State legislators worried about New Jersey's deep pension debt are contemplating turning over administration of one of the largest retirement funds to workers and retirees. The idea behind the move sounds simple: Workers and retirees, who are beneficiaries of the system, can be relied on to run it well.

The only problem is that this has already been tried around the country and has helped create some of the nation's biggest pension fiascos, as workers and unions have managed pensions for their benefit, leaving taxpayers on the hook for huge losses. This is not the kind of reform that Jersey residents facing tens of billions of dollars in pension debt need.

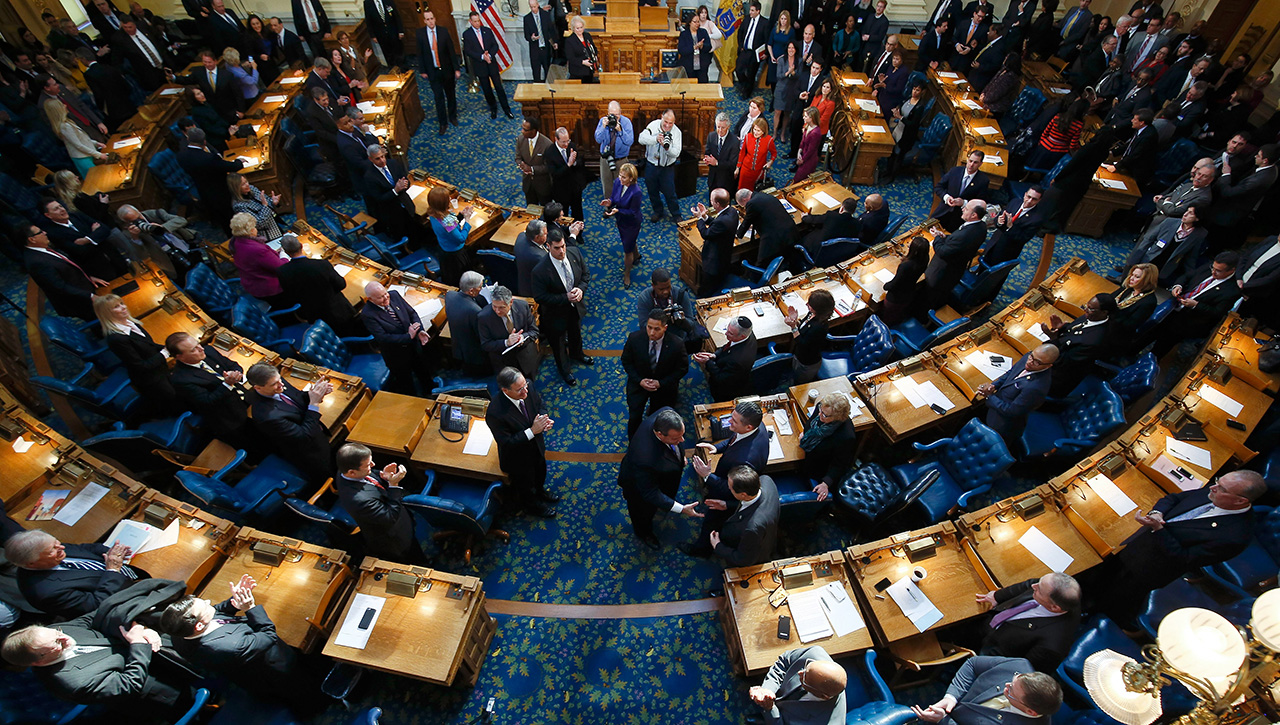

The Legislature has already passed a bill, now awaiting Gov. Christie's signature, that turns over management of the Police and Firemen's Retirement System (PFRS), run by the Treasury Department, to a 12-member board of trustees dominated by beneficiaries. One justification for the bill is anger that the State Investment Council, which directs pension fund investing, has been paying Wall Street firms big fees, but returns haven't lived up to expectations.

"Giving management to the pension beneficiaries removes political interest....

Read the entire piece here at The Philadelphia Inquirer

______________________

Steven Malanga is the George M. Yeager Fellow at the Manhattan Institute and a senior editor at City Journal.

This piece originally appeared in The Philadelphia Inquirer