Continuous Renewable Coverage: Rx for America’s Dysfunctional Health-Insurance System

Well-designed health insurance should offer good value that encourages individuals to sign up while they are healthy and pays for the care they need when they get sick. Because American health insurance is so fragmented, this is too often not the case. On the individual market, only 47% of those covered by plans remain enrolled after a year. Most Americans have insurance through their employer, and they must usually switch health-care plans when they change jobs, which they do every four years, on average.

Within such short time horizons, much of the variation in medical costs is foreseeable, which makes it hard for insurers to pool the risks of people who are sick with those who are healthy. If insurers are free to do so, this will usually lead them to raise rates and deny coverage to individuals with serious medical conditions that preexisted their enrollment application. However, if insurers are forced to cover the seriously ill on the same terms as those who sign up before they got sick, people will often wait until after they develop high medical risks before purchasing a policy—causing medical costs to soar, insurers to hike premiums, and the quality of coverage to deteriorate.

Health-insurance markets will never yield the quality coverage that people want by compelling them to purchase overpriced products that offer them little value. Instead, policymakers should seek to restore the individual insurance market to health by allowing people to get lower premiums if they sign up before they get sick—and rewarding them when they remain insured for longer periods. When Australia enacted such a reform, encouraging individuals to maintain continuous insurance coverage, it led to a surge in enrollment that improved the health-insurance market’s risk pool.

To fully reward individuals for buying health insurance before they get sick, insurers have to determine their general state of health—a process known as medical underwriting. If people switch plans only at a time of their own choosing—rather than whenever their employment circumstances change—this need not put them at risk of being locked out of coverage because of preexisting conditions. A recent federal regulatory change is a step in this direction by making it possible for Americans, most of whom are covered by their employers, to carry their own tax-preferred health insurance between jobs.

This presents the U.S. with an opportunity to emulate Germany’s successful health-insurance arrangements. In that country, individuals control the purchase of health insurance, tend to retain coverage for many years across employment circumstances, and may choose between private plans with actuarially fair premiums and standardized coverage funded by a payroll tax. Germany’s system, structured to reward continuous enrollment, leads private insurers to compete by improving medical coverage, rather than merely trying to identify people who will incur the lowest medical costs in the short run.

Why Transitory Health-Insurance Markets Are Dysfunctional

Health insurance, like all insurance, depends on pooling risks among individuals—many of whom will make few claims, while some of whom will have many, often expensive, claims. The average costs for a course of cancer treatment, for example, exceed $150,000.[1] Insurance markets can, as a result, easily fall apart if they are poorly structured. If disparities in the expected costs of coverage at the time a policy is initially purchased exceed disparities in the premiums that an insurer charges, competition will lead insurers to seek out low-risk customers rather than to protect all comers from subsequent risks—a dysfunctional market dynamic known as “adverse selection.”[2]

These disparities are no small matter. Over the course of a single year, the costliest 5% of working-age adults account for 47% of health-care costs.[3] But the identity of these costliest people is much less predictable. Information on diagnoses and spending for the previous year, for example, explains only 17% of the variation in healthcare spending.[4]

Over longer periods, risks are even more broadly spread. Even the spending levels for working-age people who have suffered large health-care shocks (such as cancer or a heart attack) tend to fall back to the overall sample mean for their demographic cohort in four or five years.[5] Thus, the distribution of health-care risks does not make it inevitable that health-insurance markets will succumb to adverse selection. Rather, the design of public policy does much to shape the breadth and diversity of risk that can profitably be pooled together.

Employer-Sponsored Insurance (ESI) is the primary source of health insurance in the U.S., covering 58% of those under age 65 in 2018.[6] By themselves, employer group insurance plans often form stable risk pools and forms of coverage. That’s the good news. But ESI is also the primary cause of the overall fragmentation of American health insurance, as people lose coverage when they leave jobs. The median length of employment at a firm in the U.S. is 4.3 years. Twenty-two percent of employees have been with their employer for less than a year, and only 29% for more than 10 years.[7]

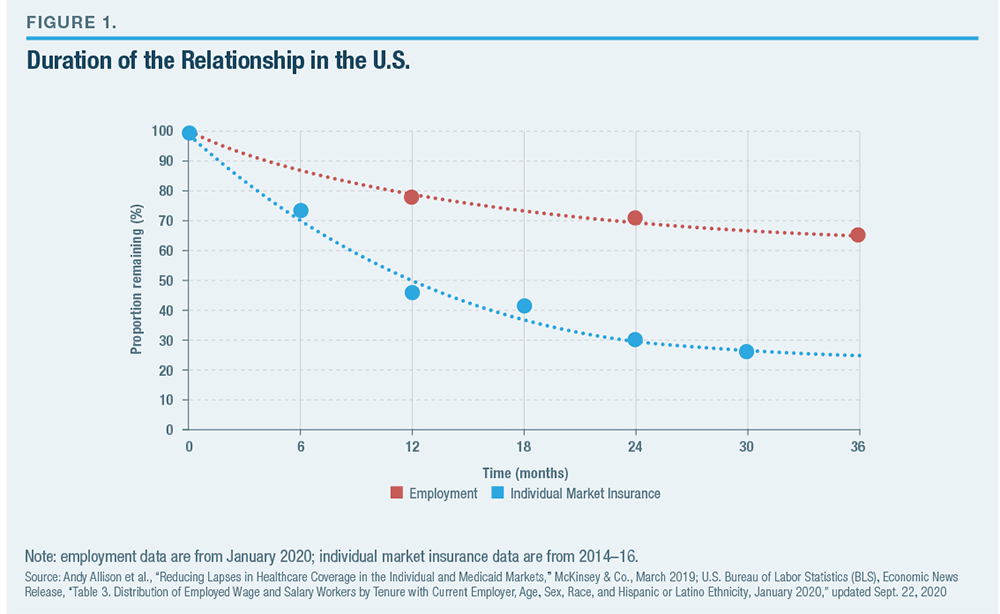

The presence and dominance of ESI loom large over the individual health-insurance market—giving it the character of a temporary and residual market, in which most Americans participate only while they are between sources of employer-sponsored coverage. For example, only 7% of Americans under 65 purchased their own health insurance in 2018.[8] Those who purchase individual market plans do not tend to remain in them very long. From 2008 to 2011, only 42% of Americans on the individual market remained enrolled for a year, and only 27% remained for two years.[9] Following the 2014 implementation of the Affordable Care Act’s regulatory reforms and its associated subsidies, 47% remained enrolled after a year, and 30% for two years (Figure 1).[10]

The regularity with which Americans depart jobs greatly increases the risk that they will have serious medical conditions that preexist their attempt to purchase insurance on the individual market. Moreover, the prevalence of the costliest chronic medical conditions increases across the board from early adulthood (18–29) to late career (55–64). The proportion of the population with diabetes rises from 2% to 17%, with heart conditions from 2% to 10% and cancer from 1% to 4%.[11] Under competitive circumstances, the relatively short time horizon over which Americans typically remain enrolled in plans creates an incentive for insurers to appeal only to low-risk individuals and exclude those with higher risks—the problem of adverse selection (aka “cherry-picking” or “cream-skimming”).

So long as individuals remain covered by a single employer, they can be assured insurance protection from health-care risks. This is also true so long as they remain enrolled in an insurance policy bought on the individual market, as the Health Insurance Portability and Accountability Act of 1996 (HIPAA) requires insurers to renew coverage for policyholders who get sick. Before the Affordable Care Act (ACA), however, if individuals with high levels of medical risk moved from an employer plan to the individual market, insurers may have been unwilling to cover them—a gap in insurance protection known as “reclassification risk.” The result was that an estimated 18% of individual market insurance applications were annually denied because of preexisting conditions.[12] Reclassification risk also means that many long-term illnesses, such as cancer, heart disease, dementia, or organ failure, cannot be well covered by a series of single-year contracts.[13]

The Affordable Care Act’s Band-Aid Fix

ACA attempted to address the problem of reclassification risk by requiring insurers to offer the same coverage to all people who sought to purchase it, for the same price,[14] regardless of their likely medical costs. Unfortunately, this regulatory approach—known as community rating—greatly inflated the problem of adverse selection by making it possible for individuals to wait until they got sick before purchasing insurance.[15]

The post-ACA individual market, therefore, attracted disproportionately sicker enrollees, which drove insurers from the market—leaving 1,036 of the 3,007 counties in the nation with only a single insurer on the individual market in 2017.[16] The remaining insurers dealt with the soaring average costs of coverage by pushing premiums up by 105% over four years—far higher than would be attractive to healthy potential enrollees.[17] By 2018, premiums for family coverage on the individual market averaged $14,016, in addition to deductibles averaging $8,803, before insurance coverage began to pay for medical care.[18]

One way ACA attempted to induce a greater number of healthier people into the pool was to bar anyone from buying insurance outside limited annual or special “enrollment periods.”[19] This proved inadequate, as the costliest medical conditions tend to persist predictably across several years, so it didn’t stop plans from being disproportionately popular for those with the highest health-care risks.

ACA also sought to induce people to sign up while healthy by imposing a financial penalty on individuals who lacked insurance coverage. This, too, proved ineffective. As most middle- and upper-income Americans have ESI, the penalty largely hit lower-income Americans or those who had just lost a job—people without much ability to pay astronomic sums for threadbare ACA coverage. Already in 2016, the Obama administration exempted 23 million of the 30 million uninsureds from the mandate, while only 1.2 million earning above the subsidy cutoff were subject to a penalty exceeding $1,000.[20] The complete elimination of the mandate penalty at the beginning of 2019 had little impact on insurance enrollment.[21]

Even if a stronger mandate would have improved the overall risk pool, it may not necessarily have led to lower premiums. That’s because the penalty also strengthened the power of insurers to inflate their markups.[22] Nor would a more sizable penalty eliminate adverse selection, even if such a thing were equitable and politically feasible. Indeed, a stronger mandate would likely only exacerbate the problem of adverse selection between insurance options by driving healthy, low-risk individuals to purchase skimpy plans.[23] ACA attempts to offset disparities in enrollees’ expected medical costs by redistributing funds between plans with lowrisk and high-risk enrollees. But this “risk-adjustment” process is imperfect and creates additional problems of its own.[24] Adjustment for differences in medical risks encourages the manipulation and inflation of diagnostic codes to maximize revenues from redistribution, and any imperfections in risk scores may serve to increase, rather than reduce, adverse selection overall.[25] Even the best risk adjustment would change only the set of characteristics that are used for selection to ones that are unadjusted rather than eliminate it entirely.[26] The redistribution of funds through ACA’s risk-adjustment process also penalizes spending by insurers on preventive care that may keep enrollees healthy while, in practice, tending to reward plans for incurring inflated medical costs.[27]

The disparity in information regarding risk levels, which makes risk adjustment necessary in theory, also frustrates its effective implementation in practice. Competing insurance products will never appeal in a way that is neutral with respect to single-year medical risks—i.e., to healthy individuals who know they have low medical risk, the same as to those who are in the midst of a major illness. Nor can they be offset with much precision—particularly when great profits can be enjoyed by failing to do so. As a fallback, ACA rules, therefore, seek to eliminate potential margins for selection by standardizing plan features. This reduces the scope for competition between plans—particularly with respect to the development of cost-control features, which would appeal disproportionately to those who are healthy in a particular year.

As a self-financing, competitive insurance market offering good-value coverage to individuals and families at a price they are willing to pay, ACA’s market has essentially collapsed. But ACA premium subsidies—which expand as necessary to guarantee a defined benefit to low- and middle-income Americans— have prevented the individual market from entirely succumbing to a death spiral.[28] Those subsidies, along with the Medicaid expansion, entirely account for the ACA’s modest coverage gains.[29] Yet these modest gains have been offset by a slump in the enrollment of those ineligible for subsidies from 9.4 million in 2014 to 5.2 million in 2018.[30] Without subsidized enrollees and federal overpayments for subsidized healthy enrollees, which indirectly cross-subsidize the nominally unsubsidized, it has been estimated that individual market enrollment would fall by 80%.[31]

Continuous Coverage Makes Insurance Markets Work

The shorter the time horizon, the more foreseeable any given individual’s health-care costs will be, the more susceptible insurance will be to adverse selection, and the less it will be able to protect people from risk.[32] Reducing reclassification risk and adverse selection requires extending the duration of coverage over time.[33] This serves to increase the scope of medical risk from which insurance provides valuable protection while reducing disparities in the knowledge of health risks between individuals and insurers—the disparities that drive adverse selection by making it easy for those with low risks to disproportionately avoid purchasing insurance. [34]

A recent regulatory change extended the exemption from taxation of health coverage that employers purchase for staff to insurance that individuals purchase for themselves.[35] This change, discussed in more detail below, will allow individuals to remain enrolled in the same insurance plans across several employment relationships and between jobs, too—eliminating a major obstacle to the continuity of individually purchased health insurance over extended periods.

The main challenge with insurance contracts that combine guaranteed renewability over extended periods with “one-sided commitments” (where insurers are required to continue covering individuals who get increasingly sick from year to year, while enrollees are free to leave) is that, as disparities in risk develop, individuals who remain low-risk have an incentive to switch to cheaper plans over time.[36] Such an arrangement leaves insurers covering a deteriorating risk pool of sicker enrollees who have little choice to remain—again inducing the dysfunctions associated with adverse selection, by punishing insurers that provide attractive benefits to those who become seriously ill.

The solution to this problem is for insurance plans to “front-load” premiums—charging individuals more than their single-year actuarially fair premium in the first year, to cover costs associated with the risk of their health deteriorating in subsequent years. With front-loading, it does not matter if low-risk individuals subsequently disproportionately switch plans, as prepayments to cover those whose medical risks increase would already have been collected.[37]

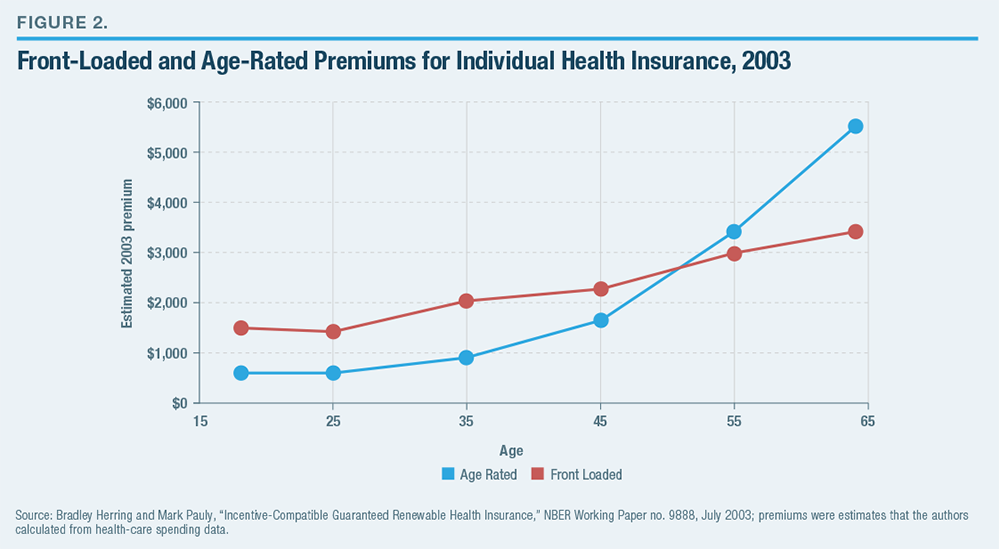

Front-loaded premiums exceed single-year actuarially fair premiums for younger individuals but allow older enrollees who maintain coverage over the years to subsequently receive lower premiums than the actuarially fair level for their age group’s annual medical costs (Figure 2).[38]

As the ACA’s 3:1 ratio limit on age rating was based on renewable plans that had been available, rather than disparities in annual medical costs by age, optimal front-loading of renewable plans would little change the variation of premiums by age relative to those that currently prevail on the individual market.[39] Yet because the medical risks of ACA individualmarket enrollees currently average 20% higher than those in group plans, the parallel establishment of a renewable market that allows medical underwriting at the time of initial enrollment would likely yield savings for all age groups.[40]

Continuous enrollment in plans also yields other advantages. The reduced danger of adverse selection would make it easier for regulators to allow insurers to develop new methods for paying and delivering services. Combined with reliably longer spells of enrollment, it would also increase the returns for plans to make investments in preventive care to improve individuals’ long-term health.[41] Reducing the time that individuals spend uninsured would reduce their exposure to out-of-pocket costs, while improving the probability of timely diagnoses and the management of chronic conditions.[42] It would better handle rare common shocks to health-care costs, such as those associated with a pandemic, and reduce the burden of administrative costs associated with initial enrollment by spreading them over several years. Pooling on a longitudinal (multiyear) basis, rather than cross-sectionally (currently healthy and currently sick), would better accommodate the great variation in willingness to pay for health-care convenience and quality, which fits awkwardly with affordable standardized coverage.[43] Generous benefit packages could coexist alongside bare-bones coverage, without being crippled by adverse selection.

Though early and continuous enrollment in renewable, medically underwritten plans would greatly reduce reclassification risk, a small proportion of the population may still be unable to benefit from them due to health risks that develop early in life.[44] For this group, which is estimated to constitute 2.5% of the population, ACA plans or Medicaid would likely remain the best source of coverage.[45] The coexistence of community-rated alternatives through ACA—which must cover all who seek coverage at premiums that do not vary by medical risk at the time of initial enrollment—might also be valued by high-risk individuals who find themselves locked in to a renewable plan that they have come to dislike. ACA plans would also be valued as a safety net by those who failed to purchase renewable plans at an earlier age, for whatever reason.

Nevertheless, concerns remain that allowing renewable, underwritten plans would prove incompatible with community-rated alternatives and further undermine the risk pool on the ACA’s individual market.[46] As an assessment by the RAND Corporation recently noted: “Economic intuition suggests that an insurance market based on a continuous coverage requirement could perform well, but there is little direct evidence on how well it might work in practice.”[47]

That lack of experience is true for the United States. But two other developed nations—Australia and Germany—do provide incentives for early and continuous enrollment that have improved health insurance and should allay concerns about the coexistence of underwritten and community-rated insurance.

Australia: Continuous Coverage Discounts Revived the Individual Market

Australia’s health-care system differs greatly from that of the U.S. and does not offer a comprehensive model for reform. But it does demonstrate how an individual health-insurance market can be revived by giving people an incentive to sign up before they get sick.

Australia has a public entitlement that provides a basic level of access to physician services and procedures at public hospitals. But it also encourages individuals to purchase private insurance to obtain better treatment without lengthy waiting lists from private hospitals, surgery centers, and specialist physicians.[48] Private insurance may also pay for uncovered charges at public hospitals, ambulance costs, and ancillary services such as dental care.[49]

Private plans in Australia are subject to community rating, with no variations allowed in premiums by age, health status, or claims experience.[50] As a result, it was common for women to purchase insurance for $750 before conception, receive a private delivery worth $3,500, and then drop the policy after giving birth. The absence of age rating similarly led individuals to wait until their health deteriorated in their sixties before buying insurance.[51] As there was no risk adjustment between plans, this led to adverse selection: insurers designed benefits and cost-sharing structures to appeal disproportionately to healthy enrollees. Plans could impose waiting periods of no more than 12 months before paying for treatment associated with symptomatic preexisting conditions, 9 months for obstetric conditions, and 2 months for other conditions.[52]

A government commission estimated that as many as 80% of new enrollees planned to make a specific claim from the insurer at the time they purchased coverage.[53] Although plans did seek to appeal disproportionately to low-risks and did increase deductibles significantly, premiums nevertheless rose 10% above the risk levels of the general population.[54] As a result, the share of young Australians in private plans declined significantly in the early 1990s.[55] Policymakers became concerned that declining private insurance coverage levels would increase the burden on the limited resources available to the public medical system.[56]

In 1997, the Australian government established subsidies for low- and middle-income citizens to assist their purchase of private insurance, along with a penalty on upper-income adults who failed to purchase private plans with a modest deductible.[57] This had little effect on the proportion of the Australian population enrolled in private insurance, which continued to decline from 31.9% in mid-1997 to 31.3% at the end of 1999.[58]

Then, in July 2000, a new policy, Lifetime Health Cover (LHC), took effect. It was designed to encourage people to buy private insurance early in their lives and maintain it over many years. By the second half of 2001, private insurance enrollment had soared to 44.9% of the population.[59] LHC allows insurers to vary premiums according to the age of a policy owner’s entry into continuous private insurance coverage. Plans are allowed to increase premiums by 2% for every year that an individual delays the initial purchase of coverage beyond the age of 30, up to a maximum 70% higher premium for individuals who first purchase coverage at the age of 65, after which the age-related surcharge returns to 0%.[60] But this surcharge is removed—in effect, a discount—for individuals who maintain continuous coverage for more than a decade. A nine-month grace period following the enactment of LHC allowed individuals a one-time opportunity to buy in without any age-related penalty for first-time buyers.[61]

LHC mostly offset the prior adverse selection effect, halving the age difference between private insurance enrollees and the general population, and reducing average costs (to insurers) per enrollee by 9%–13%.[62] Still, the incentive generated for individuals to sign up before they became sick remained weak for those younger than 40 or older than 65 because the accumulated surcharge was small for those in their thirties and no surcharge was imposed on those over 65.[63] Whereas the premium subsidies cost the government A$2 billion per year to create and served largely as a handout to those who already purchased private insurance, LHC’s incentives increased private insurance coverage without cost to the treasury.[64]

Though LHC succeeded in mitigating the most egregious hit-and-run enrollment by encouraging middle- aged Australians to buy insurance before they get sick, the applicability of LHC discounts across plans (as with those associated with the mandate) has drawn individuals into relatively thin plans that meet the bare technical criteria of coverage.[65] This may be tolerable for a supplemental health-insurance plan, but better-designed incentives would be required to avoid selection for comprehensive forms of health-insurance coverage.

The Value of Underwriting and the Shortcomings of Short-Term Insurance in the United States

In the U.S., so-called Short-Term Limited Duration Insurance (STLDI) plans were exempt from ACA’s guaranteed- issue and community-rating requirements. Once ACA went into effect in 2014, STLDIs were the only underwritten insurance plans available—and grew in popularity as a source of longer-term coverage. The Obama administration viewed this development disfavorably, and at the end of 2016 limited STLDI plan terms to three months—a rule that was subsequently reversed by the Trump administration.[66]

Underwriting allows STLDI plans to offer people lower premiums in return for signing up before they get sick. This enables individuals who would otherwise have been unable to afford exchange plans to purchase insurance and those who would have been able to afford only plans with very high deductibles from the ACA’s exchange to purchase more comprehensive coverage. A survey of individuals purchasing STLDI plans online found that 43% would otherwise have gone altogether uninsured, while only 22% would have purchased ACA plans.[67] While “platinum” ACA plans, covering 90% of medical expenses, were entirely unavailable in 35 states, STLDI coverage with 100% coverage of hospital and physician costs beyond a $2,500 deductible is now widely available where permitted by state law.[68]

Underwriting also allows competing insurers to protect themselves from the danger that improving the quality and access to medical care covered by plans will cause them to be overwhelmed by disproportionately highcost enrollees. Indeed, because ACA plans that offer care in the highest-rated hospitals experience adverse selection, most are now structured as HMOs and include only the bare minimum network of in-state hospitals that they are specifically required to cover by law.[69] By contrast, the most popular STLDI plan has a broad national PPO network that provides access to the highest-rated national facilities such as the Cleveland Clinic, Memorial Sloan Kettering, the Mayo Clinic, Johns Hopkins, and Mass General.[70]

The number of competing insurers in local STLDI markets is typically larger than the number offering ACA plans, even though the market has a relatively minuscule number of enrollees. That’s because underwriting allows plans to ensure their profitability regardless of the balance of their risk pool. Where permitted, multiple STLDI plans are widely available, covering not just hospital and physician services but mental health, substance abuse, and prescription drugs.[71] Insurance coverage of maternity services is harder to provide on an actuarially fair short-run basis, though Blue Cross of Idaho does so by setting deductibles so that plans effectively provide insurance against complications.[72] The Idaho plans use waiting periods to allow individuals with preexisting chronic conditions to receive underwritten coverage for less than ACA premiums.[73]

Critics of STLDI plans argue that they are often misleadingly marketed and suggest that they put enrollees at risk with surprise gaps in benefits.[74] States have the legal authority and responsibility to protect consumers from fraud, to ensure that coverage lives up to expectations, and to verify that plans have adequate funds to reimburse claims as promised—and to the extent that they are falling short, states should do more in this respect.[75] Yet to eliminate underwritten plans would deprive consumers of good coverage options as well as bad ones. In fact, satisfaction rates of STLDI plan enrollees (91%) are significantly higher than those in ACA plans (70%).[76]

The Obama administration’s restriction of STLDI plans to three months was primarily due to a concern that longer terms would draw low-risk enrollees from ACA’s risk pool, raising premiums for the rest.[77] In retrospect, this seems like a panicked reaction to flaws inherent in ACA’s community-rating structure, rather than a reasoned and effective response. As it turned out, the ACA risk pool eventually stabilized because of the automatic expansion of premium subsidies and regulatory action to expand cost-sharing reduction subsidies.[78] While ACA premiums rose by 105% in the four years following the implementation of the law’s regulations, premiums have fallen by 4% in the two years since the individual mandate penalty was zeroed out and the Trump administration expanded the maximum STLDI plan renewability guarantee to three years.[79] The Congressional Budget Office in 2019 estimated that a House bill to reimpose a threemonth limit on STLDI plans would throw 1.5 million Americans off their preferred insurance every year while reducing unsubsidized ACA premiums only 1%.[80]

The main problem with STLDI plans is the opposite one: brief coverage terms and the prohibition on renewability beyond 36 months expose enrollees to reclassification risk. They also increase the likelihood that individuals will develop conditions that preexist the purchase of coverage and the risk of associated claims denials. This increases the danger that individuals will face gaps in coverage or risk-rated increases in premiums when plan terms end. By increasing the foreseeability of medical costs, a short coverage relationship makes it hard for plans to offer benefits that may appeal disproportionately to the chronically ill, such as generous prescription drug coverage—even if such expenditures may serve to prevent later hospital costs.[81] Brief plan durations also cause administrative costs associated with initial enrollment to loom large, relative to the cost of insurance.

Far from protecting ACA plans from having low-risk enrollees cherry-picked by STLDI plans, the National Association of Insurance Commissioners noted that the imposition of short-term limits on coverage forces STLDI plans to dump enrollees as they get sick and develop major medical needs.[82] To the extent that cherry-picking by STLDI plans imposes an externality on ACA risk pools, taxpayers, and providers of uncompensated care, it is through the absence of front-loading and coverage of reclassification risks—a concern that would call for extending coverage terms and requiring indefinite guaranteed renewability. STLDI coverage is consistently cheaper than ACA plans that cover equivalent benefits, but the disparity is larger for the shortest terms (Figure 3), which include less coverage of reclassification risks.

Fulton County (Atlanta), Georgia, is a good insurance market for this kind of comparison. ACA premiums are close to the national average; several insurers compete on the ACA exchange; and yearlong STLDI coverage is available. Blue Cross (ACA) and UnitedHealthcare (STLDI) plans offered in Fulton County are representative of the major carriers most enthusiastic about each kind of health plan; they are discussed in Chris Pope, “Renewable Term Health Insurance,” Manhattan Institute, May 2019.

The most effective way for legislators to pull consumers out of what some have maligned as “junk insurance” plans is to allow better insurance plans to be made available; it is not by making STLDI plans junkier.[83] Extending the renewability of STLDI plans would reduce adverse selection in the market, while reducing the maximum permitted term length serves only to increase the danger that consumers will be tempted by low premiums into plans that expose them to reclassification risk and gaps in coverage, which they discover only when it is too late.

Germany: Continuous Insurance Alongside ACA-Style Coverage

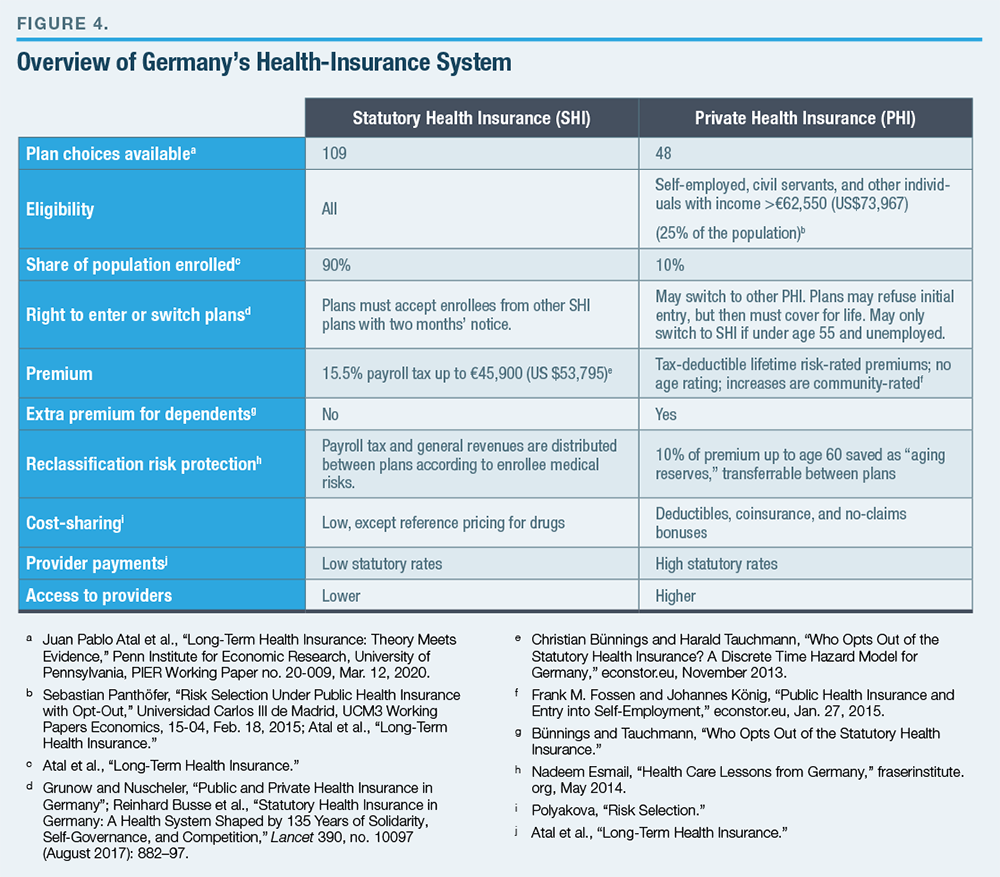

Germany operates two main parallel health-insurance systems, each structured through competing plans (Figure 4). Participation in the Statutory Health Insurance (SHI) system is mandatory for most of the population, though individuals with higher incomes are allowed to opt out of it, as well as its payroll tax, by committing to purchase Private Health Insurance (PHI).[84]

PHI plans are free to decide which enrollees to cover and may set premiums as they wish, upon initial enrollment. But they must then cover enrollees for the rest of their lives. Individuals who first sign up at a younger age pay lower premiums due to front-loading costs being spread over more years, while those who first sign up after getting sick will pay higher premiums relative to their age.[85] Further premium increases to account for rising medical costs are permitted only if they apply equally to all plan members. Plans must prove their long-term solvency to regulators each year and adjust premiums accordingly.[86]

The absence of a distinct Medicare-like entitlement for retirees has led the German government to mandate that PHI plans accumulate aging reserves to cover longevity risks and the high medical costs of the elderly by requiring real premiums for PHI plans to be constant over the life cycle.[87] This prevents PHI plans from accommodating the relatively lower ability of younger consumers to pay for health insurance.[88] It also increases the lock-in to plans beyond the levels needed to cover reclassification risk. Policymakers sought to offset this by allowing aging reserves to be partially transferrable as individuals move from plan to plan.[89] Yet because the transferrable aging reserve is not risk-adjusted, the lock-in effect remains substantial, and competition is effective only for first-time enrollees.[90]

Individuals with major medical conditions that preexist their initial purchase of insurance can be excluded from PHI plans and tend to remain in SHI.[91] The SHI system has a sicker pool of enrollees, but the distribution of risk in each pool appears to be stable over time.

To prevent PHI plans from dumping those who subsequently become sick on SHI, individuals who opt for PHI may not return to SHI unless they lose their jobs. Furthermore, as individuals grow older, the burden of building front-loaded age reserves becomes greater, and switching from SHI to PHI becomes less attractive. [92] Though young adults must often choose SHI because of low incomes, switching from PHI to SHI is rare between the ages of 40 and 75.[93]

Individuals who are sicker are more likely to switch from PHI to SHI than those who remain.[94] But this correlation does not imply causation. A regression discontinuity study examining the income threshold at which individuals become able to switch from SHI to PHI finds that individuals leaving SHI have similar levels of medical needs to those who choose to remain.[95]

Individuals who switch from SHI to PHI tend to have fewer subsequent hospitalizations than those who remain.[96] But lower utilization rates reflect differences in cost-sharing—i.e., the influence of moral hazard in reducing the use of medical services, as well as that of adverse selection in increasing the proportion of healthy enrollees. A regression discontinuity study at the PHI income-eligibility threshold suggests that PHI patients are more likely to be treated on an outpatient basis, with no statistically significant differences in overall levels of hospital treatment between SHI and PHI.[97] The long-term structure of PHI contracts, which encourages individuals to lock in advantageous initial terms by remaining enrolled for extended periods, therefore appears to successfully inhibit significant ongoing cherry-picking of low risks by plans.[98]

Indeed, key selling points of PHI plans would be more attractive to the sick, rather than the healthy. As physicians are paid, on average, 2.3 times more by PHI than SHI plans, they are more likely to see PHI-enrolled patients; wait times are, on average, three times as long for those in SHI.[99] Waiting times for a sample of six outpatient treatments increased from an average of 27.5 days in 2014 to 30.7 days in 2016 for patients in SHI plans, whereas they fell from 13.5 days to 7.8 days for those in PHI plans.[100] As the volume of services provided by physicians to SHI patients is restricted, PHI enrollees receive a higher quality of care.[101] PHI enrollees are 50% more likely to receive organ transplants, despite being healthier, on average.[102] As SHI plans pay only up to a reference price for prescription drugs, PHI plans tend to cover more of the cost of drugs and also provide better access to newer therapies.[103]

Though PHI plans may not be able to cater to those with major preexisting conditions at a young age, they have faced little trouble coexisting with SHI plans that do cover them. PHI plans have proved stable and easy to use, and they have successfully rewarded the provision of the best quality of care for millions of people for decades.[104]

Building Continuous Coverage in the United States

Encouraging individuals to enroll in a health plan and maintain their membership over the years—and from job to job—is necessary to reduce the predictability of medical costs at the time they initially apply. Continuous coverage would remedy the problem of adverse selection—which exposes individuals to the risk of being unable to afford coverage due to preexisting conditions and discourages insurers from investing in medical services that may appeal to sicker enrollees.

Creating an incentive for individuals to sign up for insurance before they get sick would reduce the costs of available plans, increase the share of the population covered by insurance, and reduce their exposure to catastrophic medical costs. This would also enable insurance markets to offer a broader choice of plan designs, enable more insurers to compete, and enhance the stability of the insurance market.

To move toward this goal, I suggest three policy recommendations:

- Allow ACA plans to offer discounts from age-rated premiums according to the number of years that enrollees have maintained continuous minimal essential coverage.

The more insurers can pool medical costs across time, the less they need to pool them across different enrollees in a way that may encourage adverse selection.[105]

Providing an incentive for people to buy insurance before they get sick—and to remain insured—could reduce the average cost of coverage without imposing mandates that are highly inequitable, politically unpalatable, and therefore weak.[106] Such an incentive exists for Medicare Part D, where seniors who choose to enroll late must pay a penalty equivalent to 1% of the aggregate premium of all the months for which they failed to sign up.[107] Australia revived its individual insurance market by offering lower premiums to individuals who sign up before they get sick. The U.S. should do so as well.

To be sure, discounts for maintaining continuous coverage on any individual ACA plan would leave the problem of adverse selection (cherry-picking) between plans unaddressed—with each insurer still trying to attract disproportionately low-risk enrollees at the expense of its competitors. Remedying this problem requires insurers to offer plan-specific incentives for continuous coverage.

- Establish new “Lifetime Security” plans with onetime medical underwriting that are guaranteed renewable indefinitely.

To make coverage available that is priced to offer good value for people to purchase before they get sick, insurers must be allowed to employ medical underwriting. However, if plans are not guaranteed renewable, those who enroll will be exposed to reclassification risk, denials of coverage or claims due to preexisting conditions, and adverse selection—as insurers will seek to reduce premiums and the quality of benefits to appeal to individuals with low expected medical costs within a short time horizon. Requiring renewability will force insurers to set premiums that include the cost of covering reclassification risk, help spread the administrative costs of enrollment over more plan years, and encourage insurers to invest in higher-quality medical services.

The experience of Germany demonstrates that when underwritten plans are fully committed to covering and pricing in long-term reclassification risk, they pose little threat to a parallel, community-rated risk pool. Indeed, Germany offers a workable model where individuals are able to choose between long-term, underwritten private insurance plans operating alongside plans where individuals pay independently of their medical risks. Uwe Reinhardt, the late Princeton health economist, rightly argued that such a choice of paths stressing social solidarity and personal responsibility would be well suited to American society.[108] In fact, it would likely be easier for the U.S., due to the existence of Medicare, which removes the need for enormous front-loading to cover costs associated with retirement.

- Allow full Individual Coverage HRA (ICHRA) funds to be used in the proposed “Lifetime Security” plans meeting essential health benefits.

In 2019, the federal government issued a new rule allowing employers to provide pretax funds through a Health Reimbursement Account to their employees, who could then purchase individual health insurance. This new ICHRA rule was an important step in promoting the continuity of coverage across jobs.[109] It is the critical bridge for a transition from health insurance that is purchased by employers to one that is controlled by individuals. Any primary source of health insurance should enjoy an equivalent preferred tax status.

Funds provided by employers for employees to purchase their own insurance should therefore also be made fully available to them for buying underwritten plans, so long as these plans fully cover essential health benefits and lifetime reclassification risks. This would ensure that Lifetime Security plans serve as a robust source of insurance coverage, rather than as a loophole that unravels employer group plans.

Endnotes

Are you interested in supporting the Manhattan Institute’s public-interest research and journalism? As a 501(c)(3) nonprofit, donations in support of MI and its scholars’ work are fully tax-deductible as provided by law (EIN #13-2912529).