”

The convenience, reliability, and cost savings of moving all manner of software to the cloud is significant enough to merit recalibrating policies and plans. However, the massive increase in cloud use is also enabling the acceleration of an entirely new class of software based on AI.

Computational software arose at the dawn of computing in the 1950s. The concept of a learning algorithm, or of “machine learning,” originated in the 1980s. Just as it took two decades before microprocessors became powerful and cheap enough for conventional computing to take off, it wasn’t until early in the 21st century that the kinds of microprocessors arrived with the capability to execute AI-class software. By 2010, AI applications had begun to enter commercial use.

At the high end of performance, a single AI chip can now deliver the kind of processing capabilities that matches an entire 1990s military supercomputer.[43] Many of those single AI chips are increasingly being installed on the “edges” of networks, i.e., in the machines and devices on the front lines of industrial operations. The market for AI chips is forecast to dominate semiconductor growth and explode some 350% over the next five years alone.[44]

The emergence of AI as a practical tool has made it possible for computers to perform everyday mundane tasks that are computationally difficult, such as easily recognizing voice commands. AI also helps in performing more complex tasks, including reading a CT scan, navigating a car or robot, or recognizing patterns in natural as well as industrial processes.

However, the key feature of AI is not centered on the hype around “intelligent machines” taking work from humans. Instead, it is bringing a “natural language interface” to computers—the ability of humans without programming skills or special expertise to ask for and receive advice in normal language. Collaterally, the advice now being proffered is profoundly enhanced by the superior capabilities of AI-class analytics, increasingly delivered using augmented and virtual reality interfaces. All this is now “democratized,” facilitated by wireless networks connected to the cloud. In other words, the power of AI is not cloistered in “computer rooms” but instead is available, in real time, on the front lines of daily activity for everyone. This feature is particularly relevant in industrial operations.

The combination of AI and the cloud provides a way to “up-skill” the nonexpert. Moving “skilled” decision-making closer to the front-line employees will “hollow out” activities formerly reserved for people classified as professionals. This constitutes a reversal of how 20th-century software hollowed out middle-skill work (e.g., drafting, typing, accounting), moving it onto the desktops of professionals. AI decision-making software becomes simultaneously more powerful and more intuitive to use. That unique feature will accelerate the migration of AI tools into the hands of “middle-skill” employees.

Up until now, business software tools have mainly helped in the collection, storage, and presentation of data. Of course, AI pattern-recognition and advice-giving— coming from simulations and models—can directly assist the professional or manager. But they can also directly inform the “middle-skill,” non-college-educated employee.

From mining to manufacturing, and all the processes and machines that are involved in accessing materials and creating products (whether pharmaceuticals or automobiles), managers and engineers are deluged with data about multiple factors relevant to operational efficiency and safety: sources and quantities, changes in location or composition of components, every character of input and output. In the hands of professionals, recognizing patterns in such data is what leads to the arrays of decisions in operating equipment, adjusting temperatures or pressures in a process, placing orders, informing people and businesses in the supply chain, and so forth. These complex, interrelated issues and tasks are far more common in industrial operations than in, say, hotel operations. Many of the patterns are ones that AI tools can be “trained” to see.

In addition, the machines and processes used in industry are becoming ever more complex. AI-enabled operational guidance can be delivered by “intelligent digital assistants” in real time to front-line operators, also reducing the need for college-level skills to operate increasingly complex machines in increasingly complex environments.[45]

That AI-driven tools are beginning to permeate industrial markets is made clear by the fact that cloud companies such as Amazon, Google, Microsoft, and Salesforce—and now hundreds of other venture-backed startups—are pursuing those markets. Evidence is also seen in various surveys of industries. McKinsey in 2019, as well as Boston Consulting Group last year, found that the AI adoption rate is growing across all sectors, including industrial and manufacturing businesses.[46]

Whether such capabilities provided by the AI-enabled cloud are labeled as services or as part of industry will, as noted earlier, depend on the location of those tools, not whether they’re engaged in industrial activities. The AI-cloud fusion portends a strengthening of America’s hand in industrial competitiveness but will further blur the services-manufacturing distinction.

Response to the Pandemic Lockdowns

Even as the overall manufacturing sector declined with the spread of Covid-19, the fabrication of hardware foundational to the digital age increased. By midyear, semiconductor sales in the Americas were up some 26%.[47] The global demand for the machine tools used inside the semiconductor manufacturing plants was also up, by 8%, with a 13% rise expected for 2021.[48] It bodes well that the U.S. is home to three of the five dominant firms that produce software that is essential for designing computer and communications chips— Ansys, Cadence Design Systems, and Synopsys. The U.S. is also home to three of the four companies that control 90% of the machine tools that are used to fabricate semiconductors: Applied Materials, KLA-Tencor, and Lam Research.[49]

All this manufacturing activity is, of course, fueling the deeper servicification of everything, including—in a kind of bootstrap effect—the manufacturing of hardware to build the cloud itself. Just as the Internet made libraries, commerce, and entertainment available in real time in people’s hands, AI and the cloud bring formerly complex decision-making tools into frontline practitioners’ hands, in real time, too, whether employees on factory floors or at the front desks. All this is particularly relevant to policymakers’ desire to accelerate U.S. manufacturing at a time when a core concern in that sector is the shortage of skilled workers in a nation where 60% of the workforce is without a college degree.[50]

Industrial Policy: Stuck in the Pre-Cloud Era

A coherent industrial policy is a practical necessity. —Robert B. Reich, Harvard Business Review, 1982[51]

Much of what the government does by way of taxes and regulation constitutes, even if only implicitly, a form of industrial policy. This is, of course, apart from the crazy quilt of trade agreements, subsidies, tariffs, quotas, and exceptions to general rules that are used to tilt the playing field in one direction or another. Even vociferous adherents to free-market principles episodically bend to support market interventions. In the mid-1980s, President Reagan implemented a 100% tariff on targeted manufactured products (TVs, computers, power tools) from Japan, stating that the purpose was to “to enforce the principles of free and fair trade.”[52]

None of this is new, and we are again litigating which end of the spectrum policies will end up on, from a heavy to a light hand on the tiller. The motivations to pursue industrial policies in our time are no different from 40 years ago: domestic jobs, the balance of trade, global competitiveness, and the geopolitical realities of “soft power” that derive from economic prowess.

U.S. manufacturing output today, at just over $2 trillion, is more than double, in absolute terms, what it was in 1980—but that growth was dominated by one sector: computer-related production.[53] America’s share of a far larger overall world market is now far smaller. The U.S. had a 30% share of global manufacturing in the early 1980s but has slipped to just under 17% now.[54] Recapturing even half the lost global market share would constitute a massive doubling of domestic manufacturing.

This paper argues that, whatever efforts the Biden administration and Congress (inevitably) decide on in the pursuit of reshoring, the potential for failure or unintended outcomes is greater now than in the past. Framing policies and measuring outcomes will be especially fraught if we don’t know what we’re measuring. A simple thought experiment can illustrate the challenge.

One can imagine subsidies, loans, mandates, and the like that lead to, for example, a new electric vehicle (EV) manufacturing plant built on American soil—but where the outcome does not register any increase in the statistical accounts of manufacturing jobs. Instead, the outcome would register an expansion of the service sector and greater imports. A scenario where that happens? Start with filling the factory, once completed, with robots and automated production equipment; the only industrial jobs showing up in official data would be from the temporary construction work in building the facility. One can also imagine the automated production line being operated by outsourced cloud-based businesses.

Maintenance of the robots? Provided by a specialist service company. Incoming parts and raw materials? Shipped by transportation services companies. Raw materials to make the batteries? Imported, creating jobs in mines overseas, since American domestic policies are not friendly to mining. Design? Chosen from an outsourced, innovative computer-aid design company. Finally: the finished products are carried to market by an outsourced transportation vendor.

The result of this hypothetical, but not unrealistic, scenario would be that the official data would record essentially zero new American manufacturing jobs but a lot more officially designated service jobs. Meanwhile, back in reality, all the new jobs would be engaged, in fact, in manufacturing those EVs. The extent to which those would be American jobs would depend on the often starkly different policies associated with “services” versus “manufacturing.”

It is easy to construct similar scenarios for manufacturing semiconductors and pharmaceuticals, or air conditioners and conventional cars. We already know that services account for some 50% of the average cost of producing a car.[55] A recent National Academy of Sciences workshop explored the fact that biopharmaceutical manufacturing is on the cusp of shifting to increased automation and software-centric production, much of which will be classified as services.[56] Yet, outside of cloistered circles of analysts who have explored these kinds of trends in recent years, little attention is being directed to how to shape policy to accommodate changing conditions on the ground.

Among the changing conditions on the ground is geopolitics. There has been extensive media coverage, for example, of U.S. tariffs directed at China and the high-profile confrontation over China’s Huawei and its role in next-generation wireless systems. Far less attention has been paid to similar actions being pursued by other nations. Realignments are under way, animated by issues from trade and intellectual property to human rights.

India’s Prime Minister Modi initiated actions to “reshape global supply chains based on trust and stability, and not just cost benefits.”[57] India is promoting domestic manufacturing while also, along with Japan, Australia, and the U.S., engaging a Quadrilateral Security Dialogue to “steer supply chains around China.”[58] New Japanese policies subsidize firms that move operations out of China.[59] Germany ended its “China honeymoon,” reacting to economic and supply-chain dependencies, as well as disappointments in seeing any opening of Chinese markets, along with concerns about protecting intellectual property and human rights.[60] Taiwan and the U.S.—in collaboration with the European Union and Japan—held an economic “framework” forum directed at “resilient supply chains” to de-link dependencies with China.[61]

To be sure, none of these or other similar actions has led to any sudden shift in the manufacturing or supply- chain status quo. One cannot change overnight where factories operate, where engineering supply chains are tightly integrated, and where materials are mined and refined. India still gets 80% of its solar panels and 70% of its smartphones from China,[62] and the ratios are similar for the United States. The U.S. and the rest of the world depend on China’s near-monopoly status in mining and refining rare-earth minerals critical to many tech products, as well as refining more than half of all cobalt essential in many products—not the least, lithium batteries.[63] These are long-cycle events, but the direction of the momentum is clear.

China, in response, has launched a “charm offensive,” sending top diplomats to European and Asian nations.[64] It has expanded its sphere of influence by doubling its loans to 68 nations in the past four years alone. These loans now match the total debt supplied by the World Bank to those nations. Huawei, for example, now utterly dominates the entire African continent’s market of 1.3 billion people.[65]

Thus, the U.S. is at a crossroads of national realignments and technological changes affecting supply chains for manufacturing the goods that the world needs. Many of the forces in play predate both the Trump and Biden administrations and Covid-19. But all the forces have accelerated, and that acceleration will continue as the cloud-AI transformation expands in the coming decade.

Reshoring: What Can Be Done?

Over the decades, essentially every proposal directed at supporting manufacturing can be classified as falling within one of three broad classes of government action:

- Creating remedies for purportedly “unfair” or blatantly protectionist trade practices by other nations

- Increasing or decreasing corporate taxes and subsidies

- Increasing regulations or providing relief from existing regulations

Today, we have calls for more of all of the above or new constructs such as a federal “directorate for technology.” Some policymakers and lobbyists want post-Covid stimulus funding to fix income inequality, others to fix the infrastructure, or the “climate.” Still others want more federal “partnerships,” more subsidies for R&D, or more education and re-skilling.[66] The list is familiar. Some of it might conceivably be useful.

However, it is the impact of tariffs, taxes, and regulations on industries that will be as critical in the future as it has been in the past. It bears noting that domestic regulatory burdens are at least as responsible for driving factories out of this country as was, say, the appeal of cheaper labor elsewhere.[67]

Given today’s new state of technological affairs, precious few proposals have offered any novel ideas attuned to the reality of economic conditions and technological change. One of the more interesting new ideas comes from the Brookings Institution’s Rush Doshi. He suggests supply-chain “stress tests” for critical industries, much as is done in the financial sector, which could reveal vulnerabilities and potential solutions in advance of a future crisis.[68] Doshi also proposes implementing new and better means for identifying and tracking U.S. supply-chain activities.

Today’s digital networks and supercomputing simulations are going to make it easier to integrate manufacturing operations and supply chains. Quite apart from gains in operational efficiency, this integration will provide the means to undertake virtual stress tests. Manufacturers will be able to answer questions about the vulnerabilities and costs associated with operations that are run extremely lean—the “just in time” supply chain—versus the costs of a “just in case” approach. The challenge is how to handle “just in case” scenarios for high-consequence, low-probability events (such as a pandemic) that can have greater health, social, or economic impacts for the population than those associated with a specific business.

Regardless of how the insurance challenge is resolved, several public policies remain important today and in the future:

- Congress should focus on facilitating more private investment in the new technologies and companies to ensure continued leadership in the manufacturing technologies that underpin future competitiveness.

- The federal government should take the lead in seeking ways to harmonize policies that create conflicts between the intertwined domains of manufacturing and services.

- Official data need an overhaul to better measure what’s happening in the manufacturing sector.

Along these lines, any serious discussion of reshoring, in particular, and industrial policy, in general, should consider what is outlined below.

Capital Is Critical to New Business Formation

Few doubt—but it’s easy to forget—that the future of manufacturing will be determined as much by the formation of entirely new industries as by sustaining those that already exist. This is particularly true at a time, like the present, of rapid technological change. It is within living memory that many of the enormous tech companies prominent in the news today were either small startups or nonexistent, from Microsoft and Apple to Nvidia and Uber. But even before the pandemic lockdowns created epic damage to businesses of all sizes, the number of new startups formed each year had not recovered from the decline triggered by the Great Recession of 2008.[69]

Few also doubt that access to capital is central to the creation and flourishing of startup firms—especially from investors willing to take risks. The reality is that the private sector has more “dry powder” to put to work in risky ventures than does the federal government— and one would hope that it is self-evident that such risks are better taken by private, rather than taxpayer, money. According to RBC Capital Markets, 2020 began with private equity firms holding $1.4 trillion of “dry powder” ready to invest, of which at least 20% targeted early-stage, high-risk ventures.[70]

The U.S. is currently home to 40% of all funding for AI startups (China is number two, at 16%), and some $60 billion has already been put to work in more than 4,000 startup AI companies over the past two years.[71] And North America is home to over half the global cloud infrastructure.[72] We will want far more of this, not less, along with companies engaged in expanding the cloud and its infrastructure cousin, high-speed 5G networks. But in recent years, the lower tax rate available to venture investors has become a target for “reform”— i.e., raising the taxes on gains made from bets on risky investments. The latter would be a surefire formula for decreasing bets on new, risky businesses. Instead, to accelerate innovation, policymakers should consider removing impediments and providing additional incentives for investments in startups.

Harmonizing Policies

This paper has explored the blurring of manufacturing and services, including (but not only) the accurate measurements of employment. That blurring, quite aside from the measurement issue, can have specific negative impacts on the competitiveness of U.S. firms.

Many regulations associated with trade in services are more restrictive than the trade in goods or can create conflicts with that trade.[73] Services that are an essential part of a product’s operation, from back-office support to maintenance, often cannot follow the product into the country where it’s shipped because of different (and independently decided) restrictions on domestic content, foreign ownership, tariffs, and licenses associated with services that are different from those for products. As many of the service-type aspects of a product, from maintenance and even operation, are increasingly “bundled” with the sale of the product itself—e.g., cars becoming “transportation-as-a-service”—the difference in how services are treated through regulatory, financial, legal, and even social policies can impede, and even eliminate, the ability to sell a product-as-a-service in another country. While OECD tracks—in its Services Trade Restrictiveness Index—the extraordinarily wide variations in how nations treat some 22 classes of services, the potential destructive interactions with industrial markets remain significantly uncharted territory.

Rectifying these conflicts will require leadership in trade negotiations, starting with a clear understanding that such issues need to be part of the framework for discussion in the first place, which is often not the case.

Measuring Reality

Finally, to ensure that policymakers, business leaders, and the public better understand the dynamics of the marketplace, there is an urgent need to improve how federal agencies report data about the manufacturing sector. For historical consistency, BEA and the census will need to continue to track and report data in the traditional manner. But additional tracking and reporting mechanisms are necessary to better understand servicification. Crucially, everyone needs to understand how many jobs currently designated as “services” are directly related, or essential, to manufacturing.

This kind of change is not unprecedented. Extensive scholarly analyses have been devoted over the decades to the various intricacies of collecting “good data” about manufacturing, including as it relates specifically to the impacts of globalization and trade.[74] Other research has noted that the outsourcing of portions of the manufacturing workforce to “employment services” can give the false impression of a shrinking industrial workforce, or at least one that appears to be shrinking faster than is the case.[75]

Congress should direct the Department of Commerce to convene a working group including academic, industry, and other experts to provide recommendations for improved reporting. One would want to know, for example, when, and to what extent, an outsourced service of any kind is still engaged in the manufacturing ecosystem—when an activity is the result of an industry shedding an internal operation, or when service- providing firms gain new business within an industry. Amazon and UPS, for example, offer turnkey “services” to manufacturers supporting their supply chains, as well as (in some cases) physical space for product assembly. Better data can help us understand the real employment dynamics, the nature of skills required in the future, and the most constructive role for policies in an ever-changing manufacturing workforce.

By itself, untangling the knot between manufacturing and services is complex. But accelerating digitalization in both sectors raises even more complicated issues. While improvements in transparency are possible, a good deal of what will continue to be required is good judgment about what policies do or do not make sense for the future of work and the competitiveness of the American economy. A good deal of humility will be required, as well. Particularly in times of dramatic change, “winners” are far easier to predict in hindsight.

Endnotes

Acknowledgement

The author is grateful for the assistance of Noah Muscente, a project manager at the Manhattan Institute.

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).