Obama's Fiscal Legacy: A Comprehensive Overview of Spending, Taxes, and Deficits

The end of the Obama presidency now allows for an overall assessment of taxes, spending, and deficits during his years in office. The analysis in this paper begins with the 10-year budget baseline that Obama inherited in January 2009 and measures subsequent tax and spending changes through the January 2017 baseline released as he left office. The data come from more than 20 Congressional Budget Office baseline updates over the administration’s eight years, supplemented with the line-item scores of approximately 110 major bills that Obama signed into law.

- The cumulative 2009–19 budget deficits are set to end up at $8.93 trillion—$4.6 trillion higher than projected for the same time period when Obama took office.

- The economy grew more slowly over this decade than was projected in 2009. Yet far from deepening the budget deficits, the slower economic recovery and technical changes saved $400 billion over the decade relative to the January 2009 baseline, as lower tax revenues were offset by lower interest payments on the national debt, the result of recession-dampened interest rates.

- New legislation cost $5.0 trillion over the 2009–19 period. However, $4.1 trillion of this “cost” came from basic extensions of expiring taxes including the Bush-era tax cuts. Economic stimulus added $2.0 trillion in spending, and discretionary spending caps and mandatory sequestrations saved $800 billion.

- The Affordable Care Act reduced the 2009–19 budget deficit by $275 billion, as its tax increases and Medicare cuts exceeded the cost of new health benefits. But the health law has made balancing the long-term budget more difficult by using most of the tax increases and Medicare cuts to finance a new entitlement rather than deficit reduction.

- Virtually all net spending increases during the Obama administration were enacted during 2009–10, when Democrats controlled Congress. During the following six years, with a Republican House and eventual Republican Senate, $889 billion in net spending cuts were enacted, excluding legislation that simply extended expiring policies.

- Obama leaves behind a budget with higher entitlement spending, lower discretionary spending, and (temporarily) lower net interest costs than originally projected. The ballooning national debt leaves taxpayers liable for exorbitant debt service costs when interest rates return to normal levels.

______________________

Brian M. Riedl is a senior fellow at the Manhattan Institute. Previously, he worked for six years as chief economist to Senator Rob Portman (R-OH) and as staff director of the Senate Finance Subcommittee on Fiscal Responsibility and Economic Growth. Follow him on Twitter here.

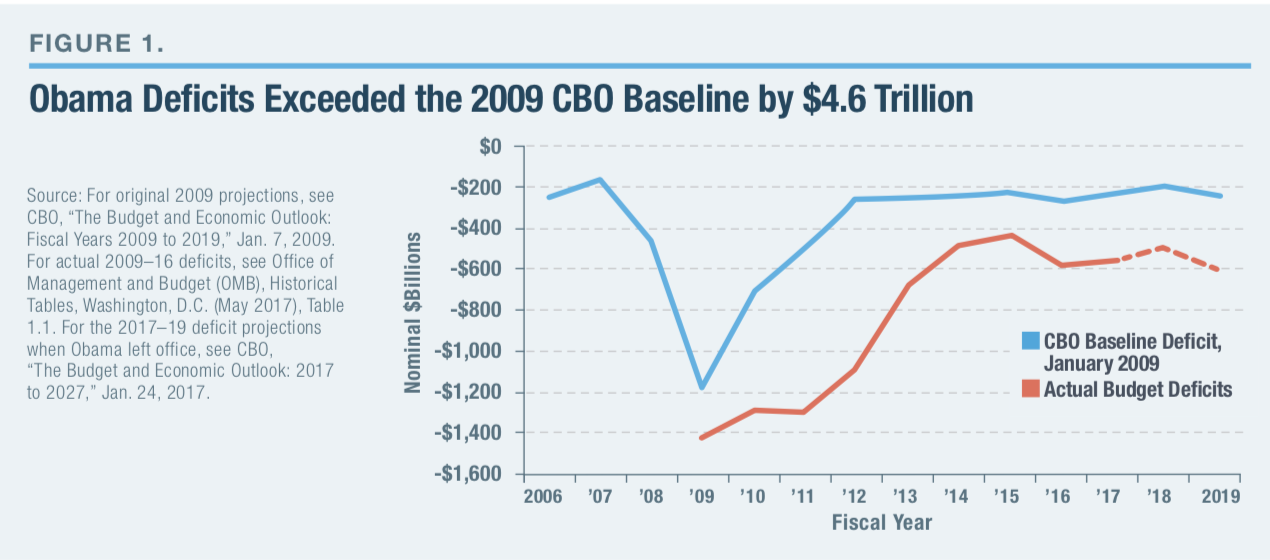

$4.6 Trillion in Additional Federal Deficits

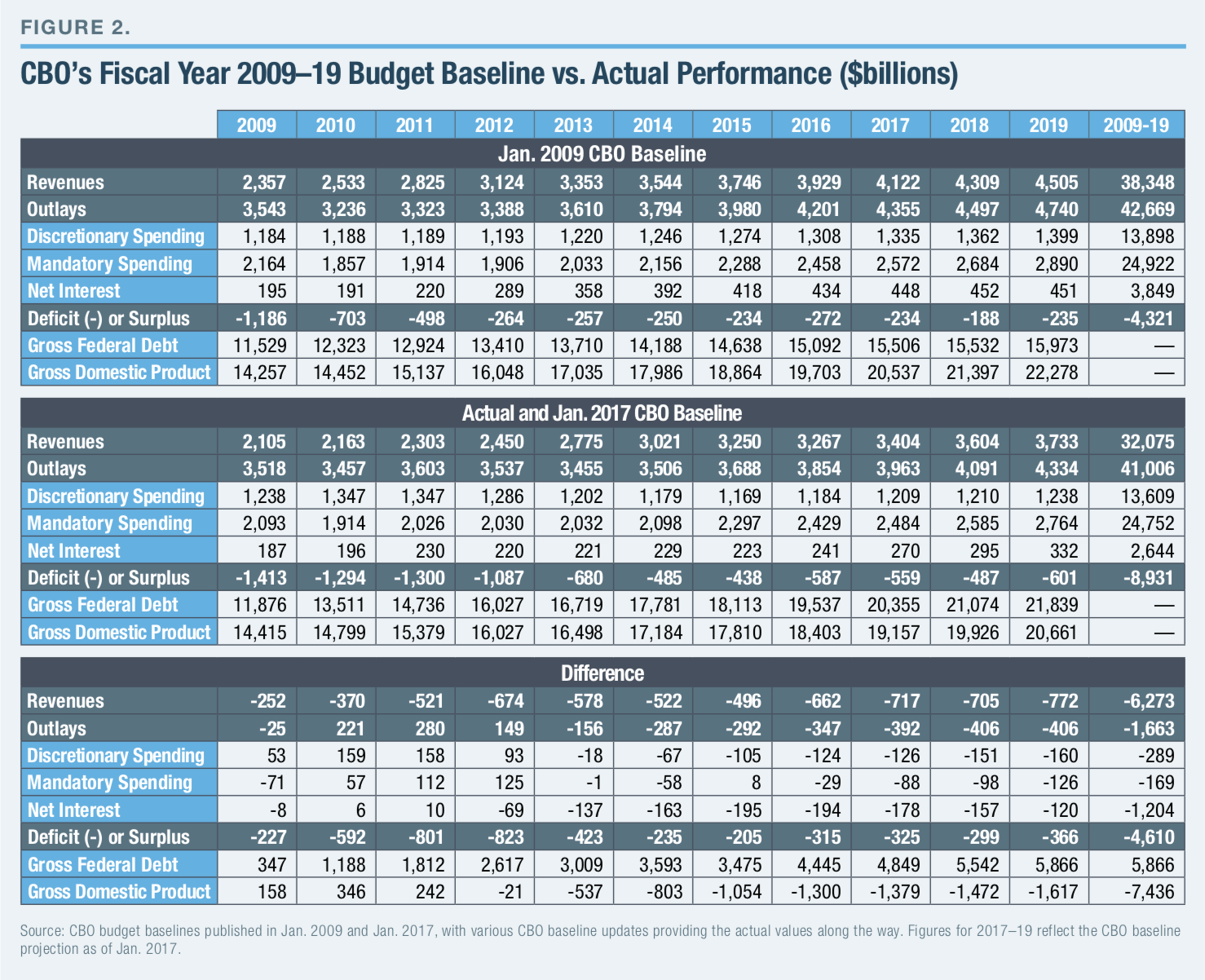

Upon taking office in January 2009, President Obama inherited a budget deficit that had soared from $161 billion in 2007 to a recession-slammed $1.186 trillion estimate for 2009. The January 2009 CBO baseline budget projection for 2009–19—which already incorporated the effects of the year-old recession in its projections—estimated that a strong economic recovery and the expiration of certain tax cuts would return the annual budget deficit to approximately $260 billion by 2012. In other words, the projections assumed that the high recessionary deficits would quickly fall back to earlier levels. Overall, CBO estimated that there would be $4.32 trillion in total budget deficits over the decade.

That is not what happened. Figure 1 shows that, as Obama left office, the 2009–19 budget deficits were now estimated to total $8.93 trillion—more than double the initial projections. Annual budget deficits remained above $1 trillion through 2012, fell to $438 billion by 2015, and have since begun rising once again. While current deficits of 3% of the Gross Domestic Product (GDP) are not historically atypical, they are significantly higher than the default baseline when Obama took office.

These deficits also exceeded the president’s own targets. A month after his inauguration, Obama pledged to “cut the deficit we inherited by half by the end of my first term in office.”[4] Instead, the inherited $1.186 trillion was pushed up to $1.413 trillion by 2009 stimulus legislation, and then remained over $1 trillion throughout the president’s first term (Figure 2).

It was not until 2014 that the budget deficit fell to half the inherited level in nominal dollars (2013, if measuring by percentage of GDP).

Had the president and Congress simply stuck to CBO’s original budget baseline legislatively (even allowing for budget effects of the weak recovery), the deficit would have fallen well below $300 billion by 2013 and approached balance by 2018. Instead, expensive new policies slowed the deficit reduction, leading to $8.93 trillion in red ink rather than $4.32 trillion—which is $4.6 trillion in additional deficits. Readers can determine which new costs were justified, and which were not.

Higher Deficits Were Not the Result of the Weak Economic Recovery

Conventional wisdom blames the persistently high budget deficits in the Obama years on the unexpectedly weak economic recovery. In 2012, for example, the president asserted that he had failed to meet his own deficit-reduction targets “because this recession turned out to be a lot deeper than any of us realized.”[5]

To be sure, the 2009–16 economy grew at barely half the 2.6% annual rate that CBO projected in January 2009. By the end of 2019, CBO now projects the economy to produce $7.4 trillion less output than it projected for these 10 years in January 2009. This translates into $1.9 trillion in forgone tax revenues. An additional $1.2 trillion in projected tax revenues was lost to technical revisions and other factors that are often intertwined with the underperforming economy.[6]

That is only half the story. The same sluggish economy and technical re-estimates that reduced tax revenues by $3.1 trillion also automatically reduced spending by $3.5 trillion over the decade—leading to a modest net reduction in the 10-year budget deficit relative to the January 2009 baseline.

The main source of lower spending: $2.3 trillion less in interest payments on the national debt, thanks to lower interest rates. These lower interest rates were a direct result of the weak economy and the Federal Reserve’s policy of keeping its target interest rates near zero, to spark growth. Consider that between 1996 and 2016, the national debt quadrupled, from $5 trillion to $20 trillion, yet interest payments were lower in 2016 than in 1996.[7] Had the original 2009 CBO interest-rate assumptions held, the federal government would be paying a $620 billion interest tab in 2017, rather than $270 billion.

That is the good news. The bad news is that when interest rates paid by Washington return to a historically normal range of 5%–7% (or even higher, because of the soaring national debt), federal spending will explode by hundreds of billions—or even trillions—of dollars.

In addition to low interest rates, the slow economic recovery and technical re-estimates saved $820 billion in mandatory program costs through developments such as lower automatic inflation adjustments and lower than projected spending on Medicare Part D. Finally, $397 billion was saved from faster than projected repayments of the 2008 financial bailouts as well as the rapid recovery of deposit insurance and government mortgage-guarantee institutions that had cratered in 2008. All told, this $3.5 trillion in nonlegislative spending savings exceeded the $3.1 trillion in lost tax revenues (Figure 3).

Even during the 2009–12 period of trillion-dollar deficits, the net budgetary loss to economic and technical revisions (relative to the January 2009 baseline) averaged about $50 billion annually.[8] Since then, these factors have provided a net savings of approximately $100 billion annually, as net interest and mandatory program savings, such as those described in the last paragraph, continue to grow rapidly.

Overall, the weak economy and technical re-estimates reduced deficits by $400 billion from the original 2009–19 budget projections. This offset some of the $5 trillion in new legislation, leading to a sum of $4.6 trillion in net additional deficits over this period.

$5 Trillion in New Legislation

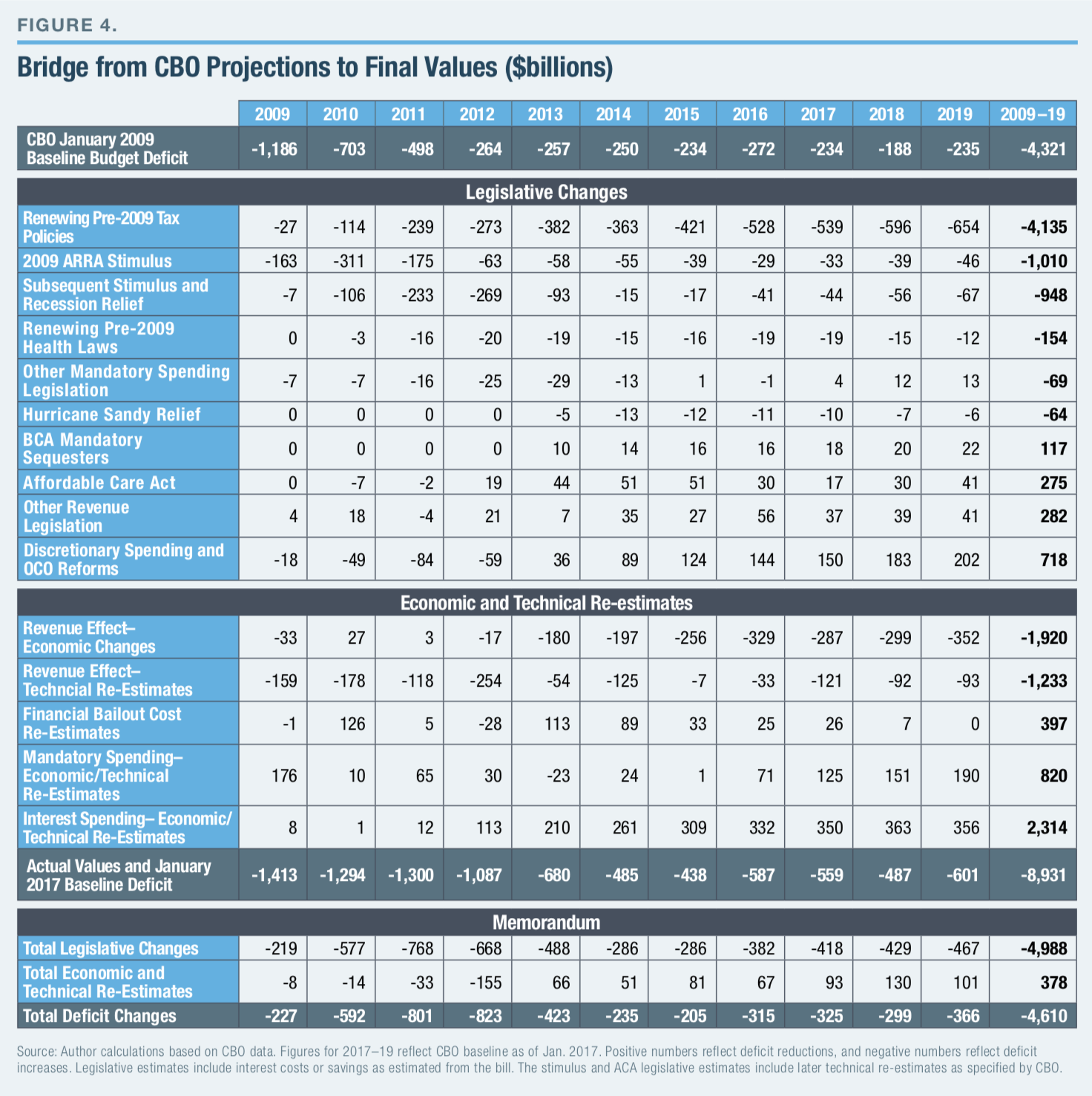

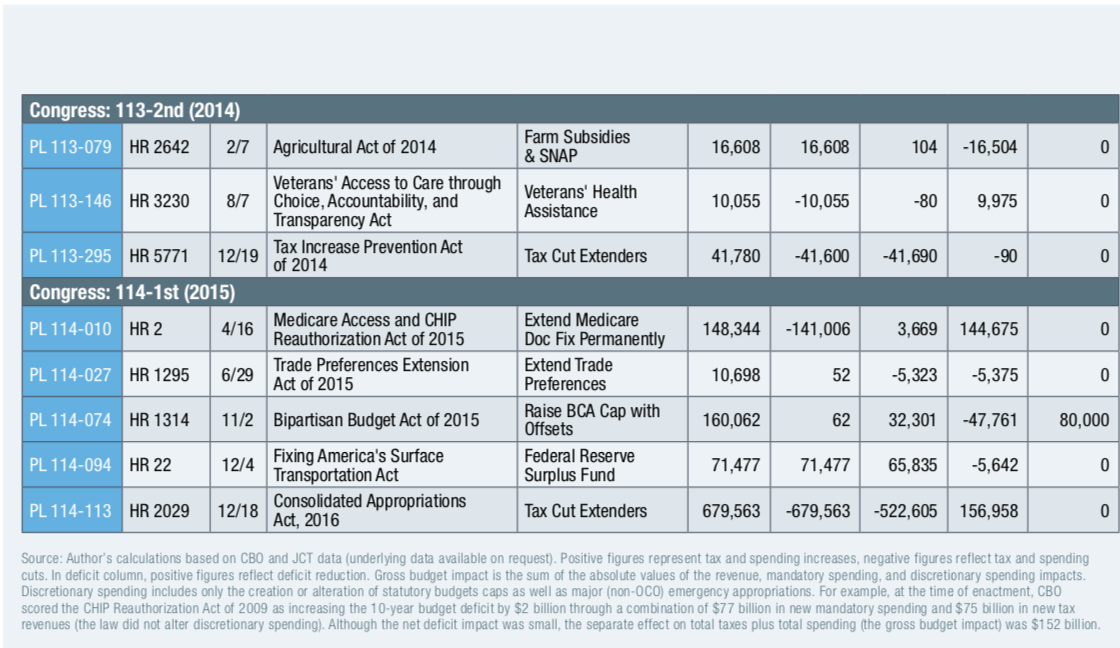

In eight years, President Obama signed legislation that cumulatively added $4,988 billion in budget deficits over 2009–19. Taxes were reduced by $3.120 trillion, program spending increased $758 billion, and $1.110 trillion in interest costs resulted.[9] The main components are summarized in Figure 4, and some details are explained below.

1. Extending tax cuts inherited from previous administrations ($4,135 billion). The most expensive bills signed by President Obama did not reflect major policy changes; they were instead extensions of tax cuts that had been scheduled to expire. This includes extensions of the 2001 and 2003 tax cuts originally signed by President George W. Bush ($1,660 billion), the Alternative Minimum Tax (AMT) “patch”[10] ($1,247 billion), and a series of small tax cuts known as the “tax extenders” that Congress regularly renews every December ($481 billion).

Because this raised the national debt, it also added $747 billion in interest costs. Following a two-year extension enacted in December 2010, the AMT patch and most of the 2001 and 2003 tax cuts were finally made permanent in January 2013, and many annual tax extenders were made permanent in December 2015.

There is a persuasive argument that these extensions should have been incorporated into the original CBO baseline rather than counted as “new” tax cuts. After all, a baseline is supposed to show the tax and spending effects of maintaining current policies. Instead, the January 2009 baseline assumed the expiration of the tax policies above and thus the implementation of $5 trillion in new tax increases (including interest costs) over the next decade, the vast majority of which would later be canceled by a bipartisan congressional majority.

Yet controversial budget rules classified this simple continuation of current tax policies as a new $4 trillion tax cut.[11] It is true that the baseline merely reflected expiration dates that were written into these tax cuts (partly because of other arcane budget rules). Yet CBO’s baseline projections regularly assume that expiring entitlement programs (such as farm subsidies) will be extended and that Social Security and Medicare benefits will continue to be fully paid, even after their trust funds are exhausted. Simple consistency suggests that the baseline should have also assumed these tax policy extensions in the original baseline (and scored their long-term cost when originally enacted), rather than counting them as expensive “new” tax cuts.

Based on a current-policy baseline (which assumes the renewal of existing policies), Obama and Congress actually raised net taxes. The January 2013 legislation made permanent the 2001 and 2003 tax cuts for most taxpayers but allowed tax rates to rise for upper-income families and small businesses by an estimated $600 billion over 10 years, relative to the tax policies at the time. Certain tax-cut extenders have been scaled back as well, and new taxes were imposed to pay for the Affordable Care Act (ACA) as well as for children’s health care (tobacco taxes). The net effect is a 2017 tax code designed to raise more revenue from a given income distribution than the 2008 tax code.

2. Economic stimulus policies ($1.958 trillion). Shortly after taking office, President Obama and the Democratic Congress enacted the American Recovery and Reinvestment Act (ARRA), which included $748 billion in new “stimulus” provisions plus $262 billion in net interest costs over the decade. Over the next several years, this was followed by an additional $716 billion in economic stimulus and recession relief costs, including payroll tax holidays ($226 billion), emergency unemployment-insurance extensions ($191 billion), and extensions of new 2009 stimulus tax relief involving the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and various business-tax cuts ($187 billion). Net interest costs added $231 billion to this last round of stimulus policies, which were mostly contained to 2009–14, except for the permanently extended EITC, CTC, and AOTC provisions.

3. Discretionary spending cuts and mandatory sequestrations ($835 billion saved). Following an initial surge, discretionary spending proved to be the source of large budgetary savings in the Obama years. More than $300 billion in “emergency” discretionary spending was included in the 2009 stimulus bill described above. Two years later, a new House Republican majority demanded and received a $2.1 trillion spending cut over 10 years, in exchange for raising the debt limit by an equal amount. Because a congressional “Super Committee” created by the 2011 Budget Control Act (BCA) deadlocked in its attempt to find alternative budget savings, the BCA ended up imposing most of its cuts within discretionary spending. Specifically, the law created 2013–21 statutory discretionary spending caps that were $1.3 trillion below the CBO discretionary spending baseline. The remaining savings would come from modestly sequestering a small sliver of mandatory spending (such as Medicare), as well as lower interest costs.

Overall, discretionary outlays—excluding 2009 emergency stimulus spending and Hurricane Sandy relief—are set to come in $640 billion below the inherited 2009–19 baseline level. These reductions consist of defense discretionary spending ($506 billion below baseline) and nondefense discretionary spending ($423 billion below baseline)—partially offset by additional emergency supplemental funding for Overseas Contingency Operations (OCO), such as in Iraq and Afghanistan ($290 billion above baseline). This $640 billion in program savings also produced $78 billion in net interest savings and combine with the BCA’s mandatory sequester savings ($98 billion plus $19 billion in interest savings) to arrive at the $835 billion saved.

The savings listed above are far less than the initial BCA score because: 1) this paper’s 2009–19 analysis period cuts off the BCA’s larger savings years of 2020 and 2021; 2) Congress has broken the discretionary caps by more than $150 billion so far, mostly in return for slowly phased-in entitlement reforms; and 3) Congress has proved adept at using budgetary gimmicks to slip in extra spending. Despite this backsliding, the BCA represents one of the largest spending cuts in several decades.

4. Affordable Care Act ($275 billion saved). Shortly after its enactment, CBO estimated that the ACA would collect $526 billion in revenues (mostly from taxes on the health industry and upper-income families) and spend $401 billion over 2009–19—for a net deficit reduction of $125 billion.[12] The president and Congress subsequently reduced the law’s savings by repealing or delaying $50 billion in taxes, fees, and fines (while also saving $14 billion in spending). Yet the ACA’s total budgetary cost has continued to fall because of factors outside lawmakers’ control. Specifically, lower than expected enrollment in the health-care exchanges and the Supreme Court ruling making the state Medicaid expansion voluntary saved $279 billion in federal subsidies, while also reducing revenues by $79 billion over the decade (mostly through reduced risk-adjustment transfers). The decision by the Department of Health and Human Services to cancel the CLASS Act—an actuarially unsustainable long-term-care program that had been included in the original ACA—cost $65 billion.[13] Finally, $52 billion was saved in net interest costs because of the rest of the law’s deficit reductions.

Altogether, the $125 billion in original projected savings was reduced by $36 billion through subsequent legislation and by $65 billion from the cancellation of CLASS. Yet the budget picture benefited from $200 billion in savings outside lawmakers’ control (mostly due to decreased exchange enrollment) and $52 billion in net interest savings. The result is $275 billion in overall 2009–19 savings.[14]

Net deficit reduction does not necessarily mean that the ACA was fiscally responsible. The original law was estimated to provide $788 billion in new health-care benefits over the decade, offset by $931 billion in new taxes and cuts to programs like Medicare (excluding education savings). Given that entitlement spending is on a completely unsustainable path, there is a reasonable argument that the limited supply of realistic spending and tax offsets should have gone toward shoring up Social Security and Medicare, rather than funding a new government program. Instead, Washington added another expensive entitlement to its long-term obligations and reduced the supply of available offsets to address the upcoming deluge of debt. The task of balancing the long-term budget was made more difficult by the ACA.

5. Health extenders ($154 billion). Just as the CBO baseline had assumed large new tax increases, it also assumed that Medicare physician reimbursement rates would be allowed to fall by as much as 21% (based on a 1997 law), even though Congress had moved to prevent these cuts every year since 2002. During the Obama presidency, lawmakers continued to extend the current Medicare physician payment structure (as well as extending other small health laws), while often cutting other health-provider payments as offsets (thus cutting net spending relative to a current-policy budget baseline). Finally, in 2015, Congress made the Medicare “doc fix” permanent (and even expanded payment rates by $33.5 billion over the following decade) without major offsets. Overall, most of this $154 billion in spending is consistent with a current-policy baseline.[15]

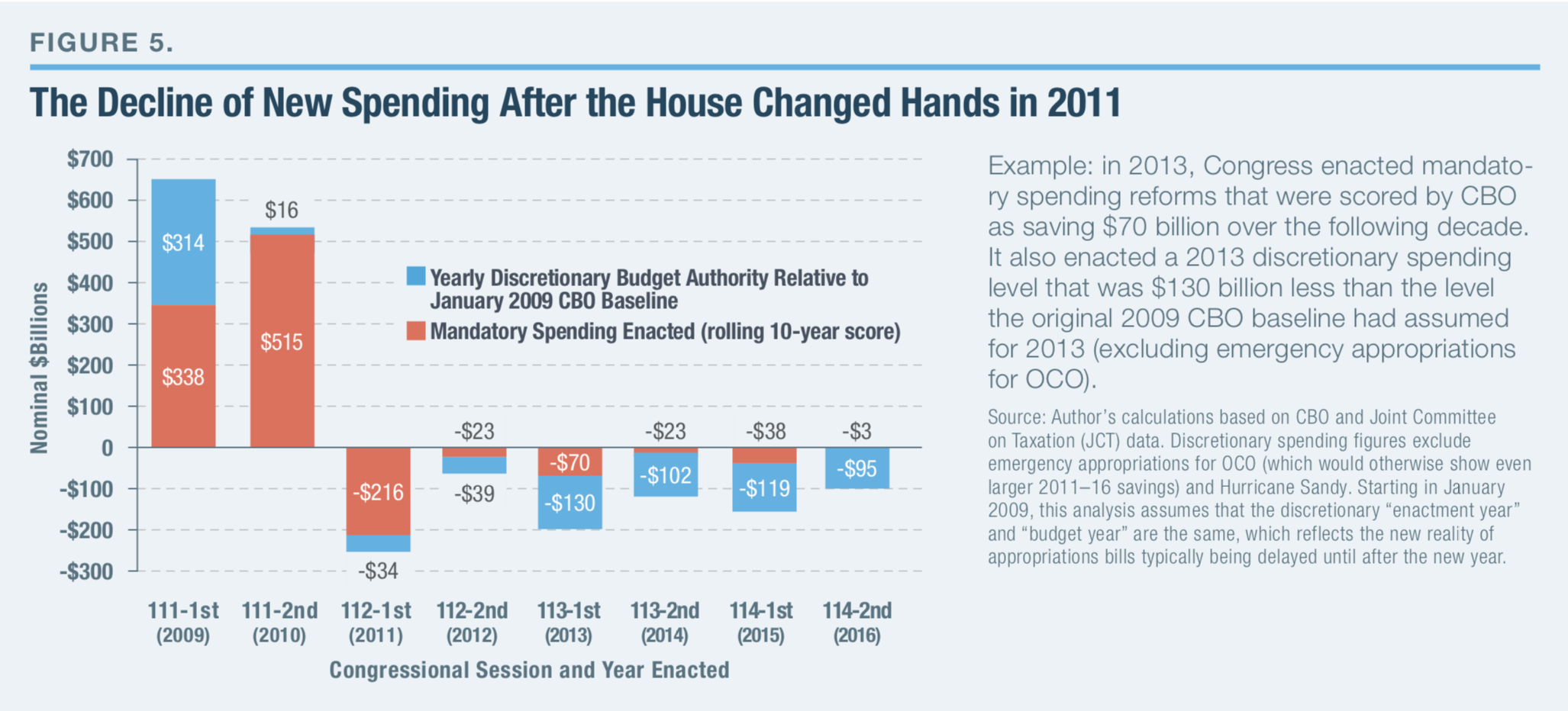

The Two Presidencies of Barack Obama

New presidents typically enter office with a voter mandate for a long list of expensive campaign proposals. Indeed, Ronald Reagan’s tax cuts, Bill Clinton’s stimulus and health initiatives, and George W. Bush’s tax cuts and education spending initiatives were all debated in the first two years of their presidencies. Over time, mandates recede, congressional opposition hardens, and gridlock sets in. The Obama presidency was no exception. Nearly all his major legislative successes occurred in 2009 and 2010, with the help of large Democratic majorities in the House and Senate.

Specifically, the 111th Congress enacted mandatory spending initiatives with a combined cost of $1,103 billion over the following decade. Discretionary spending above the January 2009 baseline (excluding OCO)[16] added an additional $329 billion over those two years.[17] However, after the Republicans captured the House majority in the 2010 elections, the next six years saw $265 billion in 10-year mandatory spending expansions and a $519 billion decline in non-OCO discretionary spending relative to the January 2009 baseline.[18] This adds up to a $1,432 billion spending increase over the first two years of the Obama presidency and a $254 billion spending cut in the next six years.

That analysis may even understate the difference between these two periods. Most of the expensive initiatives that were enacted beginning in 2011 (and even some of those enacted in 2009 and 2010) were bipartisan extensions of existing policies. This includes extending the 2001 and 2003 tax cuts, the 2009 stimulus tax cuts (such as AOTC and expansions of CTC and EITC), the Medicare doc fix, and emergency unemployment benefits. Excluding these basic extensions, the president and Congress increased mandatory spending by $853 billion during 2009 and 2010, and decreased mandatory spending by $369 billion during the next six years (Figure 5). Combined with the discretionary spending figures above, this “current-policy” tab comes to $1,182 billion in new spending during 2009–19 and an $889 billion spending cut afterward.

The revenue side also shows a strong contrast after the 2010 elections. The largest legislation—the $3.6 trillion legislation making permanent much of the “Bush tax cuts” and the AMT patch—was enacted in early 2013 under split government. However, setting aside basic extensions of earlier tax policies (including some 2009 stimulus tax cuts), the 111th Congress enacted an overall 10-year, $519 billion tax increase (mostly due to the ACA), while the next six years saw $44 billion in net tax cuts covering the following decade (dominated by the 2011 and 2012 payroll tax holiday).

The contrast between these periods shows that the common conservative complaint that the Republican Congress acted as a rubber stamp for Obama is false. The large federal government expansion under unified Democratic government ended immediately after the 2010 election. From that point on, discretionary spending was significantly reduced, and mandatory spending increases were largely limited to current-policy extensions that both parties supported.

Who Gets Credit for Fiscal Restraint?

The Obama presidency did not result in the historic expansion of federal spending that many conservatives feared. Of the $5 trillion in added legislative debt, $4 trillion resulted from the extensions of existing tax cuts that conservatives overwhelmingly supported.

The main government expansions were $2 trillion in (mostly temporary) government stimulus provisions and the ACA. And these costs were partially offset by one of the largest discretionary spending cuts in U.S. history.

To be sure, conservative fears were not unfounded. Obama and the unified 2009–10 Democratic Congress enacted some of the largest government expansions in decades. Breaking this momentum required a Republican takeover of the House of Representatives in 2011 and the Senate in 2015. From that point on, neither the Obama administration nor the Republican Congress moderated their demands. Rather, gridlock was produced by two parties trying to pull government in radically different directions.

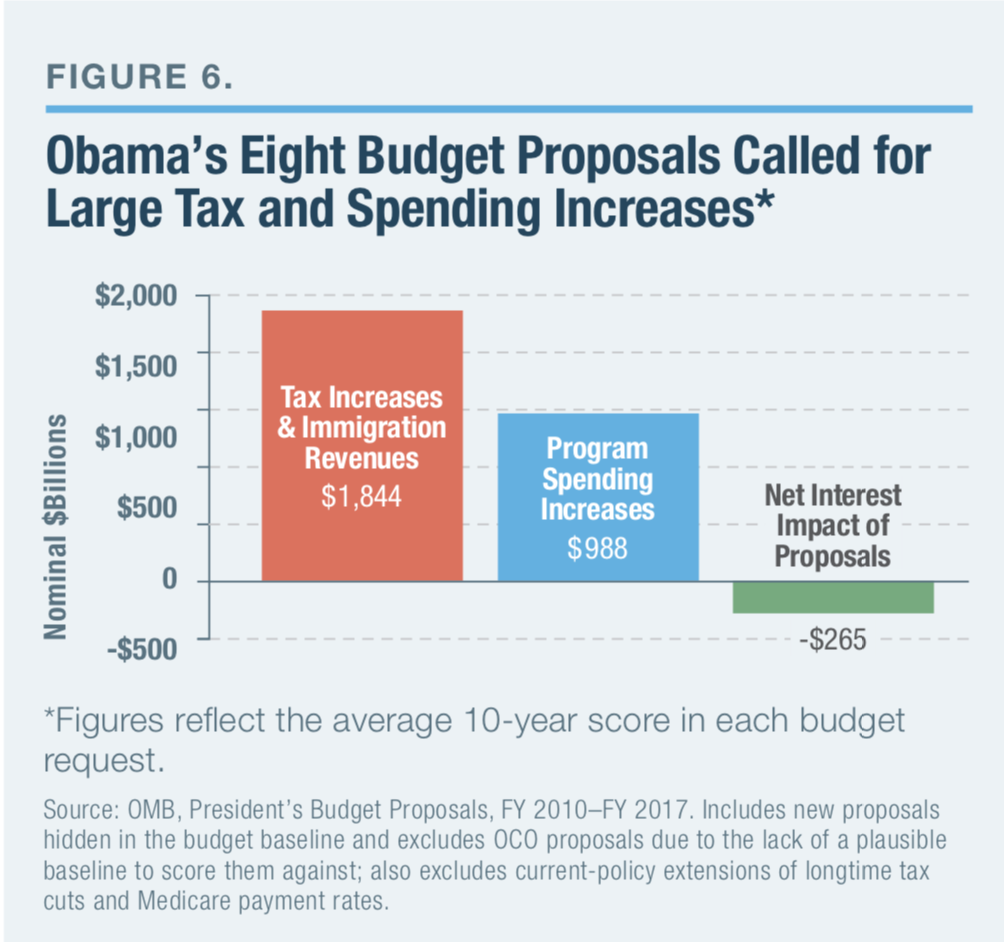

President Obama sent eight annual budget requests to Congress. Figure 6 shows that those eight budgets proposed an average of $1.8 trillion in new taxes and immigration revenues (against a current-policy revenue baseline) over the following decade, as well as $1.0 trillion in new spending on federal programs (excluding OCO spending and the current-policy Medicare doc fix).[19] Even after successfully securing large spending increases in 2009–19, the president continued to propose comparable spending increases in future budgets. Tax revenue proposals expanded from $1.3 trillion in the president’s first budget proposal, to $3.4 trillion in his final budget request. Most of Obama’s budget proposals would gradually reduce the budget deficit by chasing spending increases with even larger tax increases.

On the flip side, the congressional Republican budget proposals veered radically in the opposite direction. In order to show a balanced budget over a 10-year period, Republican blueprints typically left tax revenues at their current-policy baseline level, while proposing 10-year spending cuts that grew from $4.8 trillion in early budgets, to $5.8 trillion by 2015. These Republican budgets shared virtually no common ground with Obama’s budgets.

Essentially, the president’s proposals to sizably expand government, as well as the congressional Republicans’ proposals to drastically reduce government, were dead on arrival each year.

The BCA produced the largest policy breakthrough, with Obama winning an increase in the debt limit and the congressional Republicans receiving deep discretionary spending cuts (although neither President Obama nor the Republican Congress has been eager to own the deep cuts to defense). Beyond that, the parties managed to find common ground in favor of extending expiring policies such as tax relief, Medicare payment rates, and unemployment benefits, while also teaming up for payroll tax relief, Hurricane Sandy relief, veterans’ assistance, and partial replacements of the discretionary spending caps with modest entitlement savings from dozens of programs. The fiscal restraint from 2011 through 2016 resulted from gridlock.

The Missed Opportunity

For those concerned about the nation’s long-term fiscal health, the most important budgetary development of the Obama era was not the stimulus spending, tax-cut extensions, or discretionary spending cuts. Instead, it was the failure to reform Social Security, Medicare, and Medicaid, the three entitlement programs that remain on course to swallow the federal budget.

Driven by 77 million retiring baby boomers and rising health-care costs, federal spending on Social Security and health entitlements soared by 59% between 2008 and 2016—from $1,234 billion to $1,966 billion. These programs were responsible for 84% of the total federal spending increase during this period, and they now constitute the majority of federal spending.[20]

The costs of inaction are high. Over the next decade, CBO projects annual Social Security and health-entitlement costs to grow by another $1.6 trillion. These programs (along with interest on the debt that will result mostly from their deficits) are the entire reason that CBO projects the national debt held by the public to swell from 77% to 150% of GDP over the next 30 years (and the total debt in nominal dollars to grow from $20 trillion to $92 trillion).[21]

There is no plausible way to pay for these escalating costs. Even 100% tax rates on all income above $1 million, or even above $500,000, would not come close to funding this gap.[22] Neither would eliminating defense spending, foreign aid, or the unholy trinity of waste, fraud, and abuse.

The future entitlement Armageddon is no secret. Erskine Bowles, President Clinton’s former chief of staff, called it “the most predictable economic crisis in history.”[23] House Speaker Paul Ryan has essentially focused his career on putting Social Security and health entitlements on a sustainable path. While Democrats have traditionally opposed reforming these programs, President Obama promised not to “kick the can down the road” on entitlements.[24] In 2010, he created the bipartisan Bowles-Simpson commission to address long-term budget deficits, adding that “the cost of Medicare, Medicaid, and Social Security will continue to skyrocket. . . . This [commission] can’t be one of those Washington gimmicks that lets us pretend we solve a problem.”[25]

Unfortunately, the can was kicked down the road. Other than some modest Medicare reforms,[26] entitlement spending continued to rise during the Obama years. Obama’s eight budget proposals failed to offer reforms to significantly reduce long-term Social Security and Medicare liabilities (with the exception of a 2013 budget proposal to slow down Social Security inflation adjustments that was quickly abandoned in the face of liberal opposition). As Bob Woodward details in The Price of Politics and Matt Bai explains in the New York Times Magazine,[27] repeated “grand bargain” budget negotiations between the White House and congressional Republicans broke down, mainly because of disagreements over the ratio of tax increases versus spending cuts, as well as the White House moving the goalposts to demand additional taxes after a bipartisan agreement had been negotiated by President Obama and Speaker Boehner. White House requirements for trillion-dollar tax increases were accompanied by smaller entitlement concessions that would trim only a small fraction of the long-term entitlement liabilities. That said, Obama conceded more spending reforms in these negotiations than congressional Democrats were comfortable with, which was not without political risk. Similarly, the House Republican leadership likely conceded more tax revenues than the House Republican majority would have accepted. Overall, the failure to complete a deal putting entitlements on a sustainable path was the largest fiscal failure of the Obama era.

The Evolving Federal Budget

With the failure to put Social Security, Medicare, and Medicaid on a more sustainable basis, these three programs expanded from 41% to 49% of all federal spending.[28] Another large budgetary development was the national debt, which rose from $11.5 trillion to $20 trillion (or from 80% to 106% of GDP).[29] Even though most of the $2 trillion in stimulus costs have expired, their impact on the national debt (chiefly through annual interest costs) is here to stay. Tax-cut extensions also produced a larger national debt than if they had been allowed to expire.

Meanwhile, discretionary spending declined from 38% of the federal budget to 31%—and will continue to decline because of the BCA. Essentially, lawmakers who refused to confront escalating Social Security and health entitlements have begun cutting the rest of the budget. Lawmakers will eventually run out of other programs to cut or eliminate.

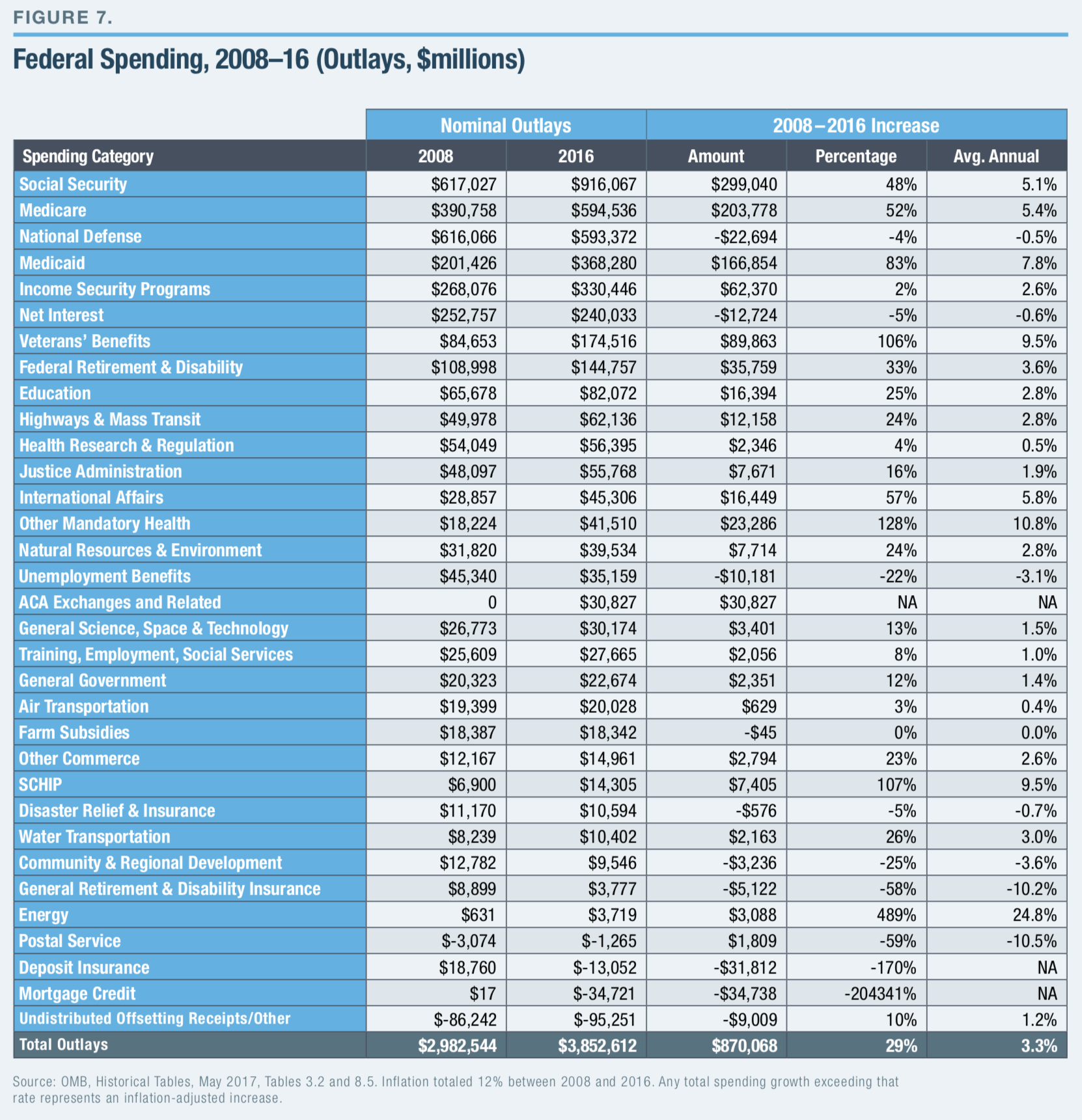

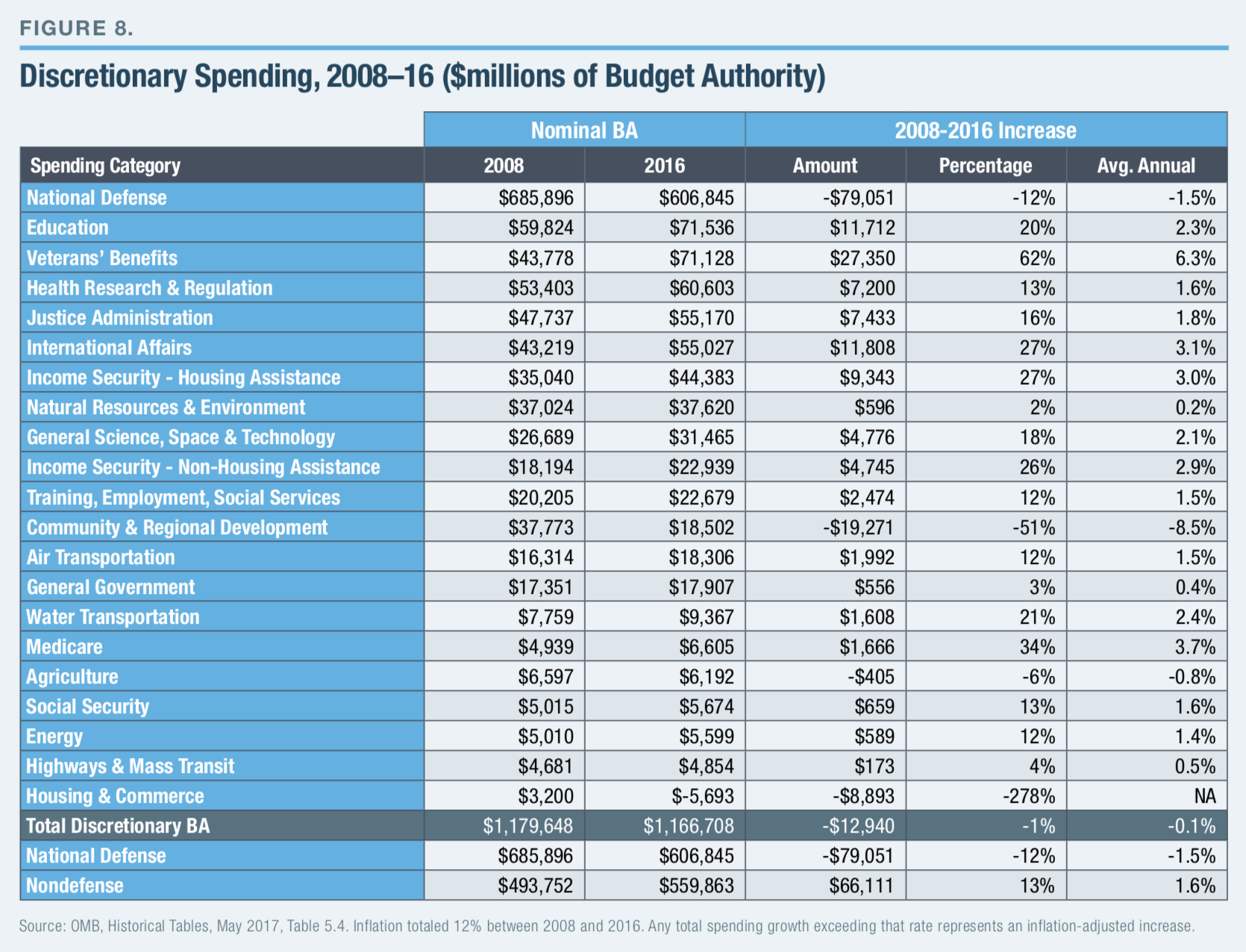

Figures 7 and 8 show other notable budgetary developments between 2008 and 2016, which include:

- Defense and net interest spending each declined in nominal dollars between 2008 and 2016 (and fell significantly when accounting for the 12% inflation over this period). Net interest costs fell because the mounting national debt was (temporarily) offset by falling interest rates. Defense spending fell as war costs dipped and the BCA capped spending.

- Veterans’ spending doubled to $175 billion as the wars in Iraq and Afghanistan created a new generation of veterans.

- Federal antipoverty spending rose from $476 billion to $744 billion—a 56% increase that well exceeds the 19% increase in inflation and population growth—despite the economy improving from a deep recession to a seven-year recovery.[30] As a percentage of GDP, this spending rose from 3.2% to 4.0%. Medicaid and the ACA drove much of the increase, although programs like SNAP (formerly, food stamps) saw substantial caseload growth even after the recession ended.

Obama’s Long-Term Budget Legacy

The national debt is set to end the 2009–19 period $5.9 trillion higher than had been estimated in January 2009. Even at a low 4% interest rate, this will require $235 billion in annual interest costs for as long as the debt exists.

Tax revenues are approximately 18% of GDP, which is above the 17.4% historical average, yet below the 20% figure that the 2009 baseline assumed would be the case when the Bush-era tax cuts expired, the AMT was no longer patched, and other tax cuts expired. Ultimately, temporary tax policies have finally been made permanent; taxes have been increased on upper-income families, small businesses, and smokers; and new health-related taxes have been enacted to pay for the ACA. The weak economic recovery (which will have produced $7.4 trillion less GDP than expected) has cost trillions of tax revenue dollars, although this does not fully show up in the percentage of GDP figures because both the numerator and denominator are lower.

Federal spending, at 21% of GDP, is roughly 2% of GDP higher than under George W. Bush but 0.5% below the level projected in January 2009. Mandatory spending is about 0.4% above the already-rising projections (mostly due to the ACA), and discretionary spending (driven by the BCA) is approximately 0.2% lower than the already-declining 2009 baseline. The real driver of lower than projected federal spending is the 0.8% of GDP saved in net interest spending (relative to the projection), due to low interest rates.

The historically low interest rates of the past several years are unlikely to persist because of: 1) continued Federal Reserve interest-rate increases toward more typical levels; 2) improvement from the current lethargic economic growth rate; and 3) a surge of new federal debt in the coming decades with interest effects that the official projections are underestimating. When interest rates do rise, the budget will turn very ugly. The January 2017 CBO baseline projects a budget deficit of $1.4 trillion in 2027. But a return to the 1990s interest rates would bring that year’s deficit to $2.2 trillion, and a return to the high interest rates of the 1980s would bring $3.2 trillion annual deficits. The longer-term picture is even worse. If the average interest rate paid on the national debt rises to 7% over the next decade (just slightly above the 1990s average),[31] it would add $55 trillion in interest costs to the national debt by 2047 (the current $92 trillion debt projection would instead become $147 trillion, or would jump from 150% to 240% of GDP).

Conclusion

In the debate over Obama’s fiscal legacy, conservatives as well as liberals can point to areas of vindication. The yearly budget deficit fell under this president, yet it would have fallen even faster without the president’s expensive initiatives. Obama signed legislation adding $5 trillion in 2009–19 deficits, but $4 trillion of this consisted of tax-cut extensions that most conservatives supported. The weaker-than-expected economic recovery did not directly contribute to the budget deficits exceeding their January 2009 projections, although it did lead to $2 trillion in stimulus policies. Obama enacted a net spending cut over his final six years in office, largely due to a new Republican congressional majority rejecting his spending proposals and insisting on cuts.

The ACA is not adding to the deficit at this point, yet it is using up valuable offsets that could have extended the life of Social Security or Medicare. The overall cost of the Obama presidency was smaller than conservatives feared, although the failure to reform entitlements and the inevitability of rising interest rates could have catastrophic long-term consequences.

Political score-setting aside, the rapid deterioration of the federal budget picture since 2001 presents a huge challenge for the country. The retirement of 77 million baby boomers into Social Security and Medicare—combined with rising health-care costs and the interest cost of putting these bills on the nation’s credit card—threatens to elevate taxes to European levels, squeeze out all other federal spending priorities, and, in extremis, eventually bury the economy in a Greek-style debt collapse. Several presidents and Congresses have understood this coming crisis but chose political expediency over the gradual phase-in of long-term reforms. President Trump’s first budget proposal refused to offer reforms that would save Social Security and Medicare from bankruptcy—which was consistent with his campaign’s opposition to reform.[32] But costs continue to grow, and the day of reckoning is coming. Current and future politicians will be judged on their response to this challenge.

Appendix

How the Numbers Were Compiled

This analysis of the Obama fiscal record begins with the January 2009 CBO budget baseline that the incoming president inherited. This baseline provided the 10-year (2009–19) default projection of spending and revenues against which to measure the president’s record. CBO updates its rolling 10-year projections three times per year and classifies all baseline movements into three causal groups: 1) legislative changes; 2) economic re-estimates that affected spending and revenues (such as faster growth, raising tax revenues); and 3) technical re-estimates of revenues or spending, such as updated projection models (which are often secondary effects of economic changes).36 CBO further breaks down these three groups by the specific spending or tax category affected (such as the technical changes affecting Medicare).

Digging deeper into the legislative changes required building a database of more than 110 of the largest tax and mandatory spending bills signed into law over the Obama administration’s eight years—down to the line-item level of detail (Figure 9). CBO and Joint Committee on Taxation (JCT) staff helped fill in many of the line-item gaps. One complication is that several scores existed for some bills—the final published score, an often unpublished post-enactment rescore for the next CBO baseline update, and JCT scores that did not always match CBO scores. I used the latest cost estimates when possible, although the post-enactment estimates often lacked a line-item breakdown and thus had to be reconciled with the earlier, more detailed, scores. Overall, this report accurately captures approximately 95% of all legislative line-item costs and estimates the rest based on the CBO data provided. From there, all line items were classified into nearly 100 categories (such as housing, education, and 2001/2003 tax-cut extensions). Some categories, like economic stimulus, required occasional judgment calls.

Because discretionary spending levels are set directly by Congress—often through statutory spending caps that do not change based on economic or technical factors—I bypassed the technical/economic/legislative breakdown and simply compared each year’s total discretionary spending with the original 2009–19 discretionary spending baseline. Also, when examining discretionary baselines, I occasionally split out the supplemental spending bills for Iraq and Afghanistan because this naturally declining category does not fit well with an inflation-growing baseline.

Net interest costs are incorporated into the cost of bills and line items. Two complications were: 1) CBO’s baseline updates list only the total interest cost of all recently enacted legislation, rather than a specific breakdown by bill; and 2) these 10-year interest projections were highly dependent on whatever future interest rates that CBO assumed at the time of enactment. I addressed both problems by redistributing each year’s total legislative net interest expense based on each tax and spending subcategory’s prorated contribution to the added legislative debt for that year.

For example, imagine two hypothetical laws enacted in 2009 and 2015 that each added $100 billion in projected new debt by 2019 but where CBO assumed a 2019 interest rate of 5% when the first bill was enacted and 3% when the second bill was enacted. Both 2019 interest rates cannot simultaneously be true, and rather than punish the first law with CBO’s $5 billion net interest cost in 2019 versus $3 billion for the second law, I would assign each law $4 billion in 2019 interest costs for their respective $100 billion in new debt. This method ensured that every bill (and line item) could have an interest cost assigned to it and that each year would have its own uniform interest rate.

Of course, actual interest rates have regularly come in far below the earlier levels projected by CBO when scoring bills. A given year may have a CBO weighted-average projected interest rate of 4% but actually come in at 2%. In those cases, the legislative cost includes the CBO weighted-average interest rate, and the interest rate savings are categorized in the economic and technical re-estimates. In other words, the actual cost of most legislation came in below the levels listed in this paper because of interest savings that are placed in the economic/technical section.

Obama’s budget record is measured over a 10-year period (despite an eight-year presidency) because the original January 2009 CBO baseline covered 10 years and therefore allows us to analyze the effects of the president’s policies over this longer period. Still, the analysis ends with the January 2017 CBO baseline that estimates the 2017–19 budget picture, and any subsequent changes to the 2017–19 budget will be credited to President Trump. Similarly, the Bush era (2001–11) includes the 2009–11 spending, tax, deficit, and debt levels as estimated by CBO in January 2009, when Bush left office. Subsequent changes between 2009 and 2011 are credited to President Obama.

Finally, CBO and JCT budget data have their critics. CBO and JCT, for example, do not inflation-adjust their 10-year numbers. More important, the use of a current-law budget baseline (rather than a current-policy baseline) runs counter to the idea that a baseline should reflect the continuation of longstanding policies that are presently in place (including those requiring renewals). Nevertheless, CBO and JCT numbers are the official Congressional data, and the most verifiable source. Rather than manually inflation-adjust 10-year figures, or build my own current-policy baseline—which would result in data that cannot be easily verified by the reader—I provide the official CBO/JCT figures and then regularly mention: 1) the relevant inflation rates, such as the 19% expected total rate over the 2009-2019 period; and 2) that certain policies (such as extending existing tax and Medicare policies) would not be classified as “new” costs under a current-policy baseline. This provides readers with the information to make their own adjustments should they wish.

President Bush’s Fiscal Record: A Look Back

When George W. Bush entered the White House in January 2001, CBO projected a $5.9 trillion budget surplus over the 2001–11 period. Instead, he presided over cumulative budget deficits of $4.4 trillion. Bush’s $10.3 trillion fiscal decline relative to his inherited baseline far exceeds Obama’s $4.6 trillion decline relative to his own inherited baseline.[33] Bush’s legislative debt overwhelmingly consisted of new initiatives (some of which were thrust upon him, such as 9/11), while much of Obama’s debt resulted from extending tax policies inherited from Bush.

Overall, the $10.286 trillion fiscal decline under Bush consisted of $5.148 trillion in lower than projected revenues and $5.138 trillion in higher than projected spending. Legislation accounted for $6.949 trillion, while economic and technical changes accounted for $3.337 trillion:

Economic and technical changes ($3.337 trillion). CBO’s early 2001 projections were developed near the end of a historical stock-market and economic bubble that had created surging and ultimately unsustainable tax revenues. CBO had projected a continuation of these economic trends. Instead, the bubble burst and created a brief 2001 recession, which was followed by a modest recovery before the Great Recession collapsed tax revenues, beginning in 2008.

The 2001/2003 tax cuts ($2.330 trillion). When the most pressing budget concern was that massive budget surpluses would pay off the entire national debt too quickly, Bush signed large tax cuts into law. Setting aside the $504 billion in net interest costs that are included in this total, approximately 70% of the tax revenue forgone benefited families earning incomes under $250,000 annually.

Defense increases ($2.171 trillion). The 9/11 attacks and subsequent wars in Afghanistan and Iraq reversed the steep defense cuts of the 1990s. Approximately $400 billion of the spending increases represents interest on added national debt.

Nondefense discretionary spending increases ($802 billion). The largest increases between 2001 and 2008 were granted to veterans’ health benefits (95%), international aid (79%), education (42%), and health research and regulation (37%)—versus 21% inflation over this period.

Other tax changes ($489 billion). Much of this category consists of the annual AMT patch and other current-policy tax extenders.

Other mandatory spending changes ($432 billion). This consists of dozens of smaller mandatory program expansions, in areas such as farm subsidies and Hurricane Katrina flood relief.

Medicare Part D (prescription drugs) ($321 billion). The 2003 Medicare entitlement has cost less than anticipated, which has played a lead role in the recent slowdown of Medicare cost growth. Still, its cost is contributing to Medicare’s long-term unsustainability.

TARP ($221 billion). Most of the 2008 Troubled Asset Relief Program bailout expenditures were later recovered during the Obama administration.

Economic Stimulus Act of 2008 ($181 billion). This antirecession bill relied chiefly on tax rebates for families.

Despite these measures, Bush oversaw much lower budget deficits than Obama because he had inherited a budget surplus. During the Bush presidency, federal spending rose from 17.6% to 20.2% of GDP (averaging 19.0%), while revenues fell from 20.0% to 17.1% (averaging 17.1%, although the initial figure reflects a temporary revenue bubble). The national debt increased from $5.6 trillion to $11.5 trillion (or from 56% to 80% of GDP) through 2009.[34] As entitlement costs continued to grow, Bush campaigned on Social Security reform in 2004 and made it a priority after his reelection. The effort collapsed in 2005.[35]

Endnotes

- See, e.g., Bob Cesca, “The GOP’s Entire Identity Is Based on a Lie: How the Obama Presidency Exposed Republican Deficit Delusions,” Salon, Oct. 15, 2015; and Jonathan Chait, Audacity: How Barack Obama Defied His Critics and Created a Legacy That Will Prevail (New York: Custom House, 2017)

- See, e.g., “Obama’s Fiscal Legacy,” Wall Street Journal, Nov. 9, 2016; and Nicole Kaeding, “Obama Presidency by the Numbers,” Cato Institute, Jan. 20, 2015.

- See the Appendix for the sources and methodology.

- Barack Obama, “Remarks at the Opening of the Fiscal Responsibility Summit,” Washington, D.C., Feb. 23, 2009.

- Barack Obama, Interview with WAGA (Fox Atlanta), Feb. 14, 2012. Some might argue that the president was referring to the recession’s legislative (stimulus) costs rather than the automatic revenue losses due to the economy, but his promise to cut the deficit in half, on Feb. 23, 2009, was made after the 2009 stimulus bill (the American Recovery and Reinvestment Act of 2009) was enacted and then signed into law on Feb. 17—so its cost would have already been assumed into the promise.

- See the Appendix for more explanation.

- In 1996, a national debt of $5.2 trillion brought an interest cost of $241 billion. In 2016, a national debt of $19.5 trillion brought an interest cost of $240 billion. See OMB, Historical Tables, May 2017, Tables 7.1 and 8.1.

- Technical revisions that were quickly assigned to new laws, such as the stimulus and the Affordable Care Act, were moved into the legislative scores of those items.

- These interest costs are based on CBO’s aggregate projections of long-term interest costs shortly after the bills were enacted. Actual interest costs came in much lower (because of collapsing interest rates), and those savings are categorized within the economic and technical re-estimates.

- The minimum income and tax deductions threshold that would make a family liable to pay the AMT was not originally indexed to inflation, so Congress would regularly pass a “patch” adjusting the threshold upward for current and previous inflation, and thus ensure that a tax intended to affect the wealthy did not creep down into the middle class.

- The $5 trillion tax increase assumed in the baseline and $4.1 trillion cancellation does not mean that actual taxes were raised by $900 billion. The baseline cost changed over time, and roughly $600 billion in upper-income-tax increases (some of which were outside the 2009–19 window) were later enacted within this category.

- These figures include the two enacted bills that together built the health-care law. See CBO, “Letter to the Honorable Nancy Pelosi,” Mar. 20, 2010, Table 2, p. 18. These figures exclude the $19 billion saved from unrelated higher-education provisions that were attached to these reforms.

- In reality, the expert consensus was that the CLASS Act would eventually run unsustainable deficits and go bankrupt, so canceling the program surely saved money over the long run.

- Despite the law’s short-term deficit reduction, some analysts argue that the dire long-term ACA budget projections mean that repealing the law would reduce long-term budget deficits. See Charles Blahous, “The Fiscal Effects of Repealing the Affordable Care Act,” Mercatus Center, 2017.

- Of this amount, $32 billion is interest on the debt.

- These figures exclude supplemental spending for OCO because the traditional CBO baseline formula of indefinitely increasing discretionary spending by inflation makes little sense for this naturally declining spending category. That said, OCO represents another category where spending was gradually reduced by later Congresses.

- As explained in the Appendix, discretionary spending changes are not analyzed as 10-year baseline changes. Instead, each year’s discretionary spending is compared with its projected level in CBO’s Jan. 2009 budget baseline (excluding OCO in this section).

- The discretionary budget authority figures classify the six Republican House years as FY 2011–FY 2016. Most FY 2011 appropriations were enacted in spring 2011, after Republicans assumed control of the House.

- These calculations are based on OMB estimates over the subsequent 10-year period. Because these figures are based on a current-policy baseline (which the White House often used for its budget), the cost of simply renewing long-term tax and Medicare payment policies are excluded. New proposals hidden in the OMB budget baseline (such as Pell Grant expansions and tax increases) are included in the calculations (and other gimmicks such as unspecified savings proposals are addressed as well). OCO funding is excluded because there is no plausible baseline against which to measure this spending and because 10-year OCO proposals typically reflect mere placeholder numbers.

- See OMB, Historical Tables, May 2017, Tables 3.2 and 8.5.

- CBO, “The 2017 Long-Term Budget Outlook,” Mar. 30, 2017. The accompanying CBO tables project a 2047 national debt that is 150% of a $61.3 trillion GDP.

- Treasury tax data show that—within the individual income-tax code—the sum of all currently untaxed income earned annually over the $1 million threshold is 3.0% of GDP. Another 1.1% of GDP of income between $500,000 and $1 million remains untaxed. Lawmakers could tax perhaps 1% of GDP more from these families before combined federal, state, and payroll marginal tax rates in excess of 70 percent would begin to lose revenue.

- Erskine Bowles, speech before the Council on Foreign Relations, Apr. 24, 2012.

- Michael D. Shear, “Obama Pledges Reform of Social Security, Medicare Programs,” Washington Post, Jan. 16, 2009.

- President Obama, State of the Union Address, Jan. 27, 2010.

- This consists of modest means-testing of Medicare Part B and D premiums, and the provider payment reductions that were included in the ACA.

- Bob Woodward, The Price of Politics (New York: Simon & Schuster, 2012); and Matt Bai, “Obama vs. Boehner: Who Killed the Debt Deal?” New York Times Magazine, Mar. 28, 2012.

- See OMB, Historical Tables, May 2017, Table 3.2.

- The $1.186 trillion budget deficit that CBO projected in Jan. 2009 for that year is credited to President Bush, while the additional $227 billion in later 2009 deficits that resulted mostly from the 2009 stimulus legislation is credited to President Obama. The Bush/Obama breaking point on the national debt is adjusted accordingly.

- See OMB, Historical Tables, May 2017, Tables 3.2 and 8.5. Antipoverty spending is defined as budget functions 604 (housing), 605 (food assistance), and 609 (cash and other assistance), plus means-tested health spending programs Medicaid, SCHIP (State Children’s Health Insurance Program), and ACA assistance.

- For past interest rates, see CBO, “The 2017 Long-Term Budget Outlook,” Mar. 30, 2017, supplemental tables.

- OMB, “A New Foundation for American Greatness Fiscal Year 2018,” May 23, 2017. For a sample of Trump’s many campaign statements opposing Social Security and Medicare reforms, see his Twitter feed on May 17, 2015.

- The Jan. 2001 projections are at CBO, “The Budget and Economic Outlook: Fiscal Years 2002–2011,” Jan. 1, 2001. As the methodology discussion in the Appendix explains, both presidents are examined over a 10-year period (despite eight-year presidencies) because the initial 10-year budget baseline allows for a longer analysis of the effect of their policies. Obama’s 2009–19 analysis ends in Jan. 2017, when he left office (adding in the 2017–19 budget projections at the time); Bush’s 2001–11 analysis ends when he left office, in Jan. 2009 (adding in the 2009–11 budget projections at that time).

- For budgetary purposes, the Bush era includes the 2009–11 spending, tax, deficit, and debt levels as estimated in Jan. 2009, when Bush left office. Subsequent changes to the 2009–11 levels are credited to Obama.

- See William A. Galston, “Why the 2005 Social Security Initiative Failed, and What It Means for the Future,” Brookings Institution, Sept. 21, 2007.

- An example would be CBO updating its long-term health-care utilization models in response to cash-strapped families scaling back usage in an attempt to limit co-pay costs.

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).