Of the four U.S. presidential candidates on enough state ballots to have a mathematical chance of winning the Oval Office, only Green Party candidate Jill Stein—who is polling at 3 percent and currently has a warrant out for her arrest—wants to forgive all federally owned or guaranteed student debt. It is ironic, then, that the federal student loan program is on course to realize more of Stein’s vision than any of her rivals’.

A new Brookings report out from American Enterprise Institute scholar Jason Delisle examines the Public Service Loan Forgiveness (PSLF) program—a little-known facet of the student loan program with a potentially significant effect on the budget. PSLF allows student borrowers who work in government or at most nonprofit organizations to discharge their student loan debt after making ten years’ worth of qualifying payments.

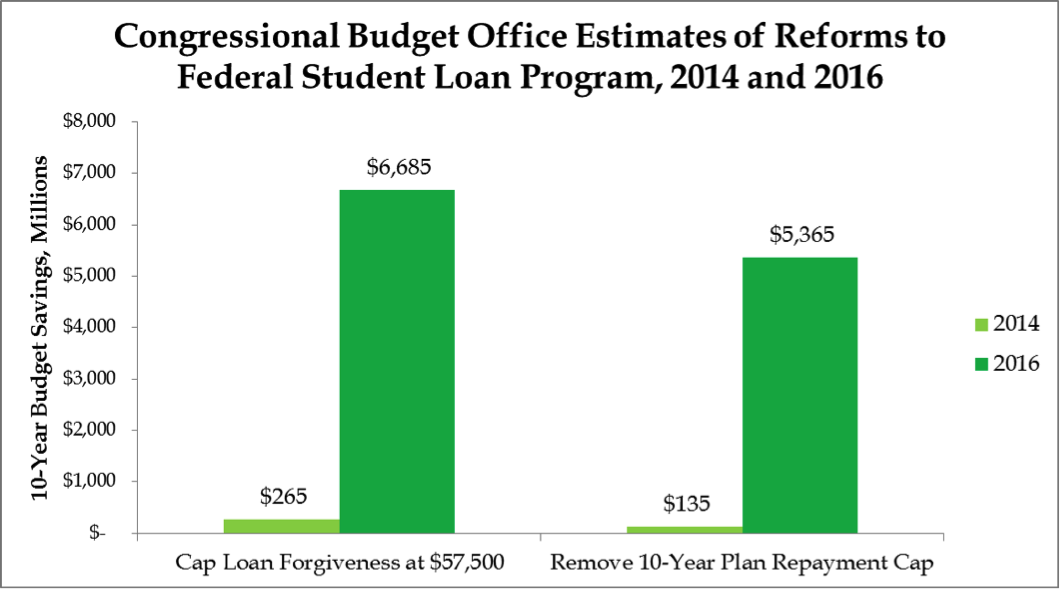

As the program went into effect in 2007, the earliest an eligible borrower could receive loan forgiveness is 2017. Hence, we do not yet have hard data on how much PSLF costs taxpayers. But Congressional Budget Office analyses of proposed reforms to the program, obtained by Delisle and detailed in his new report, show that the losses to taxpayers could be far greater than originally anticipated.

One proposal, to cap discharges under PSLF at $57,500 per borrower, was estimated to save $265 million in 2014. That estimate has since risen 25-fold to $6.7 billion. Another proposal would remove a feature of loan repayment plans that caps payments at lower amounts, thereby increasing the potential amount of forgiveness once the borrower reaches the ten-year PSLF threshold. That proposal, originally scored at $135 million, has seen its estimate rise 40-fold to $5.4 billion.

According to CBO’s estimates, the PSLF program has grown from a footnote to a major budget drain in a matter of years. Around a quarter of the workforce holds a position theoretically eligible for PSLF, according to Delisle’s report.

Why the cost explosion? First, enrollment is much higher than anticipated. Just four years ago, just 26,000 borrowers were certified for PSLF. Now, that number is over 430,000.

Potentially more important is the type of borrowers who are becoming certified for forgiveness. These borrowers are overwhelmingly likely to have attended graduate school, and as such have extremely large balances. Eighty percent of PSLF borrowers have balances above $30,000, compared to just 12 percent of borrowers with no more than an undergraduate degree. Thirty percent of PSLF borrowers have balances over $100,000.

This is overt welfare for the rich. People with graduate degrees are not the ones who need help paying back their loans—that group is populated with people who never earned any degree at all and consequently have much lower balances. On the contrary, PSLF enables people to attend graduate school basically for free, if their ten years of qualifying payments are all used to pay back undergraduate loans.

Why taxpayers should spend billions on a program that subsidizes M.B.A. and J.D. holders while leaving distressed borrowers out in the cold is a mystery to me. Even Bernie Sanders wasn’t progressive enough to say “law school should be free for all.” And yet, here we are.

This piece originally appeared on Forbes

______________________

Preston Cooper is a policy analyst at the Manhattan Institute's Economics21. Follow him on Twitter her

This piece originally appeared in Forbes