Doing so will spur much-needed economic growth.

Congressional Republicans hoping to repeal and replace Obamacare are reportedly considering retaining the law’s surtax on investment income that applies to upper-income taxpayers. The political appeal of the 3.8 percent Net Investment Income Tax (NIIT) is obvious: It is easy to beat up on rich investors while (supposedly) retaining $172 billion over the decade for health care for low-income Americans. Yet as is often the case, the easy politics reflect shortsighted economics.

First and foremost, the NIIT should be repealed because it is part of a law that Republicans have been promising to repeal and replace since 2010. If Obamacare is truly illegitimate — passed with creative parliamentary maneuvers and sold with dishonest promises to voters — then the law’s tax increases are just as illegitimate as its health-coverage provisions. Media attempts to portray these tax repeals as unrelated “tax cuts for the rich” should not trick lawmakers into leaving Obamacare taxes in place under the naïve illusion that it will satisfy liberal critics of the GOP health plans. Repealing Obamacare means also repealing the law’s taxes, period.

Second, killing the NIIT is key to unshackling the sluggish economy. Long-term economic growth requires a growing capital stock and healthy productivity growth. Policies that encourage investment further both these ends. Thus, high investment taxes are among the most destructive economic policies.

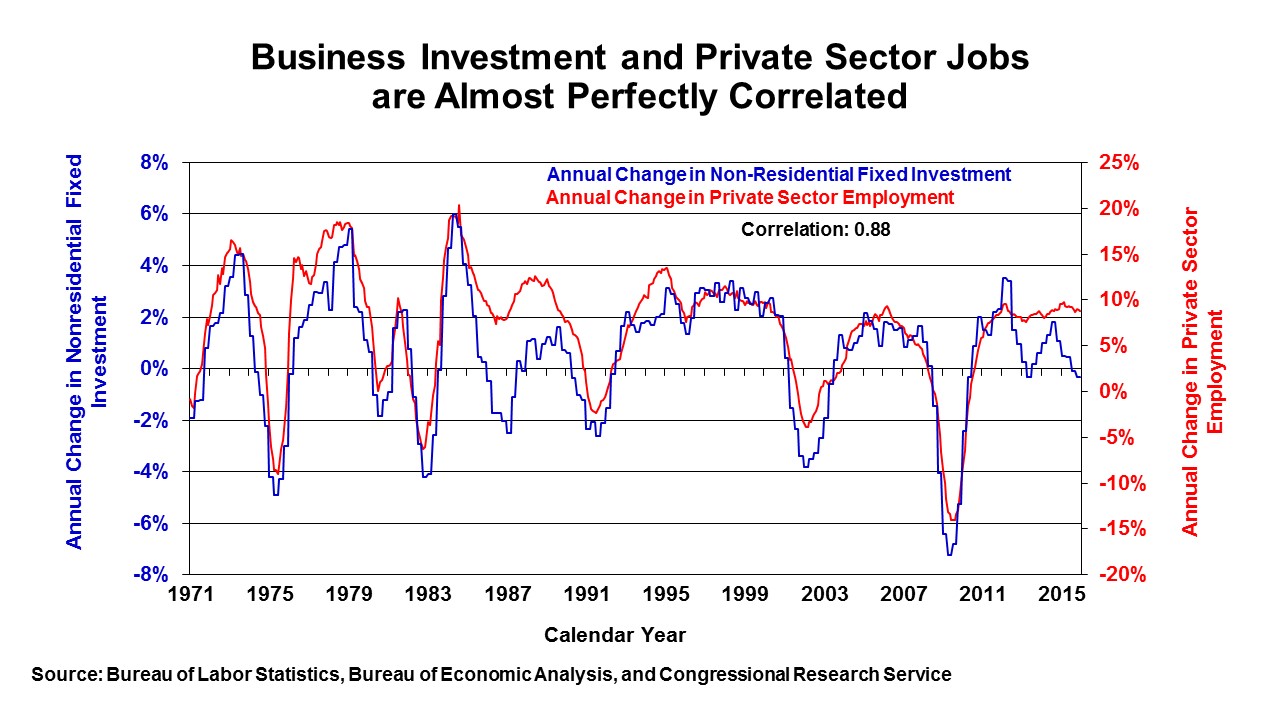

In fact, the chart below shows a near-perfect link between business investment and private-sector job growth. Obviously, part of the correlation can be explained by outside economic growth factors providing opportunities for both new hiring and investment (and economic downtowns reducing both). But it is also undeniably true that new investment provides the new capital and productivity necessary for new businesses to form and existing businesses to expand. This is especially important because, from 2007 through 2014 (the latest data available), the number of firms in America actually fell by 182,000 — a nearly unprecedented collapse of entrepreneurship

Not surprisingly, the Tax Foundation estimates that eliminating the NIIT would....

Read the entire piece here on National Review Online

______________________

Brian M. Riedl is a senior fellow at the Manhattan Institute. Follow him on Twitter here.

This piece originally appeared in National Review Online